Autumn Doesn’t Stop the Fall

The S&P 500 was down over 2% in October, marking a third consecutive negative print and a cumulative drawdown of approximately 9% from the high on 27-Jul-23. Beyond the top-heavy S&P 500, the Russell 2000 Index is now off about 6% year-to-date, while roughly one-third of the S&P 1500 trades below their 2022 low.

The story was not better outside of the U.S. The MSCI All Country World Index lost approximately 3% and the TSX was 4% lower. With nearly 50% of S&P 500 companies reporting earnings, 70% and 58% have beaten on earnings and sales, respectively. However, bucking recent trends, the majority have seen negative price reaction on the day following earnings. Outside of utilities, communications and real estate, all other sectors have seen average price reductions.

Bonds compounded the pain in balanced portfolios as the iShares 20 Year Treasury Bond ETF (TLT) fell 4.26% in the month, bringing its year-to-date total return to -13.15%. The October loss in TLT pushed the ETFs 10-year total return into the red, down 0.09%, which is surprising in the context of fund flows. TLT has accrued $17.9Bn in net inflows year-to-date according to Morningstar, nearly doubling its size. Weakness in long bonds began to accelerate in August following the US Treasury’s quarterly refunding announcement (QRA), revealing an increased supply of longer-term bonds would be issued by the U.S. to fund its growing deficits. The 30-Oct-23 announcement revealed a more muted issuance plan for Q4, $75Bn below the last estimate, but 1Q24 will ramp up once more. Investors will pay attention to the proportion of T-Bills and bonds that will make up the raise to gauge the probability of a slowdown in supply. The details will be declared on 01-Nov-23. A bottom in bond prices is necessary for equities to bounce sustainably. Large market players are forced to further de-lever and sell assets to balance their portfolios when bonds continue to falter.

Gold acted as a beacon of strength during the period despite cross-asset weakness. SPDR Gold Shares (GLD) gained 7.37%, and now boasts a 1-year return of 21.28%. A combination of underweight positioning reported by CFTC and an uptick in geopolitical turmoil in the Middle East served to buoy demand for the safe-haven. This has been particularly notable on Fridays as investors de-risk portfolios ahead of a 48-hour period without the ability to trade. On the three Fridays since Hamas’s terrorist attack on Israel, gold has appreciated an average of 1.4%. We have started to see positioning reverse in the last two weeks to more neutral territory but it is by no means historically stretched. Oil on the other hand proved to be extended. In our September market memo, we commented about the positioning euphoria. Despite the middle east conflict, WTI fell over 9% in October. For the consumer and the Fed with their eye on inflation, this was a welcomed occurrence.

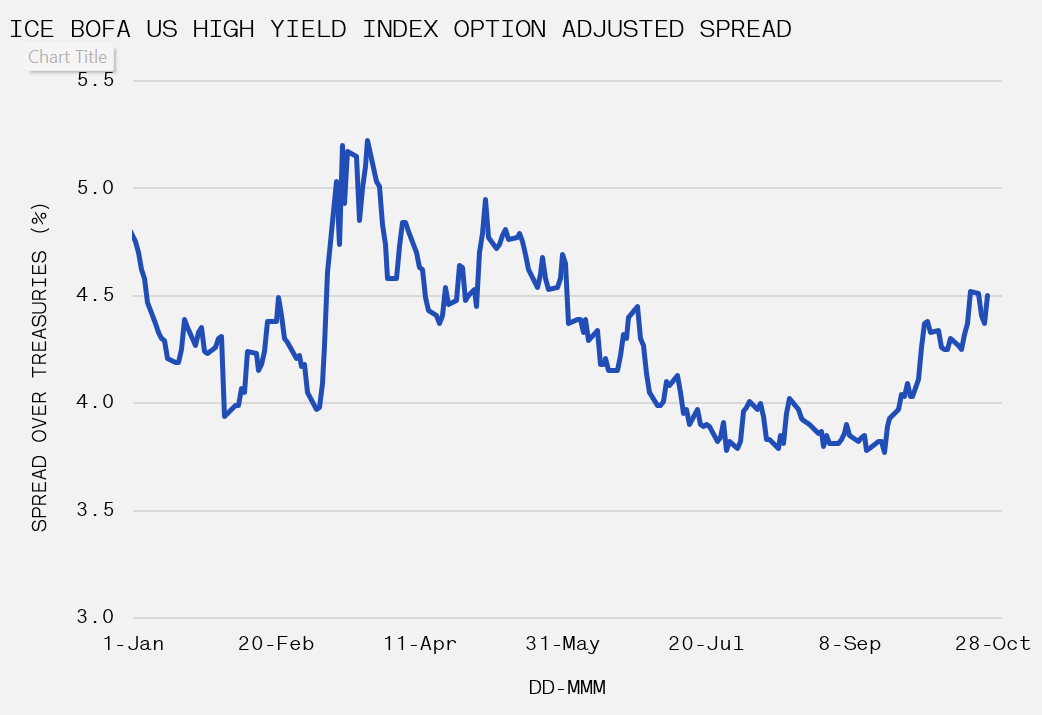

We find it instructive to not only monitor outright price movements, but the persistence of correlations between asset classes. This is important to note as an increase or decrease in correlations can be useful when assigning a weight to the month-to-month squiggles of asset prices. For instance, we look at the ICE BofA U.S. High Yield Index Option-Adjusted Spread as a measure of stress within the corporate bond market. If the spread is rising, it means that lenders are demanding higher rates to issue loans to U.S. companies, likely due to their perceived increased risk. Up until late September, this gauge was falling. However, since 20-Sep-23, we have seen corporate spreads widen considerably. Though nowhere near the 7%+ levels seen during major risk-off periods like the Great Financial Crisis (2007-08), the rise is noteworthy as it could point at signs of potential vulnerability in the economy which so far has defied most economists expectations to the upside.