Is It Getting Hot In Here?

New year-to-date highs were touched in July, with the MSCI All Country World Index leading the way up 3.4%, followed by the S&P 500 rising 3.0% and the TSX pulling up the rear with a 1.1% move. The trend of rising markets and a falling U.S. dollar continued during the period, with the DXY falling 1.4%. Large speculators remain short across all major indices outside of the Nasdaq, although not as extreme as in the spring. Nonetheless, the fire is being fueled by the combination of short covering and the more recent development with trend followers, such as commodity trading advisors. As a result, positioning in equities has moved into a more neutral area. Meanwhile, severe pessimism has emerged against the U.S. dollar. Speculators have piled into long positions in both the euro and the British pound. The Commodity Futures Trading Commission weekly report for the week ending 18-Jul-23, disclosed that U.S. dollar net shorts were at record levels. This development needs to be closely monitored, because a rapid reversal could be a taste of poison for risk assets.

The wicked struggle for bonds extended through the month as the 10-year yield knocked at its March high, north of 4.0%. For the past 10 months, the benchmark yield has been confined to a tight range. However, the upside boundary is threatened by the risk of surprising economic growth and an increase in the supply of bonds from the U.S. Treasury. If both were to materialise, a breakout in yield to the 5% zone is credible. Thus far, the Treasury has funded the vast majority of spending through shorter-term bills. Accordingly, the upcoming quarterly rebalancing announcement has the potential to impact long-term bond prices. Additional bond weakness has the ability to leak into broader markets and the economy as banks demand higher interest rates from borrowers, corporations, homeowners, students and consumers. Climbing rates erode corporate profits due to higher interest costs, worsen CAPEX opportunities and lower the present value of expected cash flows.

The underlying strength of the U.S. economy was supported by the data released in July. Second quarter GDP came in at 2.4% annualized vs. 2.0% expected, once again exceeding economists’ forecasts. Some are pointing to the outsized contribution from government spending as an anomaly, but consumer spending was invigorating. Increased rates have not deactivated the population’s appeal for shopping. Albeit, fiscal policy since Covid, which was originally intended to protect from an outright collapse, has been on ongoing stimulus and will remain a tailwind for growth on a more consistent basis.

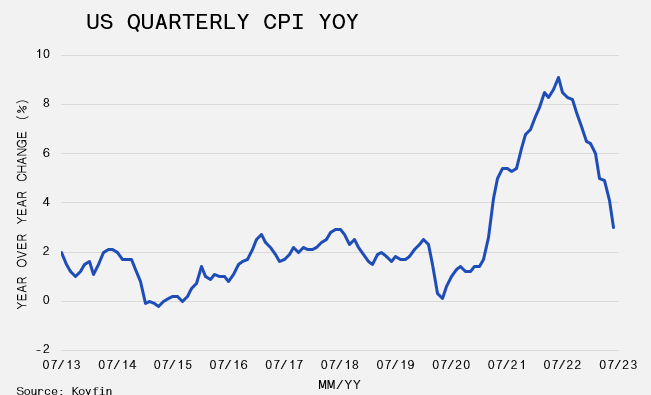

Oil prices have responded to the optimism around growth, rising 12.9% to erase its year-to-date loss. While growth shocks to the upside, headline inflation attempts to complete its round trip back to the pre-pandemic trend, rising “just” 3% in June, below consensus and the lowest rate since April 2021. But, before victory can be claimed and a hero named, the declining inflation trend will be confronted with year-over-year comparisons that are less easy to slide beneath. Weak energy prices can not be relied upon to smother every ember that re-ignites. Stay tuned to learn if the Fed’s hand is forced to choke the economic fire.