Seasonality on Display in September

Weakness accelerated across equity markets in September. The S&P 500 fell 4.6% and the MSCI All Country World Index dropped 4.1%. The TSX was a bit firmer, sliding 3.5% as the energy sector supported the benchmark.

Unrelenting strength in the U.S. Dollar continued to be a drag on equities as the U.S. Dollar Index (DXY) rose 2.8%. Another major contributor to the downside in risk assets was the complete absence of a bid in the U.S. Treasury market. Treasury Bonds with a term of 20 to 30 years, as measured by iShares 20+ Year Treasury Bond ETF (TLT) crumbled 8.5% in September. TLT regressed to price levels not seen since 2007. The disturbance in government debt has preceded the U.S. Treasury’s long-term bond issuance program. The Federal finance department needs to boost its supply of bonds, in order to fill the growing gap between tax revenue and spending. The next couple weeks will be important as falling prices and increased volatility may lead to widespread deleveraging and sales in equity and fixed income instruments.

The increase in the stock-bond correlation, or the degree to which stocks and bonds move together, has been challenging for investors who rely on the traditional 60%-40%, stock-bond portfolio. For most of the past 20 years bonds have helped cushion the blow for equity weakness and vice versa. However, looking back, the low correlation from 2000 to 2020 was a historical glitch rather than the normal course. Prior to 2000, and going back as far as 1929, stocks and bonds were on average positively correlated. If this pattern re-emerges, traditional asset managers swill struggle as the “balanced portfolio” is the gold standard for the industry’s product suite.

Fundamental improvements in crude oil fueled oil prices during the period. Inventories declined below the 5-year average. However, positioning in crude is becoming crowded on the long side. Prior to the current uptrend, traders, investors and speculators had the opposite setup. U.S. domestic production is moving sharply higher to 12.9 million barrels per day, a post-pandemic high. As such, additional bullish data points will be needed to feed further upside. Policymakers are on guard for a reacceleration of inflation piggy-backing off rising energy prices. The Federal Reserve is already constrained by the bond market in its efforts to promote stable prices and to moderate interest rates. Elsewhere in commodities, gold took it on the chin as a strong dollar and rising Treasury yields knocked the price down 3.9%.

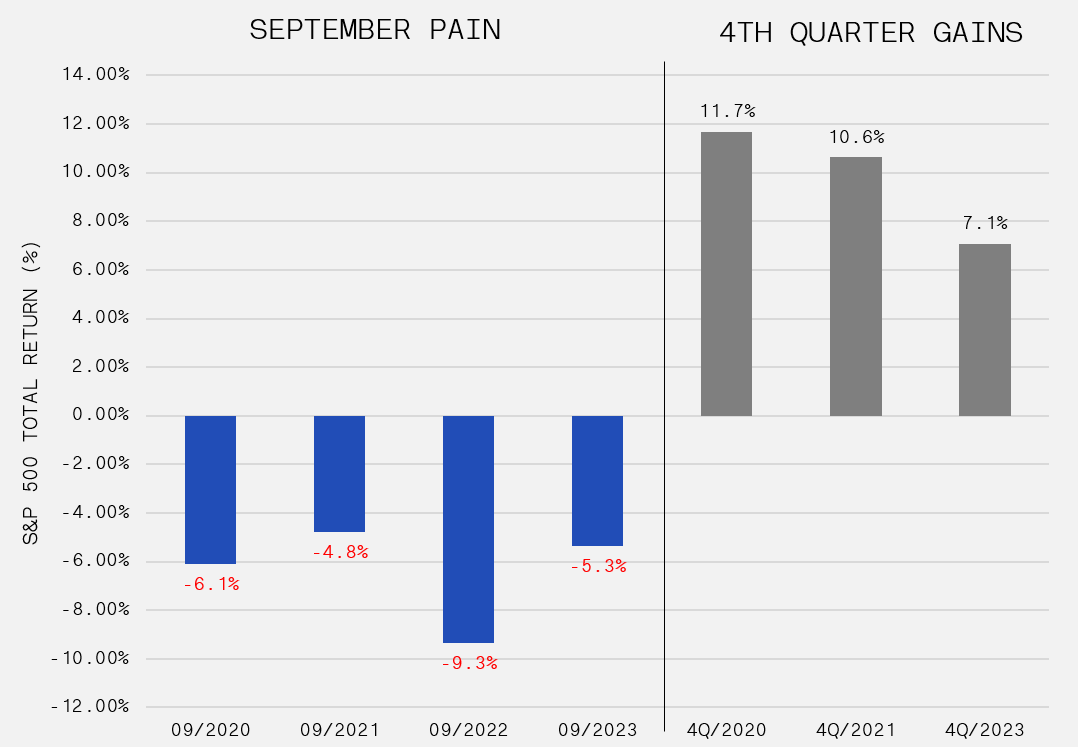

While the -4.6% S&P drop is nauseating, it certainly does not come without precedent. According to Yardeni research, September is historically a month for suffering. The average decline in the Ninth Month from 1923 to 2023 is 1.1%. Since 2020, the S&P 500 has been afflicted by the curse in each of the four Septembers with an average pounding of 5.8%. However, if you believe that history repeats or rhymes, there is reason for optimism in the fourth quarter of 2023. In 2020, 2021 and 2022, the S&P 500 rallied 11.7%, 10.6% and 7.1%, respectively, from October to December. Seasonality should never be the sole reason to be bullish or bearish and, for a healthy rally to materialize, calmness in the bond market needs to be prescribed.

Lastly, we are also on alert for direction in the High Yield bond market. Corporate credit continues to hold up well despite the turbulence elsewhere – preserving hope that a recession is not forthcoming or already upon us.