Stocks & Bonds Back-Up. Oil & Cannabis Advance.

Following a 5-month winning streak, markets pulled back in August. The TSX matched the S&P 500 with a decline of 1.6%. The MSCI All Country World Index dropped 2.8% as Europe fell over 3% and China was clobbered by more than 8%.

The S&P 500 was down 4.7% mid month, before Federal Reserve Chairman Jerome Powell spoke at Jackson Hole where he reinstated the goal of bringing inflation down to 2%. However, the combination of easing in the labour market and below peak inflation dispelled fears of more aggressive rate hikes. Accordingly, bullish late-month price action emerged in the equity markets. The other related reversal in August was the U.S. Dollar, as the index rose 1.5% in disagreement with speculators who had piled into the short side of the trade. The prospect that the U.S. would hold the line on rates was expected to weaken the U.S. dollar, relative to other nations who were not as quick to combat in inflation. Risk markets will be on alert in the coming weeks to assess if the surprise greenback rebound was a proactive flight to safety.

With most asset classes reversing their year-to-date trends in August, it was logical for bonds to end their drought and rise meaningfully in August, right? Right? Unfortunately for those who continue to accumulate bonds, the iShares 20 Plus Year Treasury Bond ETF (TLT) surrendered 3.3%. The softness coincided with supply concerns related to the U.S. Treasury’s funding announcement earlier in the month. We highlighted in July 2023 that the makeup of the funding between short-term bills and long-term bonds would be important to market participants. The Treasury revealed that they would issue more longer-term bonds to fund their operations, which will add supply to the market. Without a corresponding increase in demand, prices for debt securities are predisposed for vulnerability.

West Texas Intermediate (WTI) oil, one of the main global oil benchmarks, prolonged its ascension, rising 3.3% to $82.50. There has been resistance at this price level since November 2022. But, the bullish case is supported by inventory levels that are well-below the 5-year average and output cuts in Saudi Arabia. Whereas, the price ceiling may prove formidable given that U.S. crude oil production is now expected to rise more than previously thought in 2023. Elsewhere in commodities, precious metals held-in despite rising yields and a strong U.S. Dollar. Gold was nudged lower by 0.8% and silver crept-up by 1.2%. However, industrial metals, typically a gauge for global growth, fell, with copper down 3.2%.

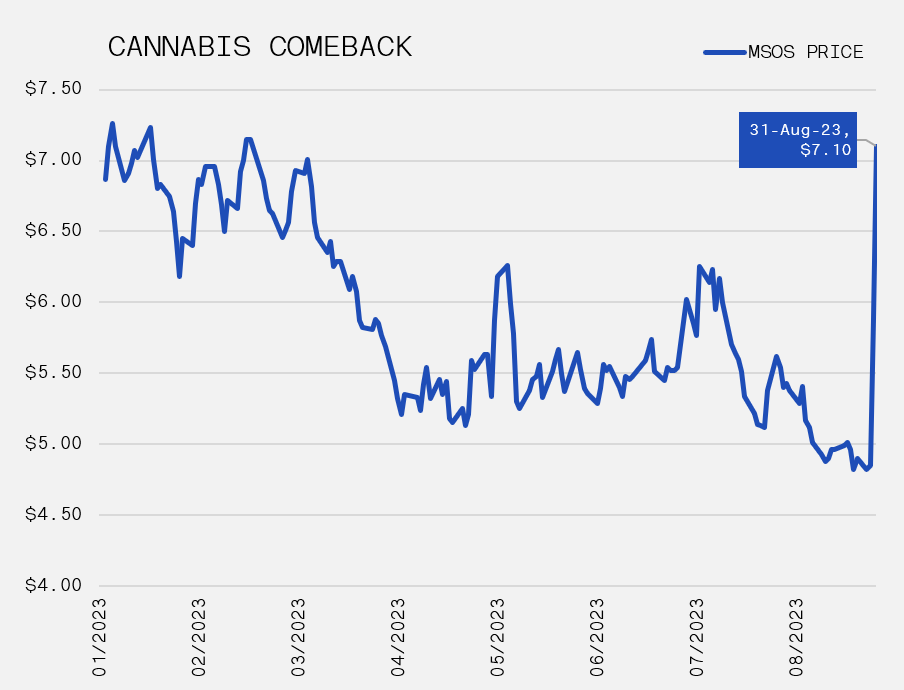

Cannabis may finally catch a real bid as the AdvisorShares Pure U.S. Cannabis ETF (MSOS) rose 47% in the final two trading days of the month. This followed the U.S. Health & Human Services’ (HHS) recommendation to move cannabis from Schedule I to Schedule III of the Controlled Substances Act. The ramifications are far-reaching if restrictions are eased. Federal reform would allow U.S. multi-state operators (MSOs) to deduct expenses that are currently prohibited under IRS Schedule 280E. Further, the removal of investment constraints would be a massive boost for cannabis companies that are starved of natural bidders. Be that as it may, short-term news and rumours have propelled past rallies in cannabis, but these have quickly faded. Moreover, this recent surge has merely taken MSOS back to where it started the year. It’s also important to keep in mind the Drug Enforcement Administration (DEA) will still need to conduct their own investigation. Nonetheless, there is no denying the impact that such a move will have on the fundamentals that set the financial value for stocks in the sector.