See Through Clouds Of Euphoria

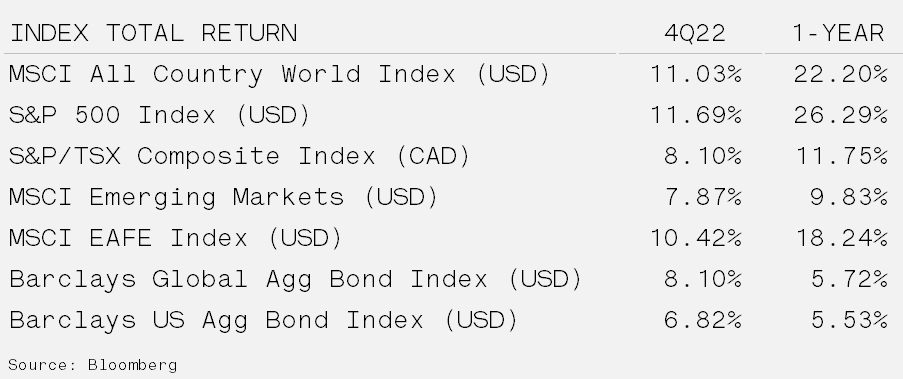

Comeback Nearly Complete For Some – Helped by a better-than-expected economy and corporate earnings, major equity markets capped off a good start to the year with a significant rally into year-end. Within the United States, the ‘Magnificent 7’ stocks averaged a return of 111%, accounting for nearly 60% of the S&P 500’s 22.2% gain. The median stock in the S&P 500 underperformed the broader index by 16%, the most since 1999. The Canadian market also lagged as global growth slowed while inflation remained sticky, this lead to lower telecom, utility and commodity related equities.

A fourth quarter push landed bonds in positive territory for 2023 but it was a volatile year. Bond market volatility was fueled by concerns over inflation, the avoidance of a recession and finally the Federal Reserve (Fed). Following a strong rise in yields in the third quarter, inflation eased and the Fed guided rate cuts in 2024, sending yields lower.

More Uncertainty But Staying the Course – As we entered 2023, many market experts expected a recession to unfold and equity positioning reflected this. In hindsight, the setup was there for a market rally and that is exactly what occurred. Inflation fell from 7% in December 2022 down to nearly 3% in recent readings. Rates however rallied for much of 2023, along with equities and gold, before the former turned lower in November following rate cut guidance from the Federal Reserve. It appears the market is poised to be reactive to monetary direction as well as fiscal impulses that will likely persist given 2024 is an election year. While fundamentals and even positioning may take a backseat, these will eventually matter. Therefore, we must understand where we are to provide guidance for what is likely to be a bumpy path for continued prosperity.

Despite higher interest rates, tighter bank lending standards, and a slowdown in the United States manufacturing complex, the US economy remained resilient in 2023. This has nearly split economic forecasts for 2024, with 43% foreseeing unchanged or stronger conditions and 56% expecting a weakening. The American consumer and labour market helped to alleviate some of the worries about an impending recession. Going forward, it appears that consumers have run through most of the COVID-19 pandemic relief savings, with excess savings down to $1.14 trillion from $2.73 trillion in October 2022. It will likely be the labour market that is challenged to keep the economy from slipping into a meaningful recession.

The US Federal Reserve began signaling rate cuts late in 2023 as inflation numbers fell closer to their 2% target. Developed Economies are unlikely to continue aggressive rate hikes, but significant rate cuts are questionable unless we see growth weaken or unemployment rates jump higher. Geopolitical tensions and disruptions may also play a role in determining rates as higher shipping costs may offset deflationary pressures of weaker oil prices (if they occur) and the delayed impacts of lower rental prices. Rates therefore appear to be rangebound, with short-term money markets providing the best risk-reward.

Since the start of the rate hike cycle in 2022, regional business cycles have weakened, earnings growth has become anemic at ~2.5% growth rate, and the market corrected over 20%. The full impact of higher rates has yet to sink in due to excess savings and the corporate debt wall yet to mature. More concerning is the increase in delinquencies and over-bullish readings in sentiment and positioning that is at its most extreme level of optimism in nearly two years. Furthermore, equity concentration reached levels not seen since 1970s with a very narrow leadership, which has historically occurred ahead of a slowdown.

The Fed and ECB are ready to ease, government spending is accelerating, interest rates are idling, and oil prices appear to be headed lower. It does not seem to be an obvious recipe for the deep recession that so many expected in 2023 and continue to forecast for 2024. However, it is never quite euphoria – the window remains open for policy mistakes, geopolitical risks persist and debt keeps expanding. Therefore, we remain focused on quality assets.