Opposite Outcomes Coming for Assets Classes

Santa rewarded investors in December, with the S&P 500 rising 4.4%, leading to a positive 24.2% year for the main index in the U.S. The MSCI All Country World Index was the monthly leader (+4.8%), while the TSX lagged slightly (+3.6%) as Energy weighed. Key sectors were REITs (+10.5%) and Industrials (+8.7%), while Energy was flat.

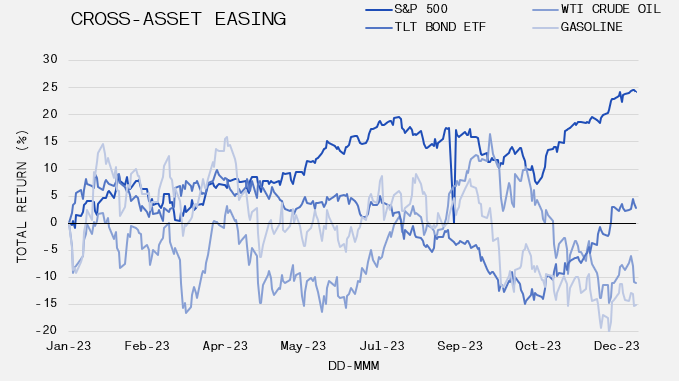

For the year, Technology and Communications both soared close to 60%, while Consumer Discretionary registered a similarly strong 43% gain. Utilities and Consumer Staples were the slugs, falling 7% and 1%, respectively. This performance dichotomy disagreed with the consensus trade coming into 2023. Given the expectations for a recession, there was considerable analyst optimism for defensive sectors. Consistent with recent trends, bonds were up in December, with the iShares 20+ Year Treasury Bond ETF (TLT) exceeding all equity indices, climbing 8.7%. Gold rose 1.3% while crude oil continued to fall, down 5.8%.

As mentioned above, there was little doubt that the U.S. economy would enter a recession when the calendar turned to 2023. The Fed was embarking on its most aggressive tightening cycle in decades producing a difficult operating environment for corporations and shrinking consumer wallets. However, growth remained strong and spending was less sensitive to higher rates than anticipated. Unemployment was persistently low despite an expansion of the work force. Real wages rose as average hourly earnings were up 4.4% year-over-year, which exceeded inflation. Fiscal stimulus also supported the economy through programs such as the Inflation Reduction Act and CHIPS Act. Factor in a weaker energy complex with gasoline prices off 15% from where they started the year, and risk was clearly rewarded in defiance of overwhelmingly bearish positioning. An additional boost materialised later in the year, when prospects for monetary policy reversal was priced-in to the markets. This reversed much of the tightening that occurred in the first half of 2023. Bond yields are back to where they started 2023 and stocks have responded accordingly.

In response to softer language from central bankers and more muted inflation, the bond markets recorded its biggest two-month bond rally since the global financial crisis. Rate cuts totaling more than 150 bps are priced into the markets, despite the Fed plotting an easing of 75 bps in 2024. The long end of the curve has also adjusted. TLT outperformed the S&P 500 by over 2% during the past three months. It is typical for the path of bond yields to follow the declining rate of growth in nominal gross domestic product (GDP), a measure of country’s economic health. Commodities similarly are pricing weakening demand, with oil down 21.2% over the same period. In contrast, stocks were making or approaching all-time highs in December. Ironically, equites are being led higher by more economically sensitive companies which have finally started to catch-up to large cap leaders like Apple and Microsoft. Likewise, credit spreads have revisited the lows of the year.

It is not unreasonable to expect rate cuts in the first quarter of the new year given that inflation is tracking toward its target. An initial drop in the benchmark rate will be consistent with the commentary coming from Fed speakers. But absent a deep recession, the probability of the seven cuts implied by the markets being realized is low. This makes the recent strength across the bond curve tough to sustain. The most significant macro pair will be the correlation between stocks and bonds, which are moving directionally in lock-step. Each asset class is pricing a divergent reality. As such, there are a wide range of outcomes to recognise and a reversal in the bond market could bleed into equities. As always, an improving (but not over heating) economy will encourage another strong year in capital markets but a watchful eye on broad asset class positioning is critical to understand whether a rotation will help sidestep declines or enhance returns.