WeWork-ing to Crush the IPO Market

The S&P 500 and MSCI World Indices printed strong gains in consecutive months. October is closing in on 2.6% improvement as progress on the Chinese and US trade deal has invigorated the equity markets. The “Phase 1” announcement involves Chinese purchases of $40-50 billion of agricultural products from the US. In exchange, the US would cancel the tariff increase on $250 billion of Chinese imports that was scheduled to take effect on 15-Oct-19. Chinese President Xi and Trump are scheduled to meet on 17-Nov-19 where it is expected that final details will be put to paper. It’s important to understand the hot and cold nature of these trade negotiations. Since Chinese hacking/IP theft is not included in this phase, it seems to be a stopgap to show headway.

The TSX took a step back, down 1.6% for the period. Once again, the energy sector led the benchmark to the downside, by falling 8.6%. However, there were no sectors on the TSX that registered a gain for the month. Canadian energy names decoupled from oil before and after the Canadian election. In August, the energy sector climbed 13% as momentum began to build for the Conservative party. As it became clear that a Liberal minority was the most likely outcome, the trend reversed, along with Canadian oil as measured by Western Canadian Select. WCS tumbled 9.9% while West Texas Intermediate (WTI) slid just 1.1%. Outside of the preliminary move in oil, most markets were unaffected by the election, and the Loonie strengthened 0.4% versus the greenback.

Gold weakened during the month, down 1.1%. Some of the softness could be attributed to a reversal in the trend of falling yields globally, as both the US and German 10-year yields rose 17 and 23bps, respectively. Rising yields and a 3.1% lift in copper prices made for an interesting month on the macro front. Despite the short-term nature of the signals, the implications for inflation are intriguing.

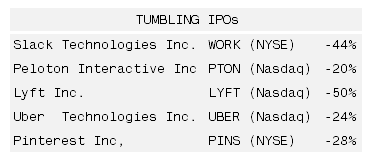

One of the more interesting trends so far in 2019 has been the evolution of the IPO market in the US. As illustrated in the adjacent table, many of this year’s initial public offerings are trading significantly below their high or list prices. This weakness signals a major shift in investor expectation. The focus may be shifting from growth-at-any-cost to one where companies are expected to run a profitable business.

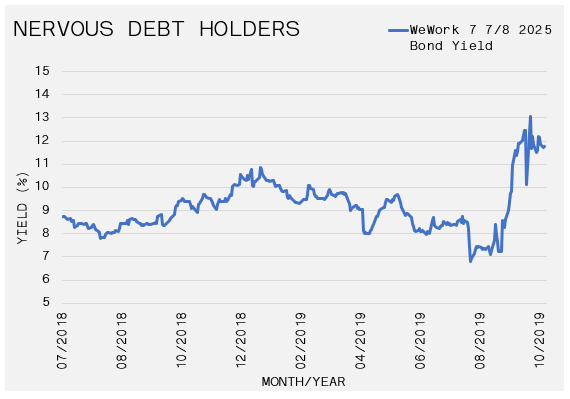

To put this in perspective, the five companies listed above are expected to lose a combined $4.4 billion in EBITDA in 2019 vs. revenues of $22.6 billion. Pinterest is the least egregious offender, responsibly burning through only $32.9 million in EBITDA. While public market prices revealed the change in sentiment, the spark was more likely related to a company still operating in the private market space, that being WeWork. Now it is clear from the numbers cited previously that investor penchant for due diligence has been severely compromised of late, but WeWork seems to have been the shot of adrenaline that the market needed to wake up to the reality. It doesn’t take a CFA designation to understand that the business model would not work. But, the public disclosure in WeWork’s S-1 provided the necessary awakening. This realization and the subsequent rejection by public markets slashed the company’s valuation from a reported peak of $47 billion to just $20 billion. Furthermore, the largest investor in the company, Softbank’s Vision Fund, seems to be the only bidder for the company. Without another suitor or an alternative source of funding, that $20 billion valuation may still seem exceptionally high. Moreover, the yield on WeWork’s bond (due in 2025) has spiked from a low of 6.8% in Aug-18 to a high of 13.0% in Oct-19. This signals that investors are not eager to continue to provide any debt funding.

The consequences of this failure extend beyond WeWork. Softbank is the largest investor in Uber, Slack, and DoorDash, and a 26% holder of Alibaba, among others. Additionally, WeWork has approximately $50 billion in office leases, which represents the largest tenant in New York, London and San Francisco. Global property markets would be impacted if this occupant failed to meet their obligations.