Stocks Blaze, Easter Bunny Pays

Markets continued to make new highs in March, as the S&P 500 rose another 3.3%, mirroring the return of the MSCI All Country World Index. The TSX, the 2024 laggard, paced both indices rising 3.5% as commodities have now joined in the gains with the CRB Commodity Index rising 4.8%. While the persistent strength of the S&P 500 index is newsworthy, perhaps more impressive has been the underlying contributions by sector. We have discussed the 2023 outperformance of sectors like Technology and Consumer Discretionary, with some even hinting at this as a reason to doubt the sustainability of the rally in broad markets. Well in March it was Energy (9.2%), Utilities (8.2%) and Materials (7.7%) that were the leaders, while Technology, Consumer Discretionary and Healthcare lagged. Either way, there certainly has been a broadening of the rally which has taken the first quarter S&P 500 performance to +10.6%. On the other side of a balanced portfolio, even bond investors will be attempting to re-learn how to high five after a +3.4% return for iShares 20+ Year Treasury Bond ETF (TLT).

The market’s perception of the U.S. Federal Reserve policy is contributing to the broad-based market strength. Building on Fed sentiment that began to shift dovish to start the year, Fed Chair Powell did nothing to temper these expectations at his 21-Mar-24 announcement and press conference. While they maintained rates at 5.25-5.5%, commentary reiterated that we have likely seen peak policy rates for the cycle, and perhaps more importantly, that it would be appropriate to begin tapering so-called quantitative tightening (QT) “fairly soon”. QT has been a stubborn and consistent weight on Treasuries which applies upward pressure to interest rates. Supply-driven support to the bond market combined with the potential for cuts in policy rate should be supportive for risk assets, which the market appears to be front-running, as seen by a rare positive month for bonds. Helping to confirm the market’s perception of a loose Fed has been the continued performance of commodities. Gold led the way, feeding off falling yields to rise a staggering 9.1% in March. WTI oil rose 4.6% while copper rose 4.4%. Interestingly, rising commodity prices are both a symptom of loose monetary and fiscal policy, and a future threat of tighter policy in the future as commodity prices are a key input to inflation. Considering the reaction to its March commentary, it will be noteworthy how, if at all, the Fed adjusts its wording in its communication over the next few months.

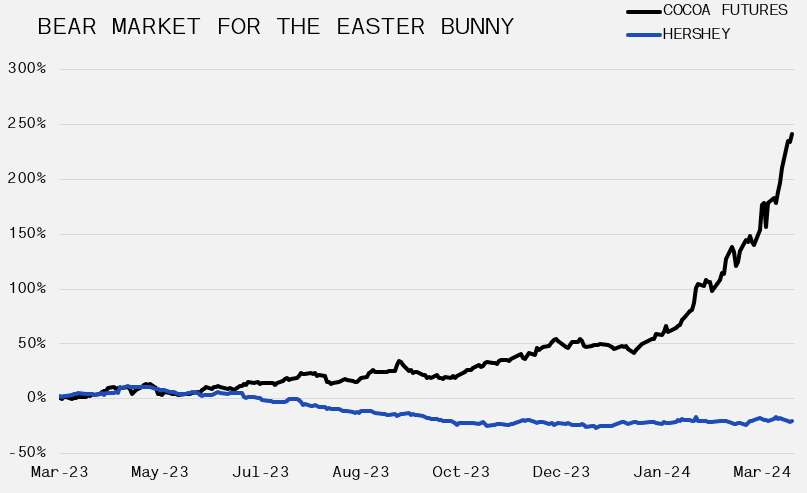

While most market participants cheer the widespread upward movement across assets, there is one notable character that is surely suffering as one commodity makes all new highs. As the Easter Bunny prepares to make their annual chocolate deliveries, he’s surely feeling the pinch while gathering raw materials in 2024. Cocoa prices continued to soar in March, bringing its one-year return to 240% as a combination of bad weather and disease have impacted supplies out of West Africa, where the majority of cocoa is harvested. Hershey, a company sharing a similar business model to the Easter Bunny, albeit with better revenue characteristics, has seen their stock price fall materially over the last year despite market support. Surely with such a large breakout there has been an influx of financial players pushing the prices beyond where fundamentals justify, so for now both Hershey and the Easter Bunny can only hope that increased media attention lately is a harbinger of some kind of top on the horizon.