October 28, 2021

The company formerly known as Facebook falters while markets rally

Market Recap & Boxscore

Markets re-established their 2021 uptrend in October, led by the S&P 500 Index, rising 5.2%, as of 27-Oct-21, as it hit a new all-time high. The TSX Index was not far behind, as strength in energy and financials contributed to a 5.1% gain for the month. The MSCI World Index lagged but still managed to pop 4.6% during the month. Commodities continued to march higher, with the CRB Commodities Index climbing 4.0%. WTI Oil surged 11.2% and breached $85 for its first time since 2014. Rates initially appeared to extend its uptrend, with the 10-year U.S. Treasury yield rising from 1.52% to 1.70%, but a late rally in bonds helped bring the long-end back down to even. This event similarly reversed some of the small cap outperformance over technology that started the month. Gold rose 3.4% and continues to be range-bound.

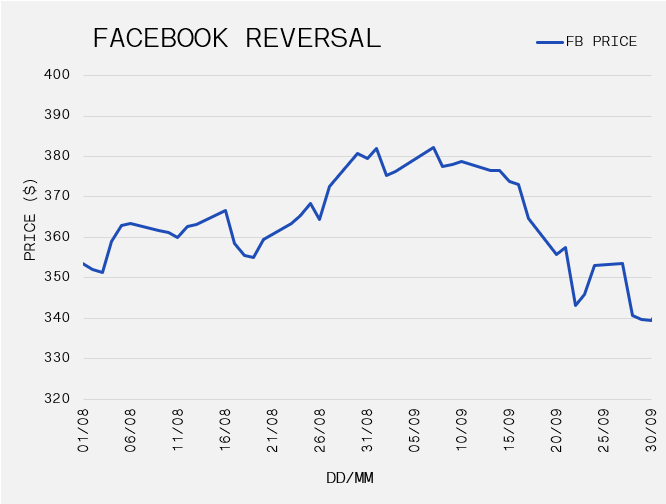

It was interesting to observe the aggressive moves in stock benchmarks without corresponding strength in the FAANG names. The only name to outperform the S&P amongst the five was Netflix, posting a 12.7% gain in October on strong earnings and subscriber growth which beat analyst expectations. (Thank you, Squid Game!). The biggest laggard of the group continues to be Facebook, down 10.9% in October and 14.8% over the last three months. There has been no shortage of narratives to justify the fall, and likely much of this started back in April when Apple announced iPhone privacy changes that would prevent advertisers from tracking iPhone users without their consent. It is no secret that FB’s bread and butter has been their ability to track and personalize advertisements, and without the ability to do so, the appeal of FB for marketing spend has subsided. Their third quarter results showed the company missed expectations on advertising performance. Further, FB announced a massive capital spending program to fund growth initiatives like AR/VR and their foray into the metaverse, which starts to introduce some thesis creep into the bull case. It is worth noting that supply chain issues are also potentially affecting the company’s results. There is less incentives for product vendors to spend on advertising without goods to sell. In any case, doubts about FB’s growth forecasts are certainly emerging.

The third quarter earning season has begun and the market’s reaction to the reported results has been noteworthy. A selloff in the reporting company’s stock price has largely been the outcome even for those who beat expectations. While the bull trend remains intact, we will be monitoring a couple of factors to gauge the rally’s vigour; (1) the relative strength of large cap tech, and (2) if price momentum fades despite top and bottom-line results that substantially beat expectations.

Rates and inflation remain top of mind for investors. Globally, long-term yields have risen and breakeven inflation rates have moved to levels not seen since we exited the Global Financial Crisis. Accordingly, the U.S. Federal Reserve’s actions will garner massive attention. Decision makers greeted early signs of inflation from November 2020 through to mid-2021 with confidence that price increases were transient. However, more recently, commentary suggests that secular inflation fears are mounting. Meanwhile, the Bank of Canada cited “higher energy prices and pandemic-related supply bottlenecks now appear stronger and more persistent than expected.” As a result, they declared their intention to start lifting rates quicker than anticipated. The Bank is also ending its QE program which originally purchased C$5 billion of government bonds per week. The challenge for policy makers and investors is to process the sustainability of better-than-expected growth with higher-than-expected prices.