May 27, 2019

Hostilities Between U.S. and China Disturb Investors

Market Recap & Box Score

“Sell in May and go away” rang true in 2019 as markets gave back their April gains. This marks the first down month in markets for 2019, with the S&P 500, MSCI World, and TSX all dropping 3.3%, 3.1% and 1.3%, respectively. It seems that global growth concerns are back on the table, with tensions between US and China highlighting the issue during the month. On 8-May-19, President Trump raised Tariffs on $200Bn worth of goods from China from 10% to 25% in hopes of hastening the signing of a trade agreement between the two countries. While many foresaw the tactic working and a quick end to the negotiations, it seems that it has done nothing more than further solidify each party’s position. Caught at the center of the negotiations are questions surrounding the prospect of a new technology cold war. Trump struck the first blow, inking an executive order to restrict US tech purchases by foreign adversaries deemed a national security risk. There is no secret that the target is Chinese alleged State-Owned Enterprise Huawei, as the move cuts off Huawei’s supply of key inputs such as semiconductors and Google’s Android operating system which are mission critical to the future of the business. Perhaps, more importantly, this could end its reign as the leader in global 5G next generation technology. One would think Trump, who sees the stock market as his primary report card, would want a quick end to the negotiation should markets weaken further. He has never been one to take the high road so time will tell. Treasuries and copper are both telling us trade wars are bad for the economy, with copper down 8.1% in May, and the 10-year treasury yield down to 2.32%.

Equity investors were not the only ones left licking their wounds, with oil reversing consecutive 11% gains to drop 10% on the month. Chinese buyers were reported by Reuters to be refusing to sign long-term supply agreements with US producers, instead utilizing supply out of Iran, Russia, and evidently Saudi Arabia, who reported a 43% increase in oil exports to China in April. This may help explain the relative outperformance of Brent Crude, down 5.0%, outperforming WTI by 5.0%. Also impacting fundamentals is seasonal refinery maintenance, moved up this year by IMO 2020. IMO 2020 refers to new shipping regulations requiring the use of more environmentally friendly fuel. Many refiners are expecting increased pricing for the product, front-loading maintenance to operate at full capacity ahead of the Jan-20 switch, helping to increase crude and fuel inventories.

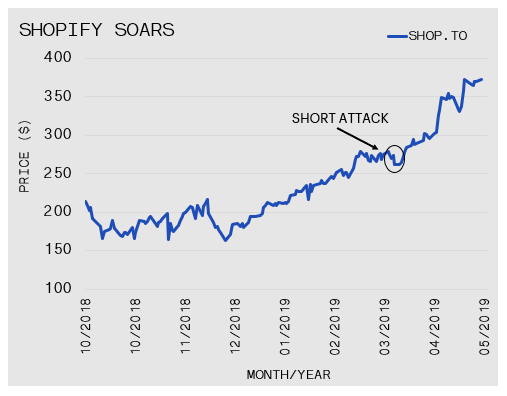

The outlier in equities was the TSX, with financials, energy, and mining all taking a hit, on the surface one would have expected the TSX to be down materially vs. its global peers. However, during the month the index was propped up by technology and industrial shares. Industrials were boosted through airline M&A as WestJet agreed to be taken private by Onex Corp and reports swirled of an Air Canada takeover of Air Transat. Tech strength was driven by CGI and Shopify. SHOP is now up 107% year-to-date as their e-commerce solution continues to drive strong revenue growth. SHOP is looking to corner the market for all their merchant’s needs, including Shopify Shipping handling the shipping needs of over 40% of merchants, and Shopify Capital providing $87.8MM in merchant cash advances and loans during Q1, in addition to the launch of a new chip reader. Investors seem to be confident in SHOP’s ability to execute on all angles, with Price to Sales based on guidance for 2019 coming in at 24.9x, vs Amazon at 3.3x. We also note that on 4-Apr-19, short-seller Andrew Left of Citron Research came public with a short report which sent shares down 6% on the day, citing competitive pressure from such companies as Microsoft, Square, and Facebook in a market where SHOP was operating in unison previously. There are two winners from this report, the investors with the foresight to buy the dip and realize a 43% gain since, and the Robin Hood Foundation where Mr. Left promised to donate $200,000 if SHOP traded above US$ 200 in 12 months’ time (US$ 275 as of 27-May-19).