Rate Cut Delays Fail to Alter The Market’s Flow

The S&P 500 followed up on a strong January with an acceleration to the upside in February. The benchmark jumped 4.9% during the month. The MSCI All Country World Index joined-in after lagging in January, rising 4.4%. The TSX continued to post modest gains, up just 1.6% as Financials and Materials lagged in Canada. On the commodity front, oil improved on its formidable start to advance 3.1%, bringing its two-month return to 9.3%. Gold eked out a small gain of 0.5% despite the combination of U.S. dollar strength and bond weakness. However, these remain the outliers as most other commodities have drifted lower. The Bloomberg Commodity Index fell 2%, extending its downward trajectory since June 2022. Much of this can be attributed to the grains, which comprises 23% of the index. Corn and soybeans are both down 7.4% and 6.8%, respectively. Within the energy complex, Natural Gas which makes up 7.3% of the index, fell 25.2% on continued inventory woes.

Earnings for the S&P 500 were impressive in Q4, driven by an economy that persistently surprises to the upside. According to Factset, as of 29-Feb-24, 97% of S&P 500 companies reported Q4 earnings, with 73% of those reporting a positive earnings growth surprise, and 64% reporting a positive revenue growth surprise. The blended S&P 500 earnings growth rate came in at 4% year-over year. While both company and general economic strength has thus far defied expectations, it is interesting to see the market catching up. We highlighted in December that the market anticipated eight rate cuts by Federal Reserve was overly optimistic. But with GDP growth continuing to levitate and inflation remaining sticky, the probability of a decrease in March rate has now almost completely been priced out. The probability of a chop in May has similarly gone from 80% to 20%. Accordingly, the previous 7-8 cuts being priced in by December 2024 has been guided to a more subdued 3 reductions by year-end. Despite the shift, the bond market has taken the moves in stride, as the 10-year yield rose just 27bp during the month and has stayed relatively flat since mid-Feb when most of these cuts were priced out. The 2-year yield, where most of the impact would be expected, rose just 39bps. While any negative return is not a welcome result for bond investors, the bond market in general could be showing signs of resilience. Despite Federal Reserve speakers confirming this with a more hawkish tone throughout the month, the U.S. dollar, as measured by DXY, only managed to rise 0.5%. However, the Loonie conceded 1.3% despite oil’s strength. In contrast to the U.S., Canada is still experiencing only moderate growth, with GDP rising 1% year-over-year in the fourth quarter, following a 0.5% decline in Q3. Inflation fell below expectations in January, up just 2.9% so it seems the market is factoring a more dovish relative rate stance north of the border.

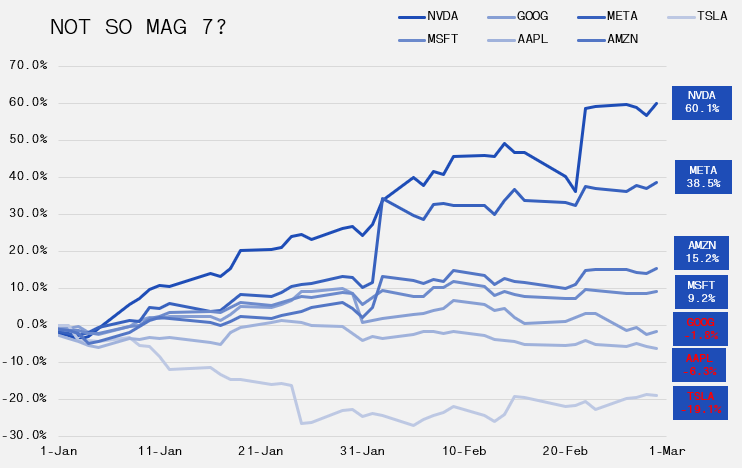

Under the hood, it is noteworthy that the gains were not simply a function of large cap tech outperformance, as has been the case. In fact, the aptly named Mag 7 has not been altogether magnificent at all in 2024. While NVDA’s 60.1% year-to-date move is certainly outsized, the fact that 3 of the 7 names are down year-to-date speaks to the broader strength of the market considering their outsized weight on the index. The Equal Weight S&P 500 Index posted a 4.1% gain in February, showing a broadening out of the recent market move. All eyes will be on whether this can continue to sustain the upside trend and whether CNBC needs to have a meeting to discuss a potential Mag 7 re-brand.