Markets Passing Through Obstructions

Markets picked up where they left off after a strong first quarter. Gains were posted across the board in April on the back of an earnings season that continues to frustrate the bears. The TSX led the way, up 3.6%, followed by the S&P 500 and MSCI World Index, rising 2.9% and 2.4%, respectively. Regarding earnings, its important to remember that stock markets are a discounting mechanism. Actual corporate performance versus expected results is most relevant because expectations are priced into current valuations. Many were predicting that 1Q23 would be the period for companies to finally reveal the impact of a cash-strapped consumer and increased input costs that correspond to sticky inflation. However, 79% of companies have beaten earnings expectations and 70% of businesses have exceeded revenue (as of 27-Apr-23). It is remarkable that actual earnings beat forecasts during a period of high inflation as typically rising input costs erode margins. Moreover, the size by which profits outstripped estimates, was even more noteworthy given predictions were for an outright contraction. Clearly, companies have had no problem passing on price increases to costumers, especially within the consumer staples sector, while cost for materials and resources begin to fade.

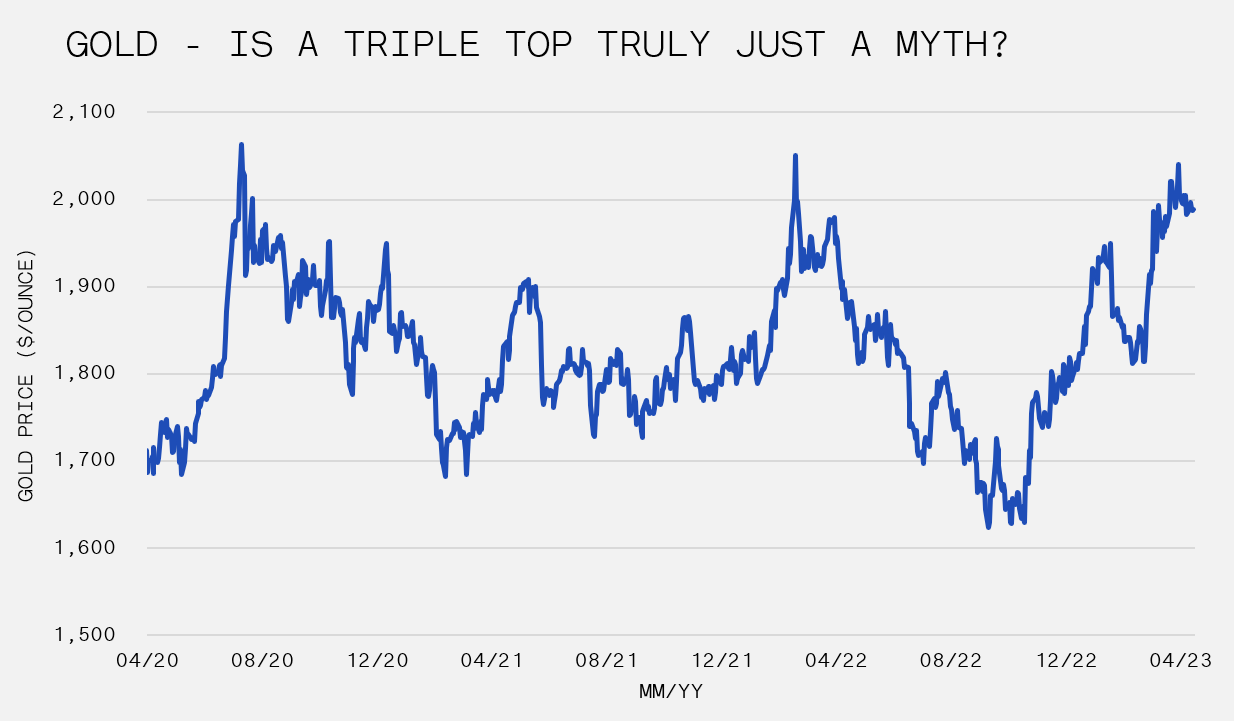

As equities marched upwards, commodities and bonds delivered subdued returns. After rising 9% in March and starting the month poised to break to all time highs, gold did what it does best – broke the hearts of gold bugs the world around. The yellow metal receded 3% to settle at a 0.6% monthly gain. Similarly, the 10-year Treasury yield had a round-trip. The benchmark bond had a 3.43% print on 03-Apr-23, rose to 3.60% mid-month, and settled at 3.43% on 26-Apr-23. WTI Oil was also in rhythm with gold and bonds; after 11.9% surge, it ended the session flat as well. The threat of a triple top chart pattern typically signals a reversal in the movement of the asset’s price. According to Kevin Muir of The Macro Tourist, triple tops are “just something parents tell young traders to make them believe technical analysis is real.” So, we will be watching closely to see if history is made here.

Optimism in crude oil followed OPEC+’s announcement of a surprise oil supply cut of 1.2MM barrels per day (bpd), increasing its total cuts to 3.6MM bpd. However, the reaction quickly waned, despite a strengthening fundamental picture. EIA data as of 26-Apr-23 showed crude inventories slid to the 5-year average. Concurrently, gasoline draws have reduced inventories to the low-end of their average as demand tracks above the 5-year high. The energy complex could be a desirable holding in the back half of 2023 if supply is constrained and the economy avoids a recession. As always, weak price action in the face of strengthening fundamentals is never the time to start catching a falling knife so patience is necessary.

Looking forward, the picture is opaque at best. Debt ceiling headlines will become front page news again soon. It has been calculated that the U.S. government will run out of funds sometime in June or July. U.S. Credit Default Swaps (CDS), are pricing this reality, rising quickly to 70bp, which is the highest recorded level since 2008, during the Great Financial Crisis. During the 2011 debt ceiling debate, the spread rose to 65bp. The odds of a technical default are still exceptionally low, but pockets of the market are pricing a non-zero possibility that some bondholders will not get paid. Additionally, data across various regional Fed surveys are increasingly showing economic activity slowing which flies in the face of resilient earnings. Accordingly, we will avoid being dogmatic about any particular view because it is a mistake to think that there is a cure for uncertainty.