Endurance is the Key in 2023

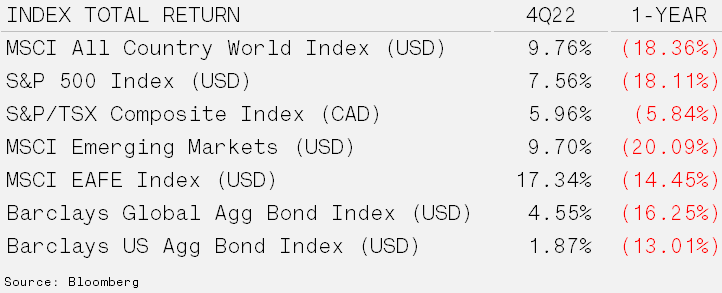

Good Quarter, Tough Year – Strong returns were achieved across most markets in the fourth quarter, as equities were pulled out of a deep correction. The decent rally certainly improved an otherwise ugly year. The year ended down nearly 20% for most averages, excluding the Canadian benchmark (S&P/TSX) due to its heavy weight in gold and energy stocks. In hindsight, it was a cliché equity rebound given the extreme positioning and miserable sentiment, overlayed with a forecasted slowdown in rate hikes. It is always easier on paper than in practice! Bonds finished the quarter positive, as well. The aggregate bond index tends to be a reliable interpreter of inflation and the direction of the economy. As such, we believe it has recognized the approaching downturn and prices responded accordingly with gains.

The Path Forward Remains Bumpy But Rewarding – Themes that drove the market in 2022, rising inflation, distorted asset prices and slowing growth, are likely to fade into the background as 2023 unfolds.

US inflation appears to have peaked in June 2022, with the Consumer Price Index moving from nearly 10% to below 7% in December. Meanwhile, the frothiest areas of the equity market and the surreal negative interest rate environment have for the most part been brought back to earth. Finally, the slowdown in economic activity came quickly but it was not as severe as doomsday seekers were predicting halfway through the year. So where does that lead us to in 2023?

It is troublesome to predict the absolute level of inflation when the cycle ends. Consensus currently forecasts that the year-over-year rate of inflation will be 2% (the U.S. Federal Reserves’ target) by year-end. It seems unlikely this level is achieved so quickly, unless there is a harsh recession. Certainly, inflation is moderating, but it remains broad-based; four-out-of-every-five components of the inflation basket show price growth of 5% or more. Further, the Atlanta Fed’s “sticky” component gauge continues to rise, as does European headline inflation.

By and large, strategists accurately forecasted the 5% growth rate in earnings in 2022. However, forecasters did not anticipate the butchery that developed in equity markets as a result of the correction in valuations. Most major indices entered bear market territory during the year, down more than 20% from peak levels. While the uptick since October lows has restored some optimism for investors, our base case is that lower earnings and tightening profit margins could be the catalyst for the next leg down in markets. Consensus estimates currently predict an 8% increase in earnings for 2023. We believe this is optimistic in the broad sense; however, inflation will aid earnings for companies with pricing power.

From the standpoint of the global economy, a slowdown appeared in 2022 but it did not materialize meaningfully. Looking forward, the bond market has identified the likelihood of a recession in 2023, but there is widespread disagreement on the severity of the drag on economic growth. Leading indicators using survey-based data are sliding and indicating an earnings recession, at a minimum. Without a significant deterioration in the labour market, however, the economy should be able to withstand this. This means job losses need to be contained to the over-bloated white-collar areas of the market (i.e. technology). According to Layoffs.fyi, tech companies have laid off almost 58,000 employees in 2023, after over 159,000 were let go in 2022.

The current backdrop has a bearish tilt and could end up producing a great buying opportunity for long-term investors. Diversification provides flexibility to tactically tilt towards quality holdings with our eye on better value and economically sensitive areas of the market when growth emerges. In the meantime, short-term, government yields are over 4% so we are pleased to earn a risk-free return again. Finally, the precious metals space appears poised to outperform on a relative and possibly absolute basis.