Complicated & Uncertain

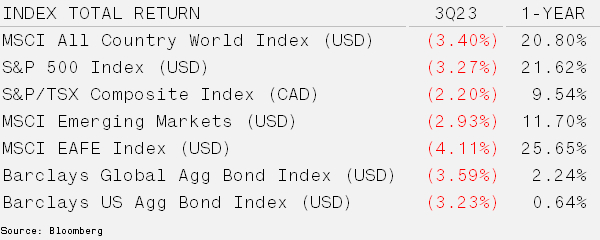

Bond Yields Begin to Bite – The enthusiasm generated by a healthy job market and consumer spending dissipated in the third quarter. Rising bond yields and signs of a rollover in recently strong areas of the economy took some of the shine off equities. Tighter bank lending standards and weak manufacturing activity combined with rising bond yields caused interest-rate sensitive assets to lead the detractors. The 10-year US Treasury yield surged 75 basis points to 4.6% which is the largest quarterly jump in a year and a level not seen since 2007.

Canada’s economy shrank by 0.2% annualized in the second quarter of 2023 as housing and exports slowed. Meanwhile, inflation rose to 4.0% in August on the back of higher mortgage rates and rental costs. The rise in oil is unlikely to help sticky inflation numbers as Brent increased over 27% during the quarter, its eighth best quarter in more than 20 years.

History Continues To Rhyme – The inflation numbers over the last few years have forced investors to dust off history books and review environments in which they have no trading experience. Sustained levels of inflation above 4% have not been seen since the early 1990s. However, most investors reference the 1970s as a reflection of the environment we are in today. Today the same euphoria and high valuation around a concentrated set of stocks exists, although it seems more structural due to passive investing. There is also a cold war involving the U.S. and the shock-and-awe with regards to the rate hiking cycle. More recently, almost 50 years to the day after a surprise attack on Yom Kippur in 1973, trouble erupted again in the Middle East, evoking more parallels to those times.

Although oil traders have become nearly immune to Middle East conflict, the potential dominos that are aligned to fall should the current situation escalate is difficult to digest. In the 1970s, oil prices rose from $2 to $32 as Bretton Woods ended and the Iranian Revolution closed out the decade. A 16-fold increase is likely out of the cards for oil today; however, global inventories remain tight and new supply from shale may be restricted by financing. Furthermore, relations between Arab leaders and Israel have been muddled as Egypt, Iran, Saudi Arabia and the UAE recently joined the BRICS. Furthermore, in a 2023 Arab Youth Survey, just 2% of young Saudis supported normalizing relations with Israel.

Should oil prices rise, the immediate impact will be felt by consumers and the U.S. Federal Reserve will be left with a difficult dilemma. Higher oil will eventually slow consumer spending and its second derivative effects may flow through the economy causing inflation to surge once again. Raising rates to avoid runaway inflation carries its own risks – it may put the U.S. economy into a deep recession and cause a major financial institution to fail. Exposure to oil prices and short-term interest rates appear to make sense.

Complicating things further, is the fact that the U.S. fiscal situation is much more fragile today. Prior to the 1970s, the budget deficit was 1% of GDP versus 6.5% last year. Net interest expense in the early 70s was 1.2% of GDP, but in the latest fiscal year it was 2.5%. Similar patterns are seen with Social Security and Medicare outlays. The pace and direction of developed country’s fiscal deterioration are concerning. Higher or even stable interest rates at these levels and/or the need for more defense spending will add to the debt pile. Some defense stock and gold exposure help to hedge the portfolio against geopolitical and fiscal uncertainty.

The most important component to the global macroeconomic landscape, the U.S. dollar (and gold), is also the most interesting. In August 1971, the United States terminated gold as a basis for the dollar, eliminating the Bretton Woods system. Currently, there is great debate over the Greenback’s dominant reserve currency status and its overall stability given the debt burden in the U.S. New entrants such as Bitcoin are also assuming some functions that the U.S. dollar previously performed. While the stage is set for the world to move away from reliance on the Dollar (the BRICs want to create their own currency) the transition will take years. The dollar remains the safe house in our opinion.