Choppy Markets Scramble to the Finish Line

As of 22-Dec-21, equity markets delivered positive returns during the final month of 2021. The US benchmark (S&P500) was positive 2.84%, the S&P/TSX and MSCI World Index followed with gains in the 2% range. The upbeat results concealed significant volatility that arose through three primary sources; (i) the Fed met on 14-Dec-21 and announced an accelerated taper of bond purchases while also expanding the forecast for interest rate increases from two to three in 2022; (ii) the expiry of both options and futures positions on Friday (17-Dec-21); and, (iii) the aggressive spread of the current Omicron variant, which re-introduced numerous shutdowns and travel restrictions globally.

Often key events like (i) and (ii), especially when occurring simultaneously, will cause widespread market participants to hedge possible declines. This in turn has the potential to cause a positive feedback loop because dealers typically adjust their offsetting positions by selling the underlying asset after its price falls. The combination of these events along with renewed COVID-19 fears caused the S&P500 to lose over 3% during the six trading days between 13-Dec-21 and 20-Dec-21. However, when the event for which protection was sought is determined to be less treacherous, the subsequent covering of the original hedges often pushes prices upwards. Consequently, the 3% loss was essentially erased by the profits registered on the 21st and 22nd.

The yield curve flattened leading up to the Christmas break. Following the Fed’s announcement that an additional interest hike should be anticipated in 2022, the 2-year yield remained slightly below the peak (0.69%) touched in early December. This is an indication that the aggressive increase in yield since June (from below 0.15%) may have tired. Concurrently, the 10-year yield has settled at about 1.45%, quite a distance from the 1.67% print in late November. The 10-year continues to trade toward the lower end of its up-trend since August. If a breakdown occurs in the first quarter of 2022, this will potentially indicate that the market has lost confidence in the prospects for economic growth or possibly that inflation fears have been extinguished.

On the commodity front, gold caught a bid as nominal yields fell, rising 1.87% in December. Nevertheless, the price remains in the middle of its 2021 trading range. If long yields break down and growth slows into 2022, the shiny metal may have the flight for which so many have hoped. Oil reversed its November weakness, with WTI increasing 2.2% in December, though it remains 13% off its October highs. Finally, the USD, as measured by the DXY, was flat during the month, though it did rise 0.8% against CAD.

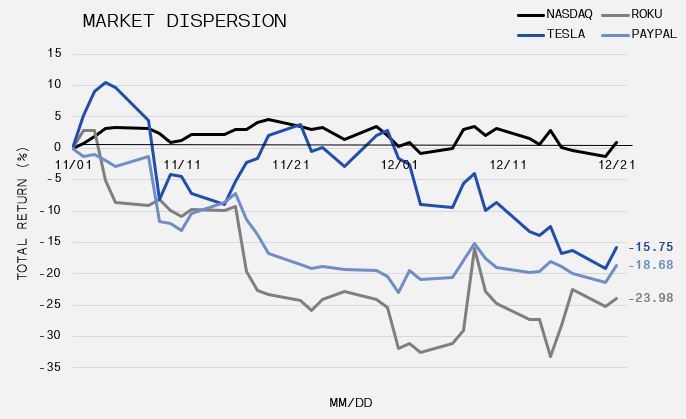

The TSX’s underperformance relative to the S&P500 since mid-November speaks to many factors playing into markets globally. The TSX is about 3% below its high point for the year reached on 12-Nov-21, while the S&P has gained about 1% during the same period. However, each benchmark’s composition provides insight into the return dispersion. The TSX’s top holdings are represented by Shopify, Canadian National Railways, Enbridge and the large banks. Meanwhile, The S&P largest weights are all technology-focused giants; Apple, Microsoft, Amazon, Alphabet (Google), Nvidia and Meta Platforms (Facebook). The performance of these behemoths conceals the struggles of the stocks beneath the largest weights. The accompanying chart discloses this phenomenon by demonstrating how the NASDAQ appears resilient while other prominent names have been battered since 01-Nov-21. Similarly, on 07-Dec-21, Gavin Baker revealed on Twitter that NASDAQ’s mighty 21.2% gain for the year was reduced to only 5.8%, when Apple, Microsoft, Alphabet, Tesla and Nvidia, were excluded. Large cap dominance has been a common narrative since 2019, but as we gaze into 2022, the persistence of the trend will be closely examined. A horse can’t run with a wounded leg.