Winners Are The New Losers

Markets marched lower to begin October due to a higher-than-expected CPI reading. However, fear peaked at the CPI-induced low point as S&P 500 rallied by over 9% to record a 4% gain as of 27-Oct-22. With energy leading the way, the TSX finished the period up almost 6%, while the MSCI gained more than 5% as Europe showed relative strength despite macro headwinds.

Many identify the Fed “pivot” as the logic for the stock market rebound. However, it is tough to ignore that equities were set up for a relief recovery following the 10% plummet in September and disproportionate short-side positioning. Importantly, the bounce came on the heels of a reversal in the U.S. dollar as the DXY fell 3.3%. The dollar gained about 12% from June to its high on 28-Sep-22. As a result, a reversal was foreseeable.

Correspondingly, bonds were finally bid in October, with the 10-year U.S. Treasury yield falling 30bps from its mid-October high to settle at a yield of 3.92%. The UK pension crisis and the overall absence in global liquidity caused bond market volatility to rise to all-time highs in September. Therefore, it is especially important for the bond market to remain calm for a sustained improvement in equities.

On another positive note, high yield bonds demonstrated consistent strength as iShares iBoxx High Yield Corporate Bond ETF (HYG) rose 4% during the interval. This is encouraging because it suggests that economically sensitive companies may not have difficulty raising capital. Interestingly, high quality corporate bonds, as measured by iShares iBoxx Investment Grade Corporate Bond ETF (LQD), are persistent underperformers. The benchmark gained just 0.3%, a continuation of the trend we highlighted last month.

The Canadian dollar rose just over 1% between measurement dates, notwithstanding the Bank of Canada’s announcement that the overnight rate would climb 0.5%. The increase was lower than the previous 75bp boost and signaled that perhaps the BoC is starting to take its foot off the gas. Certainly, the Bank is monitoring the real estate situation closely, so a more cautious tightening approach was warranted.

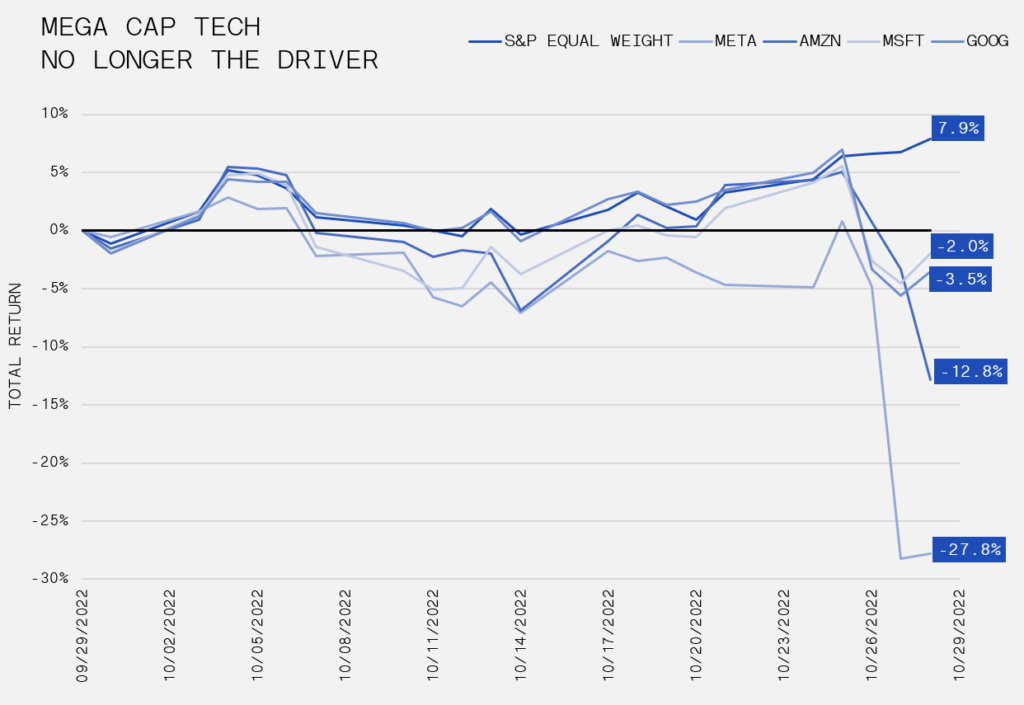

Despite overall equity strength, there was a fair bit of intra-market divergence as the Dow Jones Industrial Average gained approximately 9.5%, while the Nasdaq dipped into negative territory. A slew of disappointing earnings results from household names like Meta (Facebook) and Amazon were catalysts for the tech-index’s loss. We are currently deep in the heart of Q3 earnings season, and most of the aggregate weakness has been concentrated in the mega tech companies, which is in stark contrast to recent history.

The chart below highlights the divergence by showing the equal-weight S&P 500 index against the previous market darlings Meta (Facebook), Google, Tesla and Amazon, during the past 30 days. It is becoming clear that the breakneck growth levels achieved in the past few years helped mask their sensitivity to the market cycle and the impact that a slowing economy has on ad revenue. In October, Meta and Amazon suffered after-hour price drops that exceeded 20% following their earning publications. High single digit losses also greeted Google and Microsoft following their announcements. Nevertheless, the S&P 500 has been resilient as breadth (ie. the relative number of companies rising versus falling) was positive for most of the month. The performance dichotomy was in contrast to the past decade when the FAANG were massive winners. The sole stalwart among the big tech names has been Apple. As the S&P 500 index’s largest constituent, Apple has a significant impact on the benchmark’s results.