Where the Shoe Pinches

The ‘September Effect’ refers to the historically weak stock market returns during this particular month. While many argue its merits, those taking the “over” on the equity performance in September 2022 are currently meeting with their brokers to describe how they will top up their margin. The S&P 500 fell over 10%, marking its worst month in 2022. The MSCI World ACWI fared similarly, falling 10%, as well, while the TSX was the relative winner, falling “just” 7%. Real Estate led to the downside as the relentless rise in rates reduces demand for mortgages. Healthcare was the only relative winner, limiting its downside to under 3% as it continues to display its defensive characteristics.

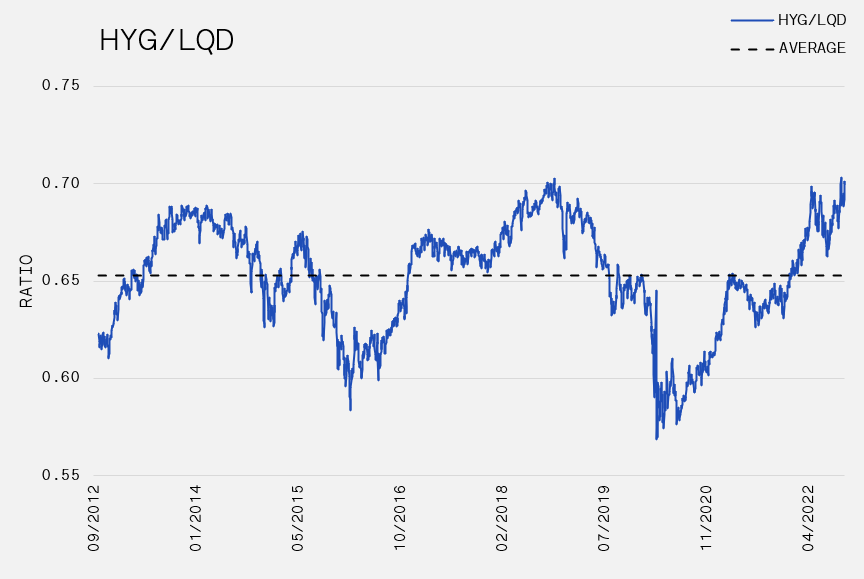

The continuing weakness in bonds is even more surprising. Global growth expectations are falling, which typically act as a downward force for yields. The 30-year U.S. government bond and iShares iBoxx Investment Grade Corporate Bond ETF (LQD) both fell approximately 7%. These are two high quality bond proxies that have been unable to catch a bid throughout 2022, despite an aversion for risky assets. The one shoe that has yet to drop (relatively) has been in lower quality credit. iShares iBoxx High Yield Corporate Bond ETF (HYG) continues to outperform LQD. We show the relative performance below, as measured by the HYG/LQD ratio. A rising trend typically indicates an abundant investor appetite for risk. As we enter the third quarter earning season, this trend is in jeopardy of failing.

The U.S. dollar has been the beneficiary of the variety of actions that have unsettled the stock and bond markets. As measured by the DXY (the value of the U.S. dollar relative to a basket of foreign currencies), the USD rose another 2% in September, bringing its year-to-date gain to 17%. Its ascent almost reached 20%, but the Bank of England’s intervention, temporarily disrupted the climb. Closer to home, the Canadian dollar extended its losses with nearly a 5% rout versus the USD in the month. Perhaps investors are latching on to Canada’s relative economic dependence on the real estate sector and the corresponding impact as mortgage rates follow government bond yields higher.

A weak currency is generally symbolic of a poor economic structure or economic fragility. Further, a depreciating currency worsens inflation and enlarges deficits in the country. Rising government bond yields can also signal that investors are losing confidence and require more incentive to hold a nation’s debt. Accordingly, the combination of a sinking currency and rising borrowing costs is a forecast for pain. The United Kingdom is suffering from this affliction. The first sign of trouble emerged on 28-Sep-22 as the Bank of England (BoE) took emergency action, announcing a GBP 65Bn bond-buying program to stem the fall in UK bonds (Gilts) which was hampering the UK pension sector. With Gilts being a primary source of collateral, and their value falling precipitously, pensions were forced to sell to keep up with collateral requirements. Fortunately for now, the announcement helped to reduce the yield on 50-year gilts by a full percentage point, its largest single-day drop on record. The move had a global impact, with U.S. bond yields and the USD falling concurrently. Some are citing this asset recovery as evidence that central banks will be willing to pivot to more accommodative policies at the first sign of trouble. However, it is more likely that the BoE was simply fulfilling its role as the lender of last resort to ensure proper functioning markets. Nevertheless, BoE’s actions help prove that central banks are still willing to intercede to avoid the worst-case scenario. While this alleviated intense immediate-term worries, as we’ve seen in the past, when signs of stress emerge, there is more than one shoe to drop.