When The Tide Goes Out

Following an incredible 27% rise in 2021, the S&P 500 started 2022 by heading in the opposite direction. The index fell over 10% in January, but as of 28-Jan-22, it had settled at losses just north of 8%, similar to the global (MSCI World) benchmark. The TSX faired better, sliding just 3%, due to its heavy allocation to sector leaders, Energy and Financials.

The major event this month was the U.S. Federal Reserve meeting on 25-Jan-22, where Governor Powell followed up a fairly muted Fed Statement with a very hawkish Q&A session, in which he pointed to a better-than-expected employment situation and above-average inflation as reasons to start hiking rates and tapering QE. The market was positioned for the hawkish tone, as participants were buying volatility protection. However, traders clearly underestimated the risk of an accelerated tightening in a potentially slowing economy.

Oil’s continued strength (+16% month-to-date as of 28-Jan-22) did nothing to temper investor worries around inflation and its influence on the Fed. The stress was evident on the short-end of the U.S. yield curve, as the 2-year yield rose aggressively from 0.73% to 1.18%. This movement implies six rate increases by the end of 2023. Economic growth in the first half of 2022 will surely show a slower pace than the above average levels reported in the first half of 2021. As such, tightening monetary policy into an economy that is losing speed, will hurt equity performance. Accordingly, inflation will be closely monitored for insight into the Fed’s actions.

On the long-end of the yield curve, bonds have not provided the cushion for equity weakness to which investors have become accustomed. The Barclays Aggregate Bond Index fell over 2% as the 10-year yield rose. In general, long-term yields fall when the short-end increases. Long bond rates are typically priced off the combination of growth and inflation. Consequently, tightening monetary conditions are negative for growth rates and inflation rates; thereby, causing long-term yields to fall. As such, it is noteworthy that short-term yields and long-term yields moved upwards together this month. One explanation for rising long-term yields is the sensitive supply-demand outlook for long-term Treasury Bonds. The Fed is scheduled to reduce its monthly purchases of Treasury Bonds and the absence of its bid from the market will put downward pressure on prices, causing yields to rise.

The U.S. dollar, as measured by DXY, rose 1.2% during the period and soared almost 3% from its January low. Naturally, if the market is expecting a more aggressive Fed, especially against a more dovish ECB and Bank of Canada, one would expect the U.S. dollar to rise. However, this hypothesis is not that reliable. Since 1977, the Fed has attempted to increase rates on five separate occasions. On two occasions (1977-1980 and 2015-2018), the dollar ended the cycle at a similar level to where it started. In the remaining three periods, the U.S. dollar sunk between 10% and 15%. Hence, the strength of the U.S. dollar may be closer to its peak; and conceivably, the crowded long positioning in the Greenback is supportive of its cresting popularity.

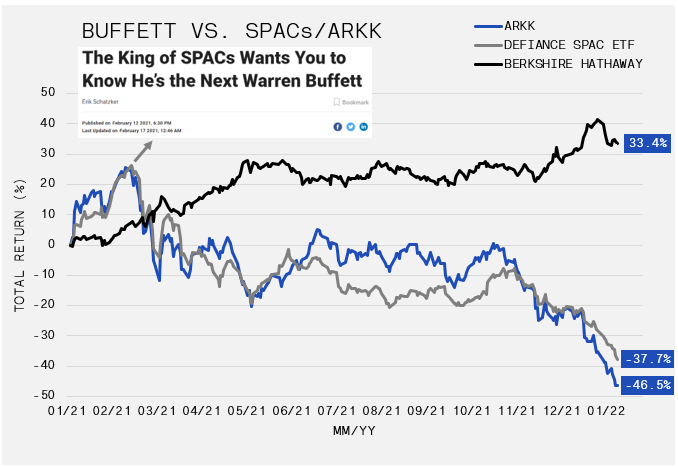

Warren Buffett has a famous quote that reads “only when the tide goes out do you discover who has been swimming naked.” The past twelve months have provided an opportunity to understand its pertinence. Following a terrific year for growth and technology stocks, 2021 started brilliantly as gains compounded with the monumental performance of meme stocks and SPACs. Many were once again questioning Mr. Buffett’s ability to navigate markets in a new tech-driven world, pointing to newly minted leaders like Cathy Wood and Chamath Palihapitiya as the new age. The chart that follows reveals the performance of Berkshire Hathaway (Warren Buffet) versus ARK Innovation ETF (Cathy Wood) and Defiance Next Gen SPAC Derived ETF. No further commentary is necessary.