Unpredictable Election Is Problematic For Investors

Volatility accelerated in October as the US approaches one of the most charged elections in history. Global stock markets started strong in October, conceivably because a Democratic sweep would provide much needed stimulus to the US economy. However, the S&P500 dropped 7.5% from 12-Oct-20 to 28-Oct-20 as Covid-19 fears resurfaced and stimulus doubts emerged. While confirming the intentions of all market participants is impossible, with the Volatility Index (VIX) touching 40, anxiety and apprehension is prominent as the 03-Nov-20 election nears.

Forecasts for a slower than anticipated rebound in demand for Oil caused WTI prices to drop 6.7%. Surging COVID-19 cases and flush oil inventories provided the setting for the weak outlook. Interestingly, bonds did not provide the protection on which investors have come to rely, with the 10-year yield rising 11bps on the month. Nevertheless, the Fed remains active as officials have emphasized that they will continue to buy Treasuries to control the yield curve. Gold was largely flat during the period, despite the bump in yields, but it slipped as the pullback in stocks deepened.

Third-quarter earnings season is underway, and the market’s reaction has been surprising. Stalwarts, like Microsoft and Mastercard, were both slammed despite strong results, while many other companies we cover finished in the red following beats and increased guidance. Investors were unhappy with the absence of guidance from Apple, whose shares now trade about 20% below its 52-week high ($137.98).

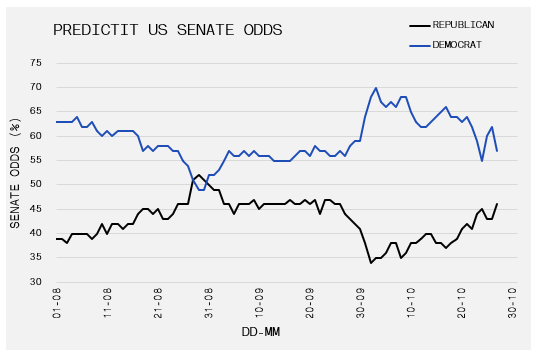

With noise around the election driving volatility, it is important to highlight the significant contests on the 03-Nov-20 ballots. There are three key battles to monitor, the first being the Presidency. Next is the vote for who controls the House of Representatives (the House), while the third is for the Senate. The President and the entire House are up for election, but less publicized is the battle for the Senate. Thirty-five of the one-hundred Senate seats are available. The Republicans need to hold 23 to retain their slim 53-47 majority. This is important as the Senate is responsible for approving motions passed by the House and any single member can have a key impact on the decisions of the US government. The odds of a Democratic Senate were surging into September. However, recent polls and betting markets are forecasting more of an even race which translates to more uncertainty for the markets and less confidence in future fiscal support. A similar pattern has surfaced around the Presidential race, which helps explain the subsiding conviction in a Democratic sweep. The only race that seems to have any sense of clarity is for the House, where the end result is reflects the popular vote rather than the electoral college (President) or the decision of a minority of specific seats (Senate).

The Democratic party are favoured for those who desire a prompt and sizable fiscal stimulus bill. House Democrats proposed a $2.2 trillion package whereas the Trump administration most recently offered a $1.9 trillion tender. As such, a Democratic President/Senate combo would ensure a quick and hefty deployment. The additional stimulus would directly aid the economy. We witnessed the impact the first round of relief had on US consumer spending and in the stock market as newly minted Robinhood investors spent their cheques. On the other side, Democratic leadership is associated with higher taxes at both the corporate and personal level. A Republican sweep casts doubt on the size of the package but comes with it a status quo and possibly more favourable tax implication. Either way, the ability to predict the outcome is hard enough, as evidenced by the swings in polling. Accordingly, accurately forecasting the market’s reaction to a temperamental result adds another layer of complexity. Consequently, we are focused on designing a diversified portfolio with ample liquidity. Our objective is to minimize negative impacts by remaining nimble and buying opportunistically.