The Light Visits The Darkness to Start 2023

For those caught licking their wounds following a tumultuous 2022, the risk-on environment in January was a soothing ointment. The S&P 500, led by the tech-heavy Nasdaq components, rose 4.7% in January, while the TSX was up 6.1%. Gains across emerging markets, particularly China as it relaxes its COVID restrictions, helped power the MSCI ACWI to a 6.5% gain. Bonds followed equities to the upside, with iShares 20 Plus Year Treasury Bond ETF (TLT) advancing 6.8% as yields fell across the curve and volatility dropped (as measured by the MOVE Index). Most commodities shared in these gains, with copper up 10.1%. Agricultural commodities, like corn and wheat, modestly participated, after almost completely reversing the large upward move that was launched with the invasion of Ukraine. Elsewhere, gold continued its advance, up 4.4% and 17.7% off its November low. Central bank purchases and the combination of a weakening dollar and relaxing bond yields have fostered the uptrend. The energy complex bucked the trend, with WTI crude declining 3.2%. Natural gas lived up to its moniker as the ‘widow maker’ for many traders who dare attempt to time it, plummeting 40.2%.

Certainly, there are multiple factors directing these actions, but none is more important than the once almighty dollar. The U.S. Dollar Index (DXY) has not had so much as a tradable bounce since early November. It leaked another 1.0% in January and is down over 10% from its 2022 high. Typically, when the greenback is weakening, financial conditions are softening, which helps create the environment for cross-asset strength that recently materialised. The market’s mood has shifted from out-of-control inflation and an overly aggressive Fed that lifted rates to levels not seen since the 1970s, to one where year-over-year inflation has fallen from 9.1% in June to 6.5% in December. Investors believe inflation has likely peaked and is rolling over, which will cause the Fed to pause and possibly reverse course. Chairman Jerome Powell will have a chance to clarify his intentions when the U.S. Federal Reserve (Fed) announces its first Federal Funds rate decision of 2023 on 01-Feb-23. Given the narrative has been modified so swiftly, we anticipate that Mr. Powell will temper the prospects for a forceful easing.

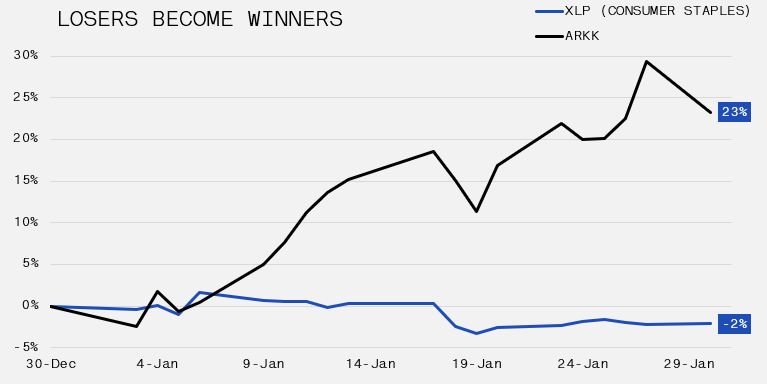

Many market participants were expecting an imminent recession in 2023, and expressed their opinion by shorting risk assets, such as profitless technology or consumer discretionary stocks. However, while leading economic indicators are starting to point to a slowdown, GDP continues to print positive (+2.9% in 4Q22) and the labour market has persistently surprised to the upside. The wave of buying to close out losing short positions has led to large divergences across equity sectors. For instance, ARK Innovation ETF (ARKK), which invests across numerous ‘story stocks’ (many of which with no path to real earnings) soared 23% in January. Conversely, the Consumer Staples Select Sector SPDR ETF (XLP), dipped 2%. Staples represent products that consumers need to purchase regardless of the economic backdrop. The disagreement between the performance of these two securities reveals a lot about investors’ posture entering the New Year. The Commodity Futures Trading Commission trader reports remain bias to short positions across both equities and bonds. However, short-covering is not a chronic condition, and perpetual U.S. dollar weakness is not a consistent strategy. As such, other stock market catalysts will need to emerge to sustain the light we have seen to start the year.