Stocks Are Stronger As Scary Year Shuts Down

The S&P 500, TSX and MSCI Indices rose 1.3%, 1.0%, 1.0%, respectively, for the period ending 23-Dec-20. Throughout the year we have become accustomed to seeing technology move opposite to energy and financials. In December, these three categories were the sector leaders; tech (+7.8%), energy (+6.1%) and financials (+5.2%). The laggards were interest rate sensitive industries like utilities and real estate as longer-term rates continued to rise.

The move in energy stocks was driven by sustained strength in oil. WTI rose 3.4%, bringing its two-month leap to 27.9% from its low in early November. We are also witnessing similar albeit more muted moves across the commodity space, likely driven by uninterupted weakness in the US dollar. The DXY once again fell 2% during the period. However, a reversal in the greenback was gaining traction as Christmas day approached. After Congress announced a Covid relief bill that underwhelmed, the outgoing President Trump announced his intention to veto the bill unless the amount of support to citizens increased to $2,000 from the original $600.

The climb in the US 10-year yield carried on throughout the month, gaining 8.3bps to 0.925%. While it is still a full 1% below the rate from one year earlier, the sustained increase over the past five months is noteworthy. Upward momentum is a derivative of future growth expectations or inflationary forces, or a combination of the two. The US Core CPI inflation rate hit 1.6% in December. The Core rate excludes things like food and energy which are typically more volatile. Nevertheless, while energy is excluded, it is a core input for the majority of goods feeding the inflation rate. As such, as we enter 2021, the year-over-year comparisons for oil prices may become increasingly supportive of inflation. Further, strength in key inflation-linked commodities like copper suggest that inflation may exceed the market’s expectations. Copper prices reached a 7-year-high during the period. Gold prices are supportive of this inflation thesis. Nominal rates rose but real rates (nominal minus inflation breakeven rate) have resumed their downward trend. Gold’s correlation with real rates held true as it rose 4.6%. The real interest rate of -1.08% as of 22-Dec-20 is still a considerable distance from the -5.86% level reached in May 1980.

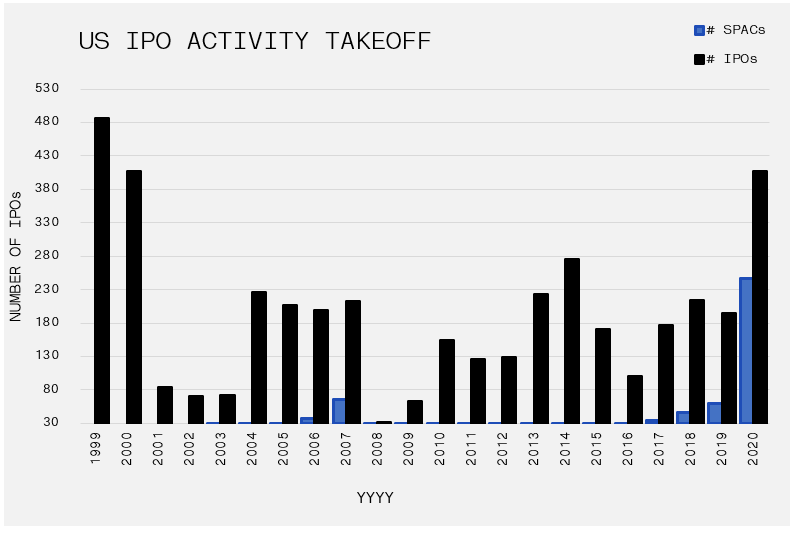

We are still alarmed by the eye-popping volume of IPO transactions in the back half of 2020. As the chart below shows, the 407 transactions completed to date in 2020, combined with 13 yet to come to close the year, will be the largest transaction year on-record since 1999, and 53% higher than the next highest year since the tech boom. The IPO stampede has been accompanied by the explosion of Special Purpose Acquisition Company (SPAC) – 246 new SPACs were created this year, compared to 59 in 2019, the next highest year. In a SPAC, a sponsor, typically an operator or investor well-known to the public, will raise funds in the form of cash with the intention to purchase a company to take them public at some later date. Some high-profile companies which have been taken public via this avenue have been OpenDoor, DraftKings, and Virgin Galactic.

Up until 2020 companies largely decided to remain private due to the inherent advantages in the private ecosystem, so the massive uptick raises many questions. As of 11-Dec-20, PWC reports that on aggregate IPOs have performed an average of 76% in 2020 vs. 13% for the S&P 500. Certainly, investor demand to chase returns has been strong. Further, debt markets have raised a combined $2.5 trillion in 2020, compared to an average of $1.9 trillion from 2016-2019. Included in that are high yield bonds which gathered more than $400 billion – setting a fresh record despite the global pandemic. There a collection of elements that spurred this activity, undoubtedly the trillions of dollars of liquidity injected into the market to help stem the pandemic is a factor.

Looking forward to 2021, the consensus believes the vaccine will provide a boost to economic activity and extend gains in capital markets. However, given the liquidity and stimulus that propped prices in 2020, we wonder if the current calendar year already borrowed much of the gains from 2021.