Stocks and Bonds Embark On a Skeptical Recovery

The calendar month is not officially over, but as of the U.S. Memorial Day holiday, it looks like the S&P 500 will close the month out with a 0.7% gain. The profit was achieved with a 6% boost in the final week, ending a 7-week losing streak and marking the index’s best one-week advance since the first week of Nov-20. The MSCI World managed to lead with a 0.9% improvement, paced by continued strength in Europe, while the TSX lagged, down 0.5%. Looking deeper, excluding energy, strength was concentrated in names that were hit hardest to start the year as consumer discretionary and technology led the way. However, energy fared just fine, up 8.3% during the month which marked an impressive 59.5% year-to-date increase for the sector. This compares to consumer discretionary which is down 24.7%. For those new to this, an 84% year-to-date spread between the top and bottomer performer is truly impressive. The turnaround in equities occurred around the time that the US Federal Reserve released its meeting minutes. The commentary was interpreted as an indication that the central bank will be less aggressive going forward. Our sense it that equity hedges were covered following the announcement. As such, the narrative fits the price action but expectations for a pause in the tightening cycle may be premature.

It wasn’t just stocks that managed to gain a bit of traction in May as the bond market turned in a strong month. The 10-year U.S. Treasury yield fell 0.20% to 2.74%, providing some reprieve for a traditional 60/40 portfolio which has suffered to start the year. U.S. high yield corporate bonds were also bid in May. The iShares iBoxx High Yield Corporate Bond ETF rebounded 2% after losing more than 10% in the first four months of the year.

Not a lot has changed with the broad bull market in commodities. Energy continued to lead the way with natural gas and WTI oil rising 21% and 12%, respectively. The agriculture complex was mixed as wheat rose 10% while corn fell 5%. Federal Reserve Chairman Jerome Powell identified the rapid rise in commodity prices, incited by Russia’s war, as an accelerant for inflationary pressures across the economy. Accordingly, a reversal in the sector will be helpful to fulfill the “less hawkish Fed” storyline.

Gold fell 3% during the period. A 4% bounce off its mid-month low helped minimize its weakness. We are starting to see signs of slowing growth in inflation and economic data, which may be supportive of gold. The U.S. dollar (USD) also seems to be sniffing this out as the DXY fell 2%, just after futures traders started piling in on the long side of the trade. If a pullback in the USD is maintained in the coming weeks, we could start to believe the rally in stocks. North of the border, the Loonie recoiled off the low-end of its recent range and rose 2% against the Greenback. The Bank of Canada will make its monetary policy announcement 01-Jun-22. The aggressiveness of its rate hike will draw attention especially since housing affordability is one of the top issues facing Canadians.

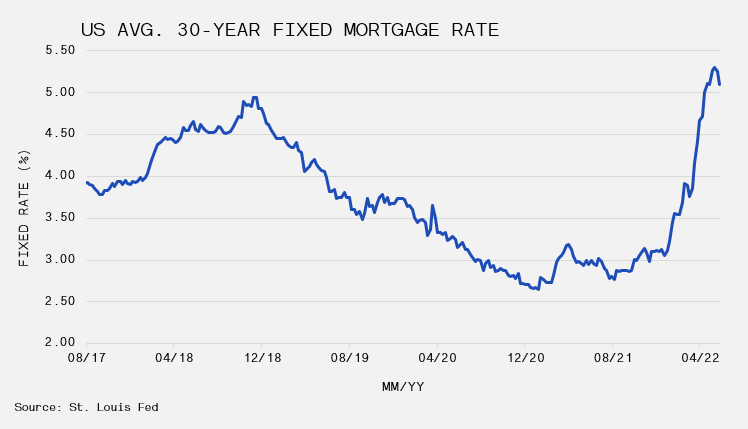

Consumer spending habits remain levered to the value of their home; as such, the prominence of price trends in the housing market cannot be overstated. With yields taking a pause, 30-year fixed rate mortgages in the US fell to 5.1% from 5.3% in mid-May, providing a much-needed pullback. Mortgage rates have risen rapidly since the start the year. This modest turnaround was well received as new home sales in April missed estimates by 21%., which pushed inventories higher by 8.3%. The housing picture remains bullish from a demographic’s perspective but expanding supply will weigh on the outlook. Homebuilders welcomed the rate pullback, as iShares US Home Construction ETF rose 6% in May, helping to trim the 32% drop to start the year.