S&P500 on Track for its Worst First Half in Over 50 Years

The rally across equity markets in the back half of May was quickly erased in June, as the S&P 500 fell approximately 7.5% to bring its year-to-date drop to the 20% range. June weakness was notable as this was the first month in 2022 where there really was nowhere to hide for equities, as even the energy sector fell nearly 15%. This led to a sizeable drop of about 8.5% in the TSX, which has been a consistent leader throughout the year. The MSCI ACWI split the difference, tumbling closer to 8%, as European equities failed to provide any strength. The only clear winner this period was China, with the Shanghai Composite Index rising over 7% as policymakers initiated a monetary easing cycle.

The mighty commodity trade sold off as the CRB Commodity Index crumbled 6%. Copper led the way down (almost 12%), gold fell 2% and WTI oil slipped roughly 1.5%. Bonds were once again correlated with equity markets. Barclays Aggregate Bond Index took a 3% beating on the back of 10-year yields rising 28bps to 3.125%. High yield as measured by HGY dived over 8% due to the combination of increasing rates and widening high yield spreads.

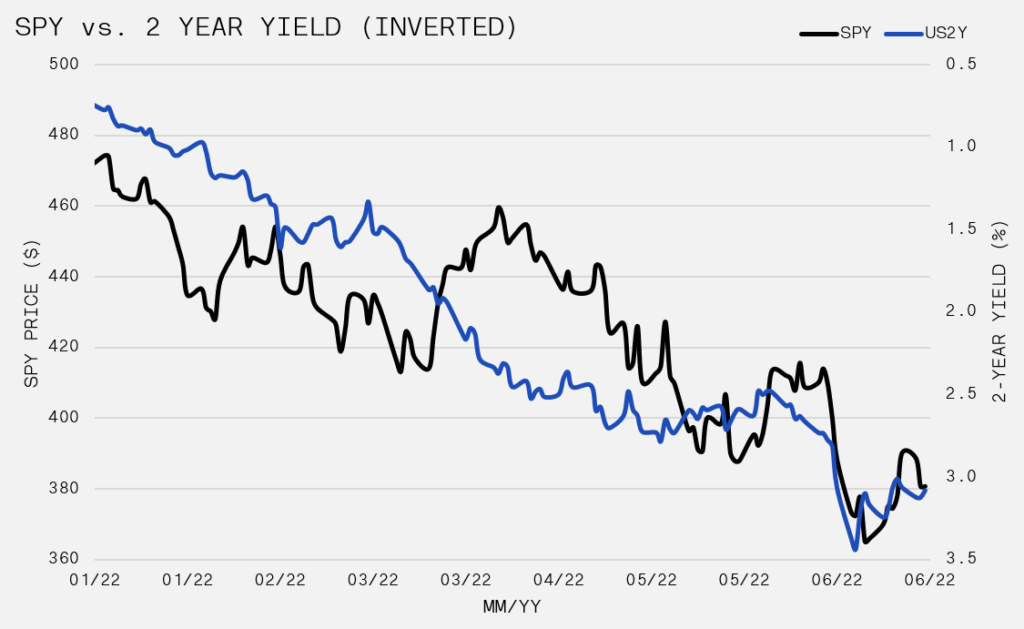

Equity direction has clearly been a product of the Fed policy, as the S&P 500’s descent has been strongly correlated with the inverted 2-year yield (see the image below). The market is pricing an increasingly aggressive Fed hiking cycle, which has pushed rates up across the curve, but particularly at the short end. After a “surprise” 0.75% hike on 15-Jun-22, Fed Chair Powell stated that the Fed’s focus will shift from an employment mandate to an inflation fighting mandate. Further, the underlying aim will move from core inflation to headline inflation. The major difference is that headline inflation is primarily an energy gauge. As such, the Fed will need to continue its fight against price increase as long as energy and its products become more expensive. This is obviously not good for financial assets that are priced off the risk-free rate. The other obvious risk to equities is a recession. According to the Bureau of Economic Analysis, real gross domestic product (GDP) decreased at an annual rate of 1.5% in the first quarter of 2022. Further, the Atlanta Fed dropped its second quarter estimate for growth to 0%. A recession is commonly defined as an economy that shrinks for two consecutive quarters. As a result, cynical forecasters are becoming increasingly confident.

But, now for the good news, if commodities are in fact in the process of topping, inflation pressure should begin to ease. In fact, easing price pressure was reported in the Core PCE (personal consumption expenditures) Index. This narrower measure of inflation that omits volatile food and energy costs, rose by a modest 0.3% in May.

It’s important to respect just how weak equities have been to start the year. Since the market is forward-looking, lowered inflation expectations and a less aggressive Fed, could ignite a rebound. Nevertheless, a bounce could be short-lived, if it turns out that hiking rates only serves to further curtail supply which induces more scarcity and price tension. In this instance, the Fed will have sacrificed employment in favour of a losing inflation policy that only pushes the economy further into recession. Accordingly, acknowledging all outcomes along the probability curve continues to be of utmost importance.