November 27, 2020

Vaccine Prospects Invigorate Stocks and Commodities

Market Recap & Boxscore

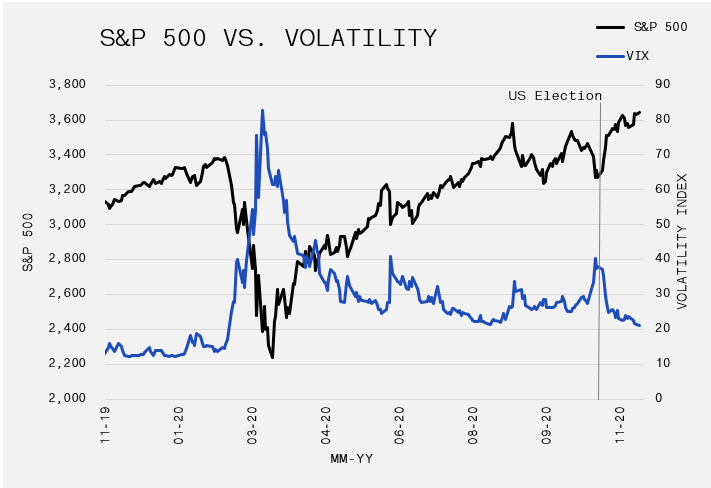

Leading up to the US election, overall volatility risk premium increased as investors generally flocked to protection. The election results did not produce chaos, despite President Trump’s ongoing theatrics, leading investors to unwind their safeguards. As can be seen below, volatility has fallen, and markets recaptured its upward momentum heading into year-end. For the period, the S&P 500, TSX and MSCI Indices rose 11.1%, 11.6% and 12.4%, respectively. Interestingly, leading the charge were sectors that prior to November were consistent laggards, those being energy, financials, industrials and materials stocks. One trade that has been prevalent for most of 2020 has been the long tech/momentum, short negative momentum, particularly “long Nasdaq, short Russell 2000”. Since the Nasdaq’s 02-Sep-20 peak where it was outperforming the Russell 2000 by 50% on a year-to date basis, relative performance has tightened substantially, reducing the gap to 30% as of 27-Nov-20. Much of this is due to positive vaccine news, expectations for better-than-expected growth into 2021 and perhaps a partial unwind of the relative trade. With the Nasdaq once again breaking through its 2020 high to end the month, it will be interesting to see how these trades evolve into 2021 as traders reset positions and expectations.

Related to the above, commodities have continued to outperform throughout the month as the US dollar dropped to a new 52-week low versus a broad currency basket. Importantly, leading the charge in November were copper and oil – key industrial inputs. Copper rose 12.6% for the period, rising to levels not seen since 2014. Supply disruptions in Chile and Peru, where 45% of global copper is produced, contributed to the price increases. However, global Purchasing Managers’ Index (PMI) measures have been surprising to the upside, which indicates demand is underpinning copper prices as well. Similarly, oil as measured by WTI rose 20.7% as economic optimism helped to reverse an overall bearish position amongst investors. The strength stretched beyond copper and oil though, with industrial metals like steel and aluminum leaping 11.9% and 9.7%, and soft commodities like soybeans and corn rising 9.6% and 1.6%. Soaring commodities helped extend Canadian dollar gains relative to the US dollar, as the exchange rate dropped to US$1.00:C$1.29, which has been a consistent resistance level over the past few years.

US Treasury Bond yields got a lift from growth expectations, as the 10-year approached 1.0% before retracing to 0.85%. In addition to the growth narrative, the absence of foreign purchases of US Treasuries has made it difficult for demand to soak up record issuance, which leaves the Federal Reserve as the primary source of end demand. The Fed’s massive bond buying is needed to maintain stability in capital markets and it helps convince market participants that yields will remain contained.

Interestingly, while the correlation between the USD dollar and commodities was typically negative during the period, the relationship between the Greenback and gold shifted to positive. The price for gold slumped 6.1% to $1,785 per ounce. Although gold found rhythm with the US dollar, it continues to have a push-and-pull association with real yields, the US Treasury yield less inflation rates. The plunge in real rates from 0.1% to -1.1% was a major driver for gold’s 36.4% climb in the first eight months of 2020. However, the 10-year bond yield’s steady rise has forced real yields to retreat which knocked gold backwards. More recently, even as real yields steadied, gold responded in an unusual manner by accelerating to the downside. But, this late in the year, no one should be startled that 2020 is offering more surprises. As correlations begin to break down in the very short-term, a long-term trend in gold prices will be determined when the historical factors re-establish their prominence; (1) the appeal of the US dollar, (2) real bond yields, and (3) the equity risk premium.