July 15, 2021

Uncertainty Mounts After Another Strong Quarter

Second Quarter 2021 Newsletter

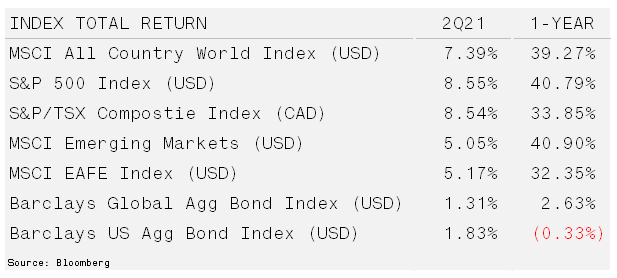

Reopening and Liquidity Underpin Gains – The reopening of the economy during the second quarter underpinned gains across most asset classes. Adding to the economic tailwind, corporate earnings were generally up as sales accelerated and global liquidity surged. More than $1.5 trillion of incremental liquidity was injected into the financial system through central bank quantitative easing and the US Treasury’s general account drawdown. Large capitalization US growth stocks, including technology and communication services sectors led the gainers.

Interest rates in North America ticked down during the second quarter. Inflation expectations moderated but remain high. However, real yields declined, which helped gold recapture part of its first quarter decline.

Multi-Factor Approach to Sports and Investing – As we approach the 2021 NHL draft, general managers have more to think about this year than others with a new team entering the league, the Seattle Kraken. The Kraken will conduct their expansion draft prior to the annual draft for young prospects as the team readies to enter its inaugural season (see video: “What’s Kraken in Seatle). General Managers must weigh the importance of short-term sacrifices for long-term success and balance the unique needs of various positions. Similarly, Portfolio Manager have multiple factors to evaluate across various positions to design portfolios that can be successful through multiple times frames.

Equities and commodities for the most part rallied and ended the first half of 2021 with strong, broad-based returns. In fact, the reflation trade has helped the S&P 500 achieve its longest stretch of positive quarterly performance since 2017. Reflation is an upswing in economic growth and inflation caused by easy money and fiscal stimulus. Cyclical sectors including financials, retail and energy outperform as these areas of the market have advanced 55.9%, 96.2%, and 94.0%, respectively since October 2020. During this time, commodities also surged with the Invesco DB Commodity Index returning 52.1%, which handily beat equity indices.

The rapid reopening of the global economy was fueled by excessive amounts of stimulus that helped keep consumer balance sheets on track. In fact, delinquency rates for credit cards are at the lowest levels in history as they declined throughout the COVID-induced lockdowns. The strength in both retail sales as well as the monthly consumer credit report supports a recovery that is well underway. However, the leadership among gainers has shifted.

Declining bond yields seem to have put a pause on the reflation trade that has dominated for nearly a year. Bank reserves at the Federal Reserve stopped expanding in April and long-term interest rates have since been trending lower. Cyclical areas of the market are also beginning to lag major indices. Energy stocks for example are down 7.9% since the beginning of June through mid-July while crude is up 4.9%.

In addition to declining yields, COVID-19 cases have picked-up as the fast-spreading Delta variant makes it way through the global population. Further, liquidity across the U.S. banking system is slowing and the U.S. dollar has stopped declining. All these factors are weighing heavily on a system that rebounded quickly from last March.

At moments like these, we must remain flexible and diversity is often a tailwind. However, we believe the global recovery will play out for the following reasons. (1) Interest rates and the U.S. dollar have experienced significant moves in both directions over the last 18 months. We anticipate that both inputs will settle and provide a more benign setting for investors. (2) An on-going improvement in COVID-19 vaccination roll-outs and treatment will provide more confidence in the durability of the economy. (3) The biggest driver will likely come from the complex deposit system. Despite excess liquidity, banks have parked cash with the Federal Reserve rather than lend. The Fed will likely alter the incentives to get those funds into the economy.

As portfolio and wealth managers trusted with our clients’ financial futures, we must be steadfastly focused on their objectives. This means holding ourselves to higher standards than simply trying to beat short-term averages. Portfolios designed for long-term success avoid long-term failure through investments that may temporarily offset each other in the short-term.