December 18, 2018

No Sight of Santa. Stocks Don’t Rally Into Christmas.

Market Recap & Boxscore

So far in December, investors have harnessed memories of childhood as they eagerly anticipate the Santa Claus rally that has so often come to pass over the past ten years. However, so far it seems that St. Nick may be lost in the clouds as global indices hint towards another down month and if things hold, a negative 2018. The MSCI World and TSX Total Return indices led the way to the downside, both posting 1.6% one-month decreases from 20-Nov-18, while the S&P 500 fared slightly better, down 1.4%. YTD on a total return basis, the S&P 500 is down 0.9%, while the TSX and MSCI World will have a tough time eking out a gain for the year, down 7.4% and 5.9%, respectively. To make matters worse, bonds have failed to provide the diversification benefit investors have come to rely on, with the Barclays Aggregate Bond Index registering a 0.9% drop for the year. The Canadian investor relying on a 60/40 portfolio and who failed to diversify globally has certainly taken a hit in 2018, as this portfolio would be down 4.1%. At this point cash may end up being the 2018 investment of the year which is interesting considering the pressure some of our managers were getting a year ago for holding cash. It is always interesting to see how sentiment shifts with the direction of the stock market arrow. This time is no different as the consensus has swung from global synchronized growth to an all-but-guaranteed recession early in 2019. Analyzing ETF fund flows helps put some context to the impact that these headlines have on investors. As markets took a dive in the last week, ETFs focused on industrials and energy reported large outflows while utilities and staples attracted new investors, which is to be expected. Gold and silver continue to be strong, up 1.6% and 2.0%, respectively. Support for precious metals is derived from weak equity markets and the Federal Reserve positioning shift. Despite positive headlines, Cannabis-related stocks have been weak, signaling either a tapped-out retail investor or overly ambitious hopes.

We commented in November on the turnaround that was surfacing in Emerging Market equities. Interestingly, December was another strong month, as measured by EEM, which was up 0.9%. The gains oddly came on the back of a rising USD (+0.7% for the month) and despite the trade talk impasse. The improvement could be related to Fed Chair Powell’s disclosure that the path for any further rate increases is uncertain. During the November meeting, language changed from the benchmark rate being “far from neutral” to “just below neutral”. The commentary pushed short-term rates lower; the 2-year yield slipped 20bps to 2.65%. And, it impacted longer-term rates, the 10-year yield dropped 25bps to 2.83%. Many intelligent pundits were citing 3.25% as the yield which if crossed, would trigger a long-term breakout in rates but this has not come to pass. For the time being, macro fundamentals have directed the ship as the global growth narrative has shifted to one of slowing growth.

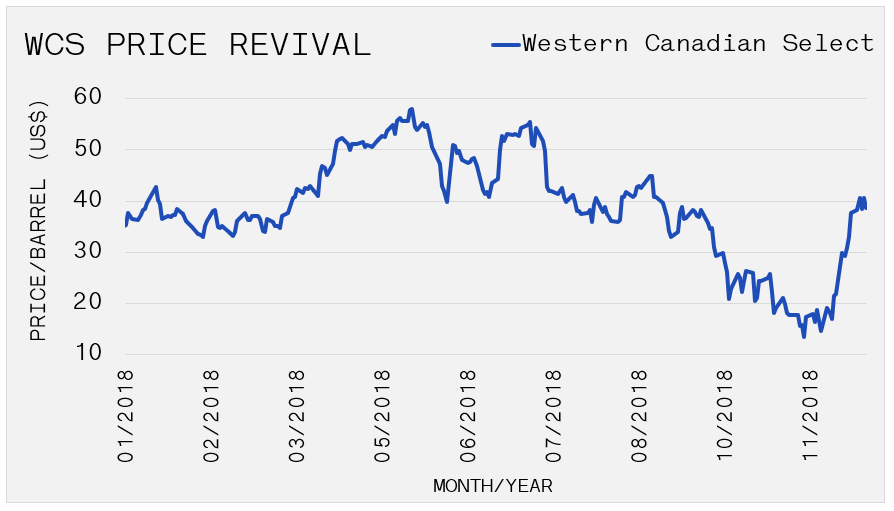

Oil has been a consistent area of focus for both this newsletter and Canadian market participants for some time, particularly the price and discount of Canadian Western Select. During December however, Canadian oil came roaring back, up 116% as Alberta Premier Notley announced an 8.7% oil production cut, reducing oil output by 375K barrels per day beginning 01-Jan-19. These cuts will remain in force until the 35MM barrels currently sitting in storage are shipped to the market, likely until the spring. In addition, by year-end 2019, the government plans to purchase railcars capable of transporting 120K barrels per day.

Despite the development, Canadian oil companies continue to languish. The BMO Equal Weighted Oil & Gas ETF fell 8.6% during the month. The absence of a rebound in equities indicates that the bounce may be unsustainable – probably due to the lack of pipeline and export capacity. Elsewhere, WTI oil was down 3.9% during the month, despite the announcement of a 1.2MM barrel per day cut from OPEC. It seems that many are skeptical of OPEC’s ability to follow-through on the announcement or the prospect of increasing supply of US Shale.