March 23, 2019

Global Growth Alarm Bells Buzzing

Market Recap & Boxscore

Equities continued to climb through the first few weeks of the month, although enthusiasm has been slightly more muted. The S&P 500 and MSCI World rose 2.7% and 2.3%, respectively, while the TSX took a back seat for the first time in 2019, rising 1.7% for the period.

Within the US, tech shares were resurrected, ascending 8% over the past several weeks. Utilities and REITs also continue to outperform, lifted through falling rates and growth concerns. Related to growth, industrials have been the primary drag as manufacturing data begins to sputter. On the commodities front, oil continues to grain momentum, up 3.1% for the month and now 27.8% on the year as OPEC supply cuts and some positive weekly data offset global growth fears. Gold was a tale of two tapes, dropping 1.9% overall but recent strength was derived from resurfacing economic worries and the Fed’s pivot (discussed below). Cannabis stocks continue their market-leading ascent; Horizons Marijuana Life Sciences Index ETF (HMMJ) increased 9.3%. The proxy has now registered a 63% gain for the year and hit its Oct-18 highs. Many anticipate that new peaks will be reached as policy momentum builds south of the border.

One of the largest macro stories during March was the ‘dovish’ Fed statement made on 20-Mar-19. Most market participants seemed to be clinging to the belief that the Fed President, Jerome Powell, would be different. Many believed he would turn the tide of accommodative leaders and tighten monetary policy irrespective of the sentiment in capital markets. However, any remaining optimism was washed out when the Fed delivered a triple whammy; lowering growth expectations from 2.3% to 2.1%; eliminating calls for any additional hikes in 2019 (vs. two previously estimated); and, announcing they would continue to roll over principal payments for Treasury securities, effectively ending the tapering program. While some understood that any two out of three statements were possible, the overly dovish stance seemed to have taken many by surprise. Predictably, the main beneficiaries were gold and Treasuries. By surrendering the tools to manipulate rates and lowering growth expectations, the Fed effectively pushed longer-term yields down. With neither concern over growth or inflation, longer-term yields will remain under pressure prompting fears of a yield curve inversion and the prospect of a rate cut to counteract any steepening. Nevertheless, we remain focused on inflation, as a shock may be on the horizon if oil prices relentlessly grind upward.

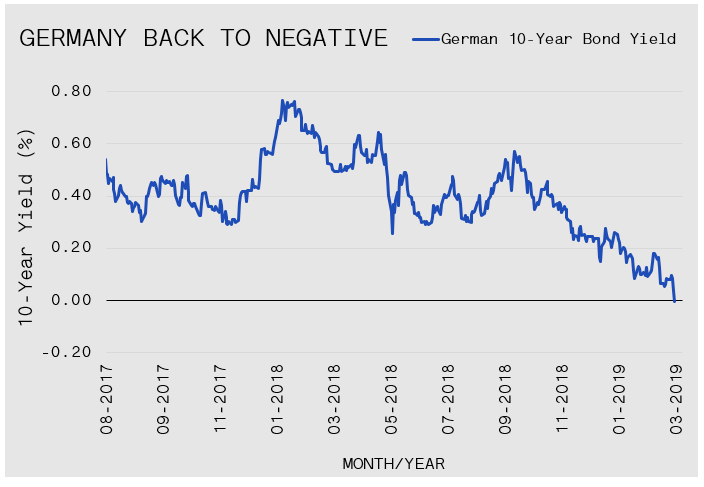

Despite rising equity markets, some of the underlying trends have been less constructive. The German Manufacturing Purchasing Managers Index, or PMI, data released on 22-Mar-19 revealed a third successive month of contraction. Being a primarily export-driven economy, the deterioration has fanned the flames of global growth fears. Cracks seem to be forming in Europe’s strongest economy. Germany faces trade negotiations not only with the US, but also China, and an impending UK Brexit. Terrible timing given recession signals growing in France and Spain, while Italy’s economy has slipped into its third recession in a decade. The automotive industry represents a large proportion of Germany’s exports. As such, profit warnings from Daimler AG and BMW, intensified the distress. These alarms have compounded to drive German 10-year bond yields into negative territory. European banks become reluctant to lend in this environment as their earnings from interest rate spreads are compressed. European companies rely more heavily on bank lending to fund operations as compared to the US who borrow more heavily in wholesale markets.

A staggering Europe and weak Chinese data hint that the US outlook may be fading as well. The US 10-year bond yield confirmed this sentiment, dropping to sub 2.5%. Given German bond yields are below zero and the Fed’s dovish posture, it would suggest that the differential in 10-year government bond yields is too wide. Unless there is an uptick in inflation, the US yield will have to move lower as we enter the second quarter of 2019.