April 23, 2019

Fund Flows Supporting Equity Market

Market Recap & Box Score

The equity rally stretched for another month as the MSCI World, TSX, and S&P 500 posted gains of 3.4%, 3.5% and 3.9%, respectively. On a total return basis, the S&P 500 is now up 24.4% from its Christmas Eve low and 16.6% year-to-date. Even more interesting, earnings season has only just begun and with an absence of positive signals from a macro perspective, these gains have been driven purely through multiple expansion. Despite calls for a stock market reversal from some of the smartest minds in finance; share repurchases, hedge fund short covering and retail fund flows have fueled the advance. SentimenTrader tracks retail flows via the Dumb Money Confidence Index. The indicator has been climbing steadily and it recently reached its highest level in a decade.

Fundamentally, we cannot refute the ‘smart money’ call for a re-test of the December lows. A slowdown in global GDP growth forecasts, potential margin compression and weakness in industrial production for export-driven countries (Germany and South Korea) support the bearish scenario. However, fundamentals act more as a rudder rather than a motor in the short to medium-term. Accordingly, fund flows remain the market’s engine, specifically corporate buybacks are fueling the machine.

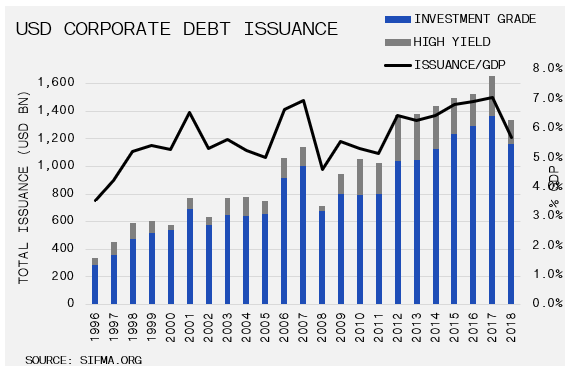

What is driving the buybacks and potentially the market? The embedded chart illustrates the growth of US corporate debt issuance since 1996. Following the 2007 crisis, US debt issuance has been on a sustained upswing, while the growth of high yield debt over the same period has been even more pronounced. Notably, corporate debt issuance diminished in 2011 and 2018. The chart does not capture the drastic slowdown in corporate debt in late 2015, in anticipation of the Federal Reserves’ first rate increase in December. As a result, a backlog of mergers and acquisitions that had yet to be financed slid from $246bn at the end of September to more than $900bn. Coincidently, these calendar years (2011, 2015 and 2018) were the three years since 2008 where the S&P 500 was either flat or down.

So, what is happening 2019? At the recent March meeting, the Fed Committee announced their intention to halt any further rate hikes in 2019 and complete its balance sheet roll-off program by the end of September. While many cite the Fed’s surrender to the stock market, it seems like credit market conditions were the impetus. Mr. Powell did not hesitate to raise rates in Dec-18 following a 10% drop in equity markets in Oct-18. However, when there was a 90% decline in credit issuance, the plan for hike rates and balance sheet runoff was quickly cancelled. This pivot seemed to hit the mark as credit markets opened-up. Investment Grade issuance rose from $9.1Bn to $106.6Bn, month over month. Similarly, high yield issuance leaped from $0.9Bn to $20.4Bn. Equity markets followed suit; after the 9.18% collapse in Dec-18, the S&P500 has jumped 16.6% in 2019.

Which leads us to another piece of the puzzle, that being inflation and the underlying commodity prices that drive it. April brought on a second consecutive 11.0% rise in the price of WTI oil to $65.50. The latest bump was in response to Trump’s call to end any waivers on countries importing Iranian oil. Not only does this escalate the current feud between the two countries but it essentially removes Iran’s 1.5MM barrels of oil per day from the market. With oil continuing to trend higher, the potential short-term effect on inflation and on interest rate policy will be noteworthy. An uptick in inflation could have a knock-on effect through the erosion of corporate margins. Further, if it forces the Fed’s hand, or alters the markets’ expectations from the Fed, debt markets will come under pressure. Within precious metals, both gold and silver took a breather in April, down 2.9% and 2.6%, respectively.