August 01, 2018

Facebook & Precious Metals Dive while Indexes Thrive

Market Recap & Box Score

Sustained strength in equities was offset by overall commodity weakness in July. The S&P 500 led the way, up 3.3% for the month, with Consumer Staples finally catching a bid. Technology shares were the frontrunners, as early gains compensated for company-specific weakness later in the month. The MSCI World Index only slightly trailed with a 2.9% gain, while the TSX was dragged down by weak oil to finish the month up 1.2%.

While earnings season started very strongly, some unlikely names changed the narrative in the final two weeks of trading. First, Netflix reported less than expected subscriber growth, ending the month down 16% in the final two weeks. Next, Facebook was down a cumulative 21% since it reported its lowest quarter-over-quarter user growth since 2011. Some shrugged off recent negative press related to such events as Cambridge Analytica or advertisers looking to reduce social media spending. However, with stalled user growth for four consecutive quarters, fears of a growth plateau are building. It remains questionable that the company reports that half of all Americans and Canadians, including infants and seniors, use Facebook on a daily basis. But, assuming this is correct, Facebook and its investors may need to start adjusting assumptions of continued growth in its userbase. The company’s ability to innovate is second-to-none; so, by no means is this story complete. Twitter, although less of a darling, also reported slower user growth than the market expected, losing over 25% of their market cap since 26-Jul-18. Despite these large misses, overall earnings have been positive. Nevertheless, the negative reaction to quarterly earnings misses by tech leaders causes one to reflect on the proximity of a bear market.

We would be remiss if we did not at least mention tariffs during a 2018 monthly commentary. As the US pursues the America First policy, some countries caught on the other end of President Trump’s tweets have decided to work together to try to offset some of the impact. Most important to Canadians, is the nation’s union with Mexico, Japan, South Korea and the EU to address tariffs on vehicles and vehicle parts exported to the US. The US has cited threats to National Security as reasons to justify tariffs on these goods. Warning of tariffs up to 25% will surely add a significant amount to the price of vehicles. We continue to question the impact this would have on the American consumer, but it seems like voters are supportive of an aggressive President who will continue to beat the drum to encourage the momentum.

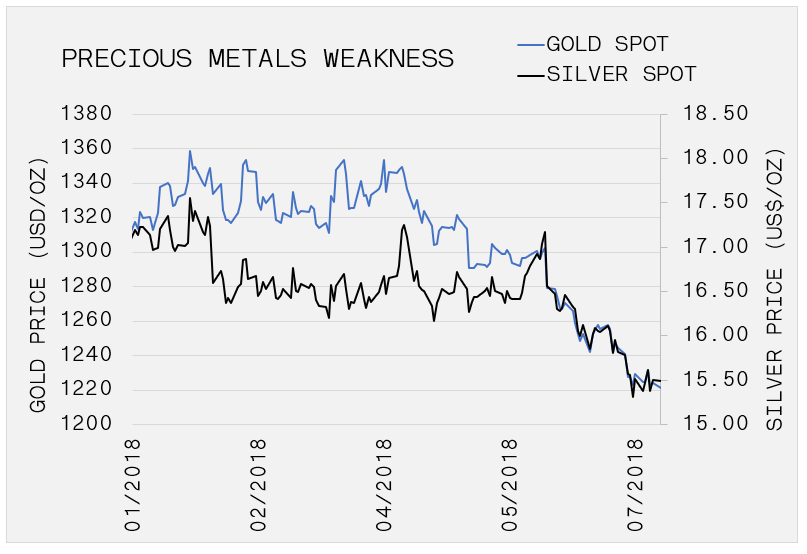

2018 has not been good to either silver or gold, with both losing their luster through the first half of the year. It is clear that the popular US Dollar and the prospects for rate increases have produced much of the weakness. A rising Federal Funds Rate makes the relative attractiveness of yield-bearing instruments greater than that of gold. However, an absence of movement on longer-term yields reflects the bond market’s feelings towards the Fed’s ability to continue to raise rates. Further, an uneasy European political situation and the steady drumbeat of the inflation narrative all point to a potential opportunity for precious metals. While the USD, as measured by the DXY, takes a pause on its year-to-date uptrend, it seems gold and silver have both stabilized at their current levels. Certainly based on current correlations the US Dollar Index (DXY) should be the primary determinant of the next move for bullion prices, but opportunities are brewing for outside influences to start providing a tailwind.