July 26, 2019

Equity Markets Rise Amid an Uncertain Economy

Market Recap & Box Score

Markets continued to perform well in July with the US leading the way. The S&P 500 posted a 3.6% gain for the period. The MSCI World and TSX lagged but still recorded strong gains, at 2.6% and 1.8%, respectively. In the US, technology (+7%) and financials (+6%) were leaders while healthcare and energy trailed.

Expectations for lower short-term rates are a significant factor in the markets upward trajectory. Growth sectors, such as technology, disproportionally benefit from lower rates because the cost of funding and discount rate produce a higher present value for these businesses. Financials are assessed differently because their valuation is derived from the yield curve, or the difference between long and short-term interest rates. Banks borrow on the short end and lend on the long end of the yield curve. Profitability is boosted when longer-term interest rates are higher than short-term. This worked against the financial sector in 2018 as the Fed sought to increase rates while the markets continued to price in low growth through suppressed long-term rates. In 2019, the trend has reversed. If the Fed allows inflation to “run hot”, the case can be made that the yield curve will steepen further, and momentum in financials will persist. The yield for the US 10-Year Treasury rose 11bps during the month, while WTI oil softened 2.6%, despite inventory data the was fundamentally strong.

Second quarter earnings season kicked off during the month. General expectations for Q2 were fairly bleak, especially lapping a robust 2018 when earnings were boosted by Trump-enacted tax cuts. Further, wage pressures, increased raw material (oil) costs, and global weakness in manufacturing and economic data were foretelling dim results. However, most companies have beaten expectations on both top and bottom-line numbers. Also, on 26-Jul-19, the US declared initial Q2 GDP growth of 2.1%, overcoming Wall Street estimates. With companies broadcasting solid results, a stubbornly resilient US economy and a supportive Fed, equity markets have potential to maintain an upward path. The downside case is supported by valuations that exceed historical averages and underlying indicators (inventory builds, government outlays, weak imports) that reveal softness in the economy.

As it relates to potential weak spots, the auto industry should be on the top of investors’ list of canaries. In the US, Ford disappointed and its stock lost up to 9% on the day of its earnings release. Guidance was cut and hints about capacity reductions continue. Overseas, Daimler (Mercedes-Benz), reported its first quarterly loss in a decade, though from a volume perspective, things were not as weak as headline numbers indicated. The company absorbed a €4.2 billion charge on diesel vehicle and air bag recalls. In the UK, stock of Aston Martin collapsed over 40% due to a reduced profit forecast. Meanwhile in Japan, Nissan announced 12,500 job cuts, or 10% of their workforce, as operating profit fell 99%. Globally, auto markets are one of the largest employers. Accordingly, when the sector faulters, it augurs poorly for consumer health, and in turn the economy.

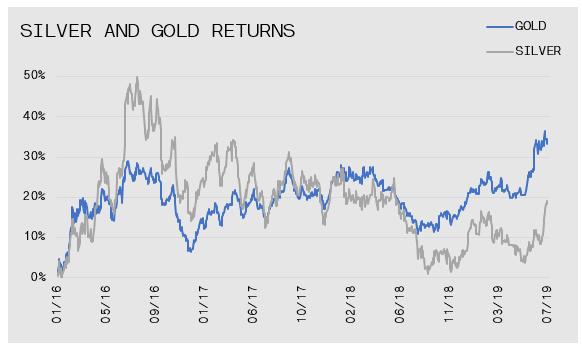

Precious metals had an interesting month as gold took a breather after a very strong June. Conversely, silver ascended 7.2%, in an attempt to close the gap with gold in 2019. It is important to try to make sense of the fuel that is propelling gold. According to Commitment of Traders report, speculators and producers are crowded on the long side, while expectations for rate cuts from the Federal Reserve are at extreme dovish levels. This has been the case for most of the bull run, yet prices withstand the strain. In a slow growth, benign inflation world, where $15 trillion of global bonds exhibit negative yields, gold becomes an enduring and attractive asset.

In contrast to gold, industrial metals, are used in a wide variety of construction and manufacturing applications. As such, copper prices, for example, can be a barometer for the economy. In July, at a time, when gold prices paused, copper may have found a bottom in its downward cycle that began in early 2018. The price movement of these two metals could have predictive power for the course of growth and interest rates.