September 01, 2021

Equity Markets Manage to Stay On Track

Market Recap & Boxscore

The S&P 500 rose 2.4% in August 2021. MSCI World and TSX also registered positive results, gaining 1.8% and 1.6%, respectively. Large capitalization companies have been carrying most of the weight over the past few months. As such, the strength in small and mid-cap names late in the month was noteworthy. In similar fashion, we are starting to see some life re-emerge in the “reflation trade”. The Financials, Industrials, Energy and Materials sectors outperformed, resuming the trend that occurred from November to June.

Delta variant waves in India and U.K. receded during the month, while daily infections in the U.S. exceeded 280,000. Notably, it had been more than six months since the U.S. had topped 100,000 infections in a single day. Moreover, in June the daily number had dropped to approximately 4,000. The U.K.’s dramatic declining case count provides hope that the U.S. will recover quickly but vaccine hesitancy, aversion to mask wearing and reluctance to self-isolate are seen as risks. As such, the persistence of the reflation trade may well depend on the America’s resolve against Delta, as well as a revival in China’s economy, which may need a jab of policy support to boost growth.

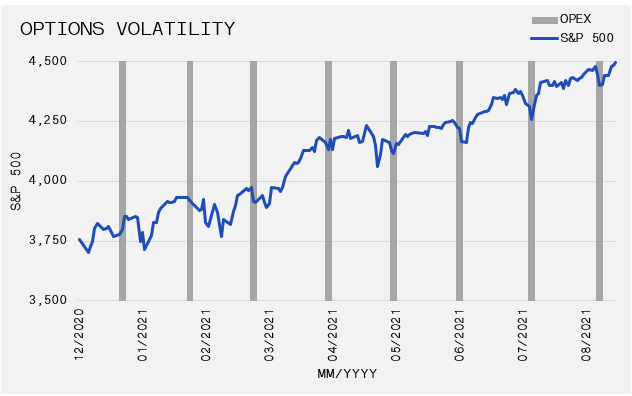

While the month-over month trend continues to push to the upside, we continue to see similar and repeated bouts of volatility in and around the third week of the month corresponding to options expiration (“Opex”). In August, the S&P 500 softened by 2.5% in just three days between the 17th and 19th, before rallying 3.4% to end the month. The move was more pronounced in the Russell 2000, dropping 5.7% before rallying 7.5% to end the month. The narratives used to justify each and every daily move are plentiful. However, the timing of these intramonth drawdowns is getting oddly similar.

In our opinion Opex is a possible explanation because of the option hedging strategies employed by dealers and large banks). When an option buyer enters a position, a dealer who sold the option will buy the stock in the market to remove the risk. When the scale of this activity is high in an up-trending market, gains are compounded as buyer increasingly push up the prices. As the option expiry date approaches, the dealers start to exit the market as the need to hedge subsides, removing that bid from the market that was previously pinned to a certain level. Post-expiration, the opposite occurs as the need to hedge rises again. However, this is not a one-way street, and can work in the opposite direction as put options, which pay as a stock price falls, rise in value as the market falls, which forces additional selling to hedge dealer positioning for puts sold. While the trend remains up which has made every dip a buyable event so far in 2021, the timing and regularity of these events suggests some participants have caught on to the trade and may be looking to front-run the move.

Long rates seemed to have found a short-term bottom in early August. The yield on the 10-year U.S. Treasury bond has climbed 11bps from its post-February low to 1.305%. The U.S. Federal Reserve met in the final week of August to discuss monetary policy. Most speculation going into Chair Powell’s speech revolved around the potential for hawkish statements related to tapering the $120Bn in monthly bond purchases. However, Powell’s speech seemed much more accommodative. Despite the expectation that tapering will begin in late 2021, it does not appear that the Fed is in a rush to disrupt markets by overreaching. Accordingly, we are not overly concerned with higher bond yields in the near term for a couple of reasons (1) the U.S. government is using the surplus in the Treasury General Account to fund its payment obligations, thereby reducing the supply of Treasury Bonds (2) Foreign buyers haves been acquiring Treasury bonds at record high levels amid a search for yields as inflation fears peaked and the global economy paused.

Commodities were mixed in August, although the more cyclical commodities like oil and copper garnered positive momentum in the back half of the month. Oil salvaged what would have been a very weak August, bouncing 10.6% off its 23-Aug-21 low to finish the month down 7%. Soft commodities were mixed while gold finished the month down 0.8%. During the first weekend of the month, gold buckled by over 6.1% with rumours swirling of a forced liquidation from a large player. Gold has been trading sideways for much of 2021 despite falling real rates.