June 26, 2019

Don’t Sell In May, The Fed Will Save The Day?

Market Recap & Box Score

While our headline generation may be called into question, the question of whether the Fed’s rate hiking cycle is over was temporarily put to bed in June, helping to lift markets globally. The S&P 500, MSCI World, and TSX indices all ended in the green, up 4.4%, 4.0%, and 1.4%, respectively as the TSX gave back its May outperformance. Beginning with some hat-tipping from Fed members and concluding with the Fed statement on 19-Jun-19, investors were calmed as the probability of a 2019 rate reduction moved to 100%. Two primary beneficiaries of the news were gold and US treasury yields. Gold bugs celebrated as it initially broke through its 2011 downtrend line and since held above the $1,400 level, ending the month up 10.3%. The US 10-year yield broke through 2%, ending the month down 145bps to 1.99%, a meaningful decline from 3.23% in Oct-18. The movement in yields and gold prices validate the Fed’s message – the future rate path of interest rates will be downward in the absence of inflation.

An interesting dichotomy has developed in markets in 2019; market exuberance driven by a dovish Fed contrasted with a sluggish economy that is forcing the Fed to provide stimulus. Global manufacturing has decreased materially, with the Markit Economics Composite World PMI shrinking to 51.2, approaching its 2016 lows. This has been compounded by questions around the soundness of Chinese bank liquidity, a slowing global auto market and perhaps most importantly, a continued decline in the CRB Raw Industrials Spot Price Index. This CRB index is a gauge of the prices of key industrial inputs and ‘boots on the ground’ measure of economic activity. Geopolitically, the US and Iran are one bullet away from military conflict.

However, one key lesson learned since 2009 is that data alone does not necessitate a market pullback, and in the absence of a spark, euphoria can and will continue. The prospect of easing US/China trade tensions, perhaps as early as the July G-20 meeting, and an amicable Fed could sustain the tailwind. The Fed’s preference for a weaker US dollar will be valuable for improving the competitiveness of domestic exporter and for boosting corporate margins. Foreigners who are servicing USD denominated debt will also get relief from a lower greenback.

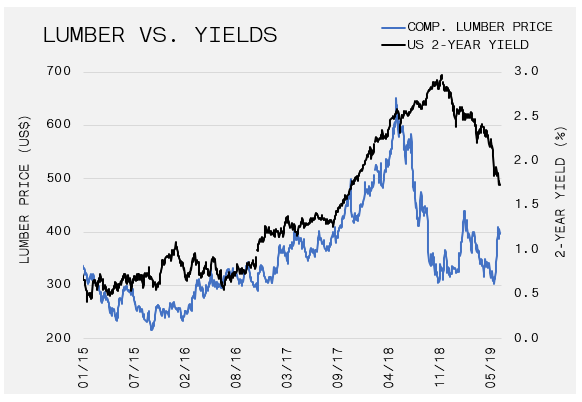

One sector that has not read the “everything must go up” memo in 2019 has been lumber and its producers. After a strong period of outperformance beginning in late 2016 to mid-2018, these companies have been struggling to find a bottom, with industry leaders Canfor and West Fraser losing 67.9% and 38.2%, respectively. The “outperformance” of West Fraser highlights the issues facing the industry as a confluence of environmental and political realities hit the BC lumber market, where Canfor has staked the largest claim. First, the mountain pine beetle epidemic destroyed large swaths of timber across BC. However, lumber remains economically viable for up to 8 years after the tree is dead, so supply available to loggers increased up to 2017. The beetle created more dead timber, lowering input costs and increasing capacity. Since then, the trend has reversed, which when combined with an increase in wildfires has drastically reduced supply, increasing stumpage rates and reducing margins and capacity simultaneously. Compounding this has been an anticipated increase to stumpage rates on 01-Jul-19 and the passage of Bill-22 in BC. The bill restricts the ability of companies to transfer their tenure, or logging rights, to another company. These factors have combined to create massive uncertainty in BC and daily announcements of mill shutdowns or curtailments. Canfor CEO Don Kayne estimates that up to two billion board feet of lumber capacity will have to be eliminated to match market forces, which points to further shutdowns upcoming. We are beginning to see green shoots in the industry, as lower interest rates have potentially stabilized housing demand. The corresponding demand for lumber, combined with capacity cuts pushed composite lumber prices up 32.5% this month. That said, the index is still down 34.8% from its May-18 high. Lumber provides a lesson in market cyclicality and the opportunities and risks inherent within it.