February 28, 2020

Coronavirus & Your Portfolio: Headlines May Misguide You

Smart Money

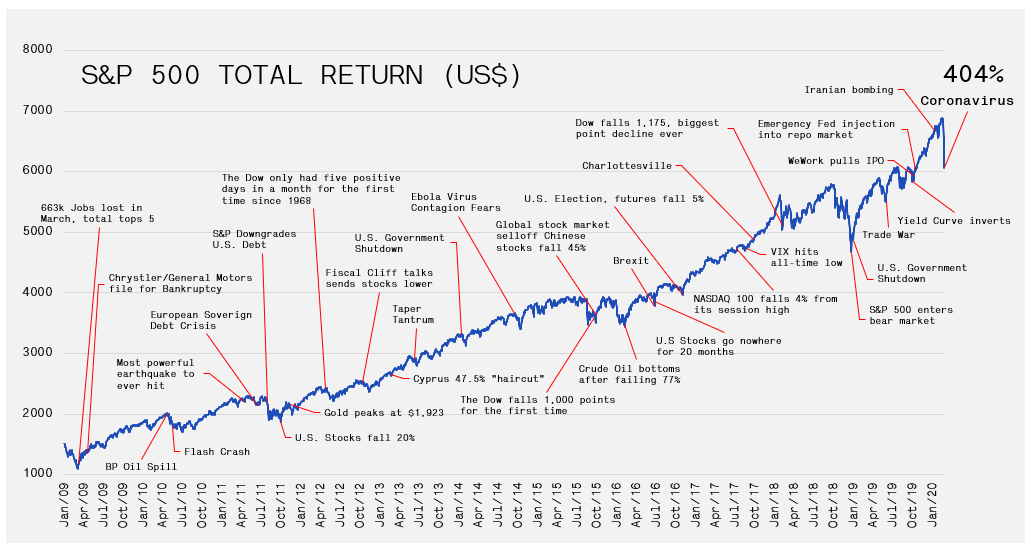

This week has provided ample ammunition for click-bait headlines. News of the coronavirus spreading has been the catalyst for an overdue correction in equity markets. In times like these, it is important to remember a number of truisms that are employed by successful, long-term investors. The first is that corrections (defined as a 10% decline) and/or bear markets (defined as at least a 20% decline) are normal occurrences in equity markets. In fact, corrections occur on average every 12-18 months and should be considered a great time to add to your best ideas. The second is that there is always a reason to sell. In fact, the imbedded chart shows that over the past 10-years there were numerous corrections and triggers. Nevertheless, the market climbed over 400%. As Warren Buffett famously stated: “Buy when others are fearful and sell when others are greedy”. All the same, we recognize investors become increasing concerned about the greatest risk of all, a permanent loss of capital. As such, we combat these risks in multiple ways:

Multi-asset class portfolios. This means that only a portion of your capital is exposed to these large swings. For example, bonds (and cash) can not only help protect money in a bear market, their stability also provides an option to take advantage of stock discounts. If a car you wanted to buy was all of the sudden 15% off, would you be more or less likely to purchase?

Low correlation investments. Your assets include securities that may be a drag on returns when the equity markets are surging but act as a source of relative return when stocks decline. This may include farmland, gold or hedged strategies; investments that can make money regardless of the equity market’s direction.

Undervalued Companies. We avoid “story-stocks” or over-hyped securities. An example is a business that we previously owned, Mastercard. This is a great company operating in a dynamic sector with terrific competitive advantages – it is essentially a toll road for electronic payments. However, at over $300 per share, the price implied that it would take 20-years to recover your capital at the rate the company earns a profit. Further, most of the top company’s today (Facebook, Amazon, Google) barely existed 20-years ago. More significantly, one of the most loved companies of the late 1990s, General Electric, is down 55% over that period.

We have seen the economic picture shifting dramatically since the end of 2018, with signals of a U.S. recession on the horizon combined with excessive behavior in some areas of the market. As a result, only 40%-50% of your capital is exposed to equities, we have plenty of “dry-powder” to deploy when better buying opportunities arise. This does not mean we will be unscathed, rather we are in a good position to make rational decisions. It is not about timing the market. We employ a studious and continuous risk management process that corresponds to your investor characteristics.