February 25, 2021

Commodities Gain But Markets Struggle As Month Winds Down

Market Recap & Boxscore

Echoing January’s tune, global equity markets stumbled in the final week of the month, this time after a very strong showing for most of February. Despite this, most markets remained positive in February, with the TSX resuming its leadership on the back of a strong commodity showing, up 6.1% for the month. The S&P 500 Index rose 2.7%, led by Energy (+ 17.7%) and Financials (+ 9.4%) sectors, while rate sensitive utilities lagged, down 5.3% for the month. The MSCI World Index lagged, rising 1.6% as Europe and China trailed North American Indices.

Market darling Tesla has been on its back foot since it announced its $1.5 billion purchase of Bitcoin. Tesla fell 23.9% during February, dropping below the price at which it was included in the S&P 500 Index. Related to this, Ark Investments experienced the downside of the momentum trade. Tesla represents 10% of flagship ARKK exchange-traded fund, which triggered the 6.9% drop in February. Ark focuses on innovative, small capitalization companies. Accordingly, as Ark’s assets under management have increased from $10 billion to $50 billion in 2020, the companies within Ark’s portfolio have likewise soared. However, if outflows continue, Ark will be forced to sell these positions. The size of outflows will accelerate the slide in the price of the underlying holdings. This creates a negative feedback loop for Ark, and potentially markets in general.

After a brief rise to start the year, the USD fell 50bps during the period. Despite the modest change, commodities moved up aggressively, with copper leading the way, rising an astounding 20.2%, contributing to a 69% year-over year gain. Lumber similarly rose 19.8% to a new all-time high above $1,000, and its one-year return is now 119%. Soft commodities produced a similar story, as sugar, corn and cotton all rose over 10% during the month. Soybeans and wheat were up 6.7% and 5.9%, respectively. The crisis in Texas supported the Energy sector as the ensuing supply chain issues, along with refinery blockages, propped gasoline and oil by 21% and natural gas prices by 14.5%. It is not often that commodities print 20%+ monthly increases, especially after a period of sustained strength. Many are still dismissive of inflation, and the tepid January Consumer Price Index report of 1.4% year-over-year provided naysayers more confidence in their status quo view. Nonetheless, it is doubtful that CPI can continue to show miniscule gains. Grocers and restaurants will need to pass along price increases to counteract rising soft commodity costs. Further, housing rents – which account for 7.9% of the inflation basket – are climbing. The renter base is growing due to the unaffordability of homes, housing shortages and migration to suburbs. As economic data begins to lap weak readings during the depths of the Covid-19 shutdown, CPI should quicken.

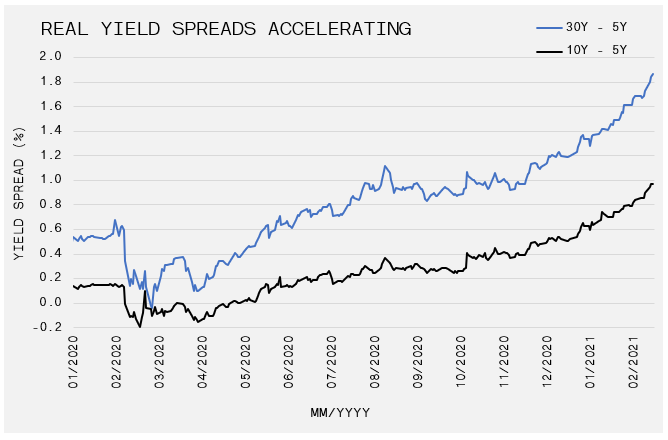

While the CPI has remained stubborn, markets have not been fooled. We shed some light on the move up in long-term yields in the January letter, and this month momentum continued to build as the 10-year and 30-year yields rose 43 and 50bps, respectively, to 1.46% and 2.29%. As long yields continue to rally, the short end has remained persistently low, which has pushed both nominal and real yield curves up aggressively (see below). Part of this is intuitive as the long-end is more sensitive to inflation and growth expectations, while the short-end is more sensitive to Fed control.

The Fed’s discipline will be tested in the coming months as short-term rates are at risk of becoming negative. Negative interest rates make it less appealing to hold cash and induce spending, lending and speculation, while curtailing bank profitability and creating widespread uncertainty in the market. Treasury Secretary Janet Yellen outlined plans to start drawing the $1.5 trillion Treasury General Account down to $800 billion by the end of March. This flood of reserves will hit bank balance sheets, as commodity prices intensify, and before Biden’s $1.9 trillion inflationary infrastructure plan is due in April. All things considered, the Fed could be squeezed into the unenviable position of negative short-term rates and rising long-term Treasury yields.