The 2022 NHL Entry Draft will be held on July 7–8, 2022, at the Bell Centre in Montreal. Great timing for us to share some tips for young players and investors. Investing isn’t about earning the highest return, it’s about earning a reasonable return given the risk you are accepting and repeating the return consistently and for a long period.

Smart Money

Our regular summary of the capital markets. Check back each month for new updates.

July 29, 2022

Mid-Summer Relief

Market Recap & Boxscore

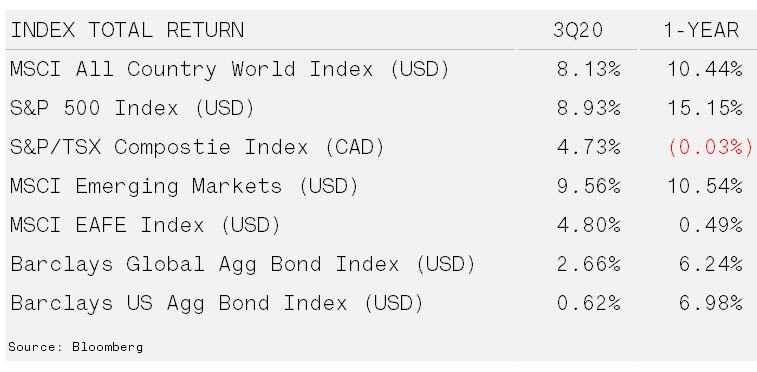

A rally in the back-half of July propelled stock market indices to a positive month. The MSCI World led the way, up 5%, while the S&P 500 followed with a 4% return. The TSX lagged, with a gain of under 1%, as the heavy weight in Financials and Energy slowed the year-to-date leader. Interestingly, it was the year-to-date losers that guided the S&P 500’s 11% rally off its June l...

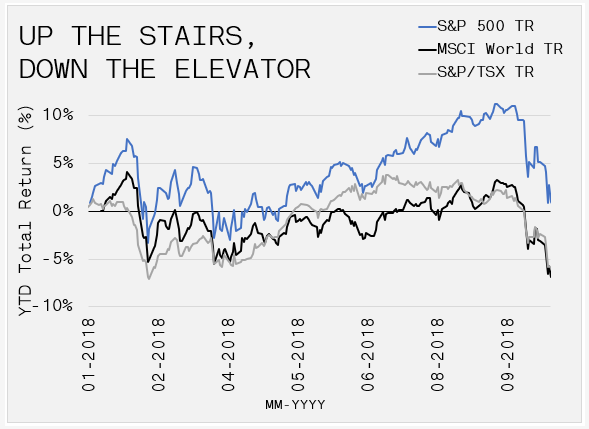

A rally in the back-half of July propelled stock market indices to a positive month. The MSCI World led the way, up 5%, while the S&P 500 followed with a 4% return. The TSX lagged, with a gain of under 1%, as the heavy weight in Financials and Energy slowed the year-to-date leader. Interestingly, it was the year-to-date losers that guided the S&P 500’s 11% rally off its June low. Consumer Discretionary and Tech stocks registered gains of nearly 12% and 10%, respectively. The sole outlier was Communications as Meta Platforms Inc. produced quarterly results that once again disappointed across almost all metrics. The company, formerly named Facebook Inc., accounts for 24% of the Communications sector.

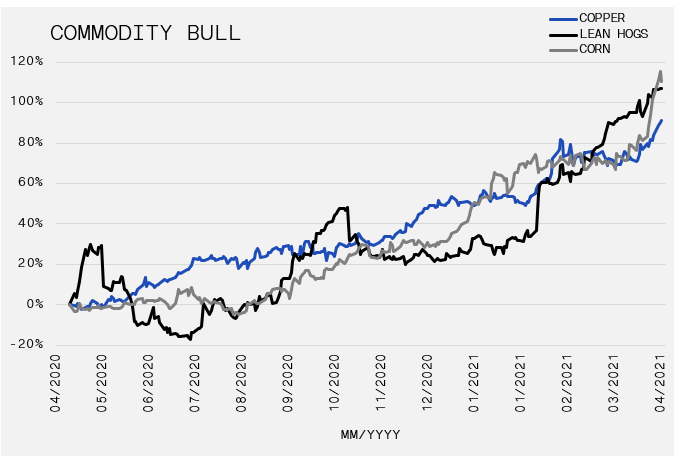

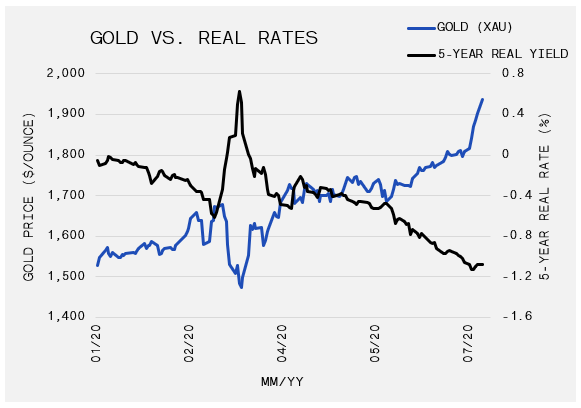

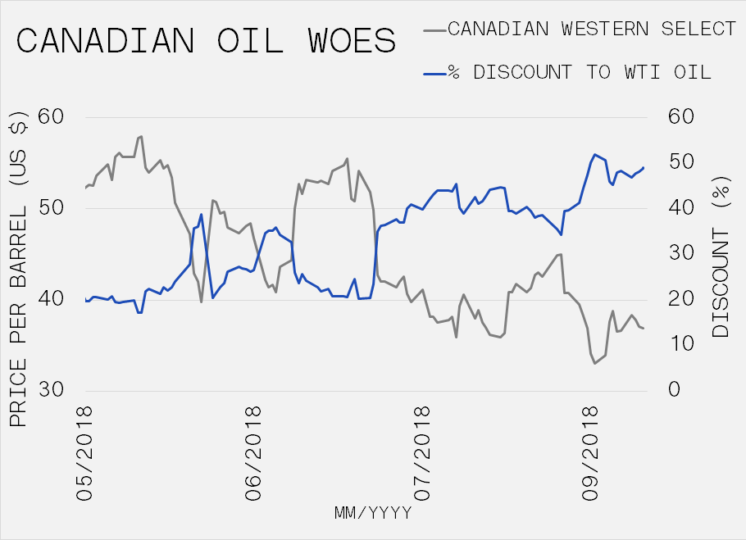

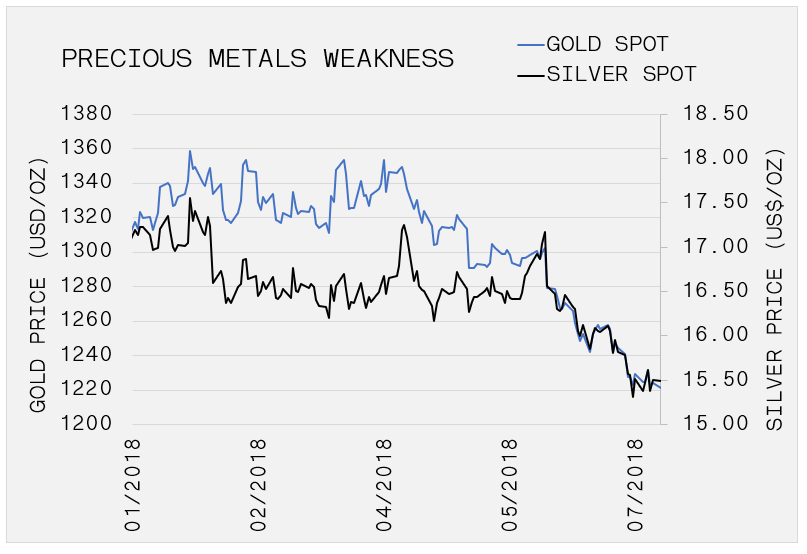

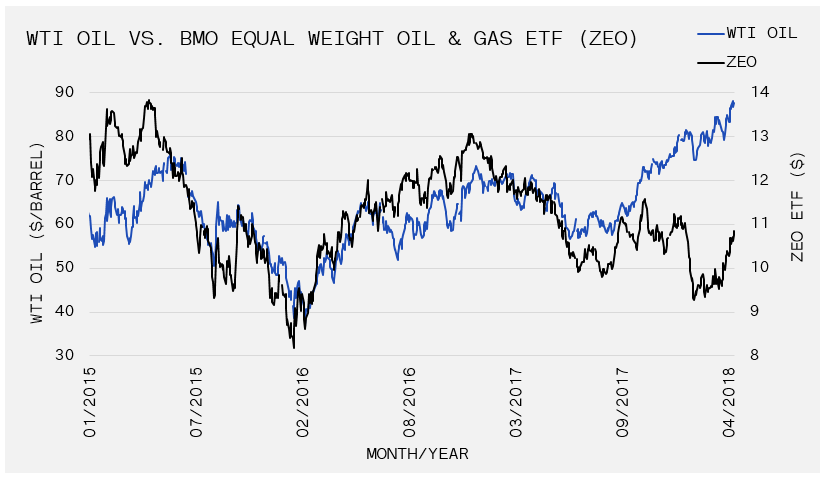

Commodities continued to weaken in July. Corn fell over 19% and WTI oil and copper dropped 13.4% and 7.9%, respectively. Gold slumped 3.9% during the period. However, real rates and the U.S. dollar faded into month-end, allowing gold to rebound 4% off its July bottom.

About half of the S&P 500’s constituents have reported Q2 results. It was feared that earnings would fall far short of analyst consensus estimates. However, panic has not materialised. Refinitiv reported 69% of companies beat expectations. Moreover, the reaction to company results has been an important difference from prior quarterly reporting periods. For instance, Microsoft Corp. and Alphabet Inc. both reported revenue and earnings that fell short of expectations. Nevertheless, their share prices popped 7% and 8%, respectively, on the day. This is in stark contrast to the relentless selling that greeted even strong earning reports earlier in 2022.

Continuing on the topic of counterintuitive follow-throughs, U.S. GDP fell 0.9% in the second quarter, which followed a 1.6% decline in Q1. Agreement on the definition of a technical recession is contentious. However, it is undeniable that the economic landscape is far from rosy given the clouding job picture and two consecutive negative GDP prints. Despite the GDP report on 28-Jul-22, stocks failed to give back any of the outsized gains that accrued following the Fed’s announcement of a 75bp rate increase a day earlier.

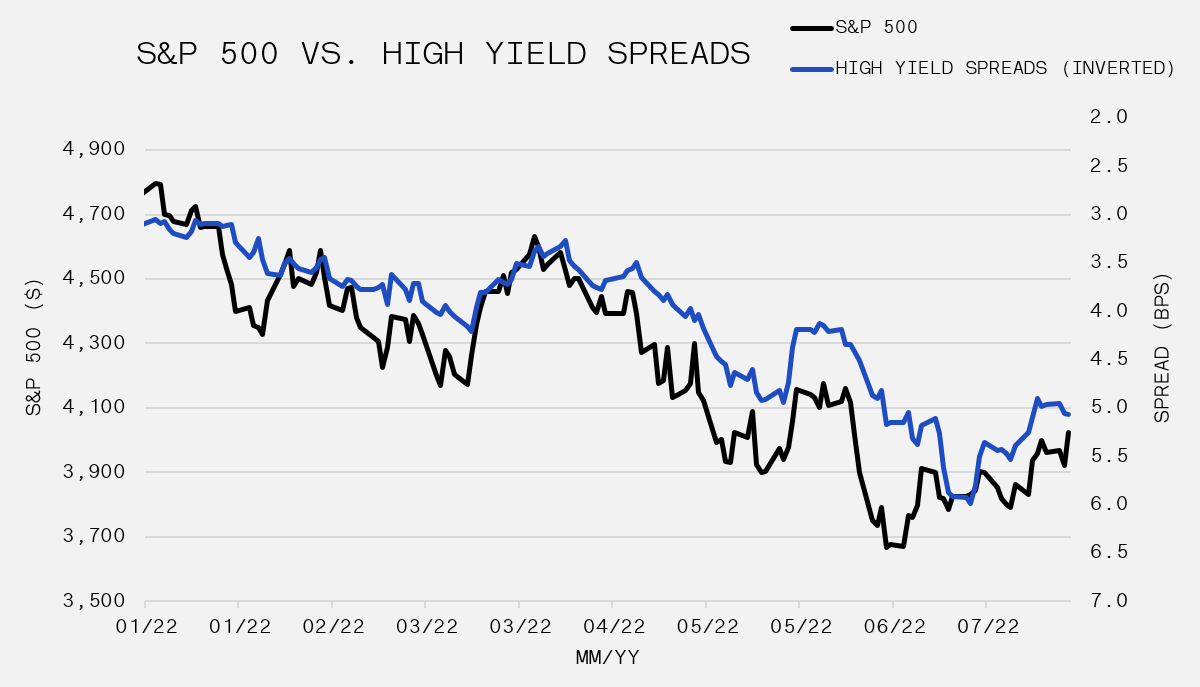

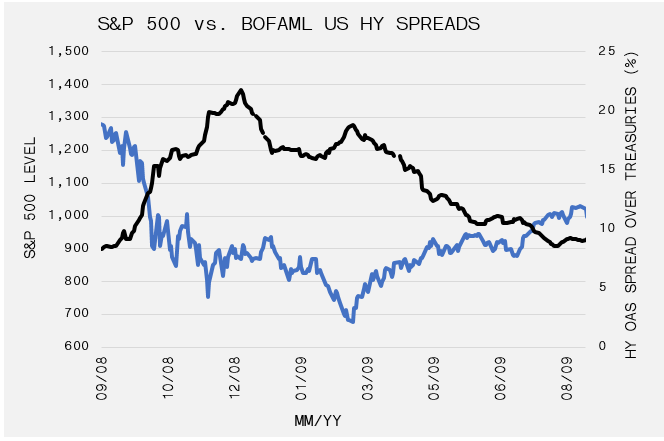

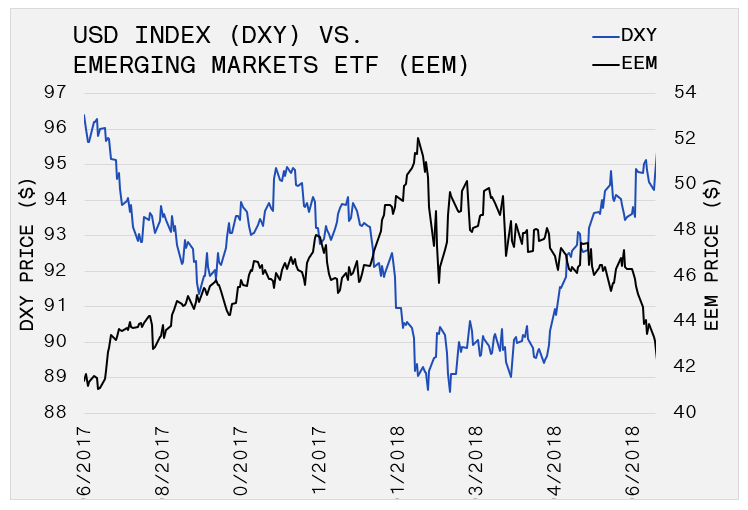

In our previous Monthly Recap, we commented about the profound weakness in the equity markets to start the year. In consideration of the first half bust, the outsized short position in S&P 500 futures and the low level of gross exposure among hedge funds, it is not overly surprising that stocks rallied in the face of negative economic news. Time will tell whether this is simply another aggressive bear market rally or if the bounce is more durable. For insight into the possible market direction going forward, there are three key indicators that require constant evaluation (i) the U.S. Dollar, (ii) credit spreads, (iii) the yield curve. The USD, represented by the DXY, is a key measure as it gauges the Federal Reserves determination for fighting inflation and it acts as a safe haven in times of stress. It rose another 2% in July, though it backed off 3% from the high on 14-Jul-22. The yield curve became negative during the month. The short end of the curve is lifted due to the Federal Reserve rate hikes while the bond market anticipates an economic slowdown and lowers bond yields on the long end. Despite the strong dollar and the recession signal, credit spreads tightened which typically suggest a willingness to take more risk and potentially improving economic conditions. The ICE BofA US High Yield OAS contracted from 5.26% to 5.07%. One month does not make a bull market, but there is an opening for additional upside, if the USD softens more and the yield curve re-steepens.

July 15, 2022

How Did We Get Here?

Second Quarter Newsletter

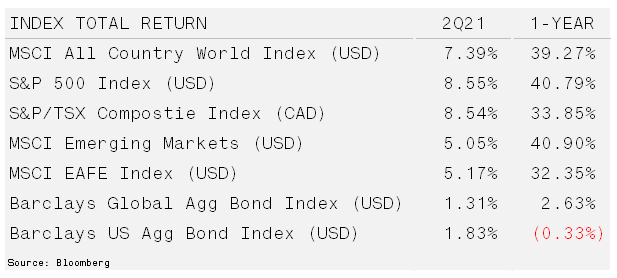

Brutal Quarter Confirms Bear – The S&P 500 entered bear market territory during the quarter, falling 16.1%. Mid-way through June, the benchmark was down as much as 24% from its peak. Persistently high inflation, leading to a hawkish (less accommodative) Federal Reserve combined with an economic slowdown were the drivers behind the weakness. The commodity-heavy S&P/TSX Composi...

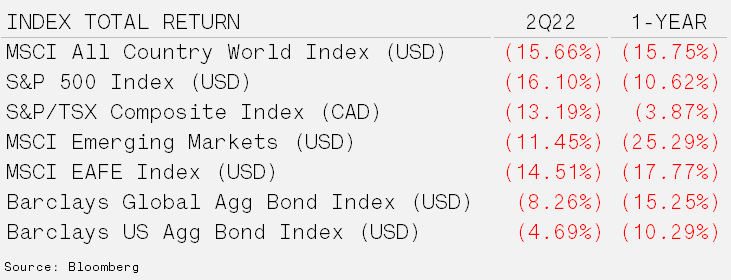

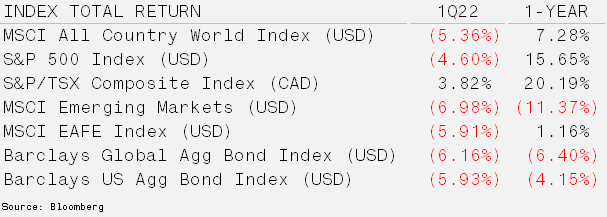

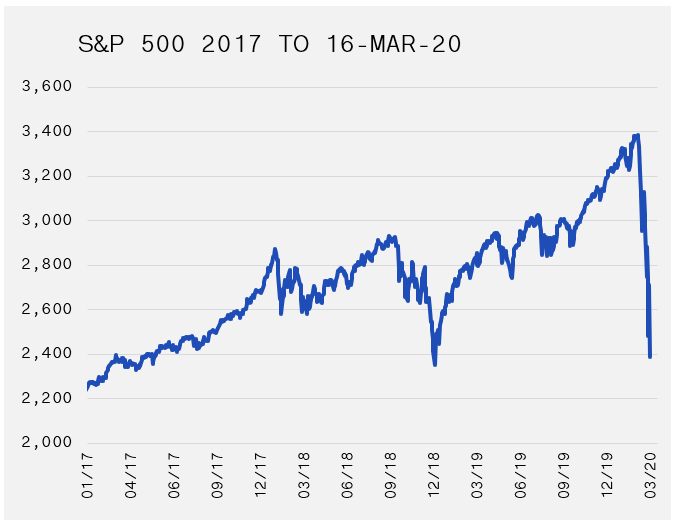

Brutal Quarter Confirms Bear – The S&P 500 entered bear market territory during the quarter, falling 16.1%. Mid-way through June, the benchmark was down as much as 24% from its peak. Persistently high inflation, leading to a hawkish (less accommodative) Federal Reserve combined with an economic slowdown were the drivers behind the weakness. The commodity-heavy S&P/TSX Composite fared much better. However, in the back-half of the quarter, the sectors that were supporting the Canadian index faltered as oil and gold prices lost momentum.

The performance of bonds has been perhaps the more concerning development over the quarter and really the last year. These typically “low risk” investments registered double-digit losses over the trailing 12-months. Late-cycle behavior continues to unfold with wider credit spreads and an inverted yield curve.

The Seven Sins of Inflation – Inflation is a rise in the average cost of goods and services over time. Financial markets measure inflation through the Bureau of Labor Statistics, which compiles data to determine the Consumer Price Index (CPI). The average rate since the Second World War is 3.76%. However, the 10-year moving average is just over 2%. In June, CPI touched a 40-year high of 9.1% year-over-year. Although we continue to believe that structural forces remain in place that make it difficult to maintain a level greater then 4%, it has been the combination of these seven forces listed below that lead us to where we are today. The first two are more long-term in nature and give us the most to think about while the others are supply side shocks, corporate greed, and geopolitical events.

– (1) Rising labour costs in China due to a shrinking working age population and increasing Gross Domestic Product per capita.

– (2) Political forces and capital allocation that favours Environmental, Social & Governance (ESG) have led to under-investment in conventional energy sources.

– The global pandemic of 2020 is responsible for three contributors to the rising inflation prints; (3) trillions of dollars spent in relief packages in the United States, (4) labour shortages as workers left the labour force and (5) supply chain disruptions.

– Public equity valuations are driven primarily by revenue growth and profit margins. Corporations have relied on (6) price increases to stabilize margins to offset rising labour costs and raw material expenditures.

– Finally, (7) the Russian invasion of Ukraine had a direct impact on energy and food prices. Sanctions against Russia removed oil and natural gas supply from the global market at the same time blockades have trapped corn and wheat in one of the world’s largest producing regions.

The factors combating these inflationary forces are mainly structural. The level of national debts, aging populations and a stronger U.S. dollar should alleviate some of the upward pressure on inflation over the long-term. However, it does not appear that we will quickly return to the often cited 2% level of inflation. National interests are now at the forefront of geopolitics. As such, the ESG, supply chain and rising cost concerns overseas have raised awareness of domestic dependence on globalization.

For today’s investors, inflation is vastly outpacing cash savings. Prices double every 19 years based on the post-WWII average inflation rate (3.76%). As a result, protection against the loss of purchasing power for long-term investors is paramount.

Fixed income investments were designed to provide real returns (returns after accounting for inflation) but over indebtedness and lower growth have suppressed long-term yields. Stocks have a mixed track-record when isolating inflationary periods, but in general have held up well. Public market sectors tied to natural resources and real assets have performed the strongest, along with real estate. GAVIN attempts to accumulate these assets during periods of below average inflation when the risk/reward is skewed in our favour. This includes our farmland participation, private and public real estate strategies and commodity investments.

July 07, 2022

Retiring at 28

Smart Money

If the players who were drafted in 2012 started their NHL careers when the lockout ended in 2013 and continued to play in the league through the conclusion of last season, they would have maximized the NHL pension benefit. The top 5 picks in 2012 were Nail Yakupov, Ryan Murray, Alex Galchenyuk, Griffin Reinhart and Morgan Reilly. The age of these players is 28 years old. As we look fo...

If the players who were drafted in 2012 started their NHL careers when the lockout ended in 2013 and continued to play in the league through the conclusion of last season, they would have maximized the NHL pension benefit. The top 5 picks in 2012 were Nail Yakupov, Ryan Murray, Alex Galchenyuk, Griffin Reinhart and Morgan Reilly. The age of these players is 28 years old. As we look forward to this week’s NHL Entry Draft, we also want to celebrate the players who accumulated the maximum NHL pension credits with the completion of the 2021-22 campaign. Accordingly, we summarized the defined benefit pension program’s facts and features in the link below. Good luck to the players available in this week’s draft and congratulations to those who have achieved their maximum pension!

June 29, 2022

S&P500 on Track for its Worst First Half in Over 50 Years

Market Recap & Boxscore

The rally across equity markets in the back half of May was quickly erased in June, as the S&P 500 fell approximately 7.5% to bring its year-to-date drop to the 20% range. June weakness was notable as this was the first month in 2022 where there really was nowhere to hide for equities, as even the energy sector fell nearly 15%. This led to a sizeable drop of about 8.5% in the TSX,...

The rally across equity markets in the back half of May was quickly erased in June, as the S&P 500 fell approximately 7.5% to bring its year-to-date drop to the 20% range. June weakness was notable as this was the first month in 2022 where there really was nowhere to hide for equities, as even the energy sector fell nearly 15%. This led to a sizeable drop of about 8.5% in the TSX, which has been a consistent leader throughout the year. The MSCI ACWI split the difference, tumbling closer to 8%, as European equities failed to provide any strength. The only clear winner this period was China, with the Shanghai Composite Index rising over 7% as policymakers initiated a monetary easing cycle.

The mighty commodity trade sold off as the CRB Commodity Index crumbled 6%. Copper led the way down (almost 12%), gold fell 2% and WTI oil slipped roughly 1.5%. Bonds were once again correlated with equity markets. Barclays Aggregate Bond Index took a 3% beating on the back of 10-year yields rising 28bps to 3.125%. High yield as measured by HGY dived over 8% due to the combination of increasing rates and widening high yield spreads.

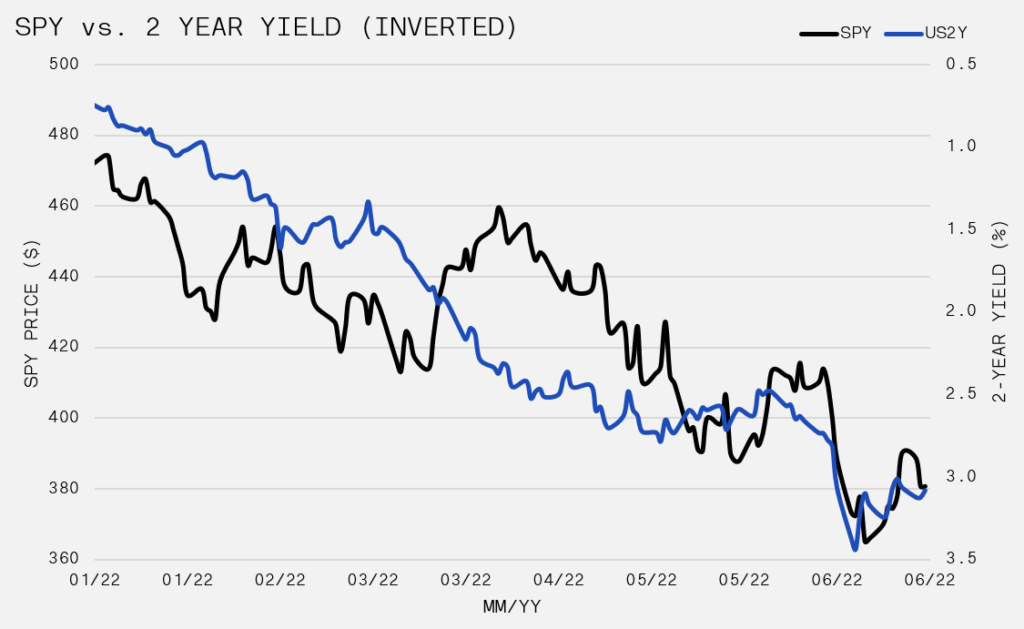

Equity direction has clearly been a product of the Fed policy, as the S&P 500’s descent has been strongly correlated with the inverted 2-year yield (see the image below). The market is pricing an increasingly aggressive Fed hiking cycle, which has pushed rates up across the curve, but particularly at the short end. After a “surprise” 0.75% hike on 15-Jun-22, Fed Chair Powell stated that the Fed’s focus will shift from an employment mandate to an inflation fighting mandate. Further, the underlying aim will move from core inflation to headline inflation. The major difference is that headline inflation is primarily an energy gauge. As such, the Fed will need to continue its fight against price increase as long as energy and its products become more expensive. This is obviously not good for financial assets that are priced off the risk-free rate. The other obvious risk to equities is a recession. According to the Bureau of Economic Analysis, real gross domestic product (GDP) decreased at an annual rate of 1.5% in the first quarter of 2022. Further, the Atlanta Fed dropped its second quarter estimate for growth to 0%. A recession is commonly defined as an economy that shrinks for two consecutive quarters. As a result, cynical forecasters are becoming increasingly confident.

But, now for the good news, if commodities are in fact in the process of topping, inflation pressure should begin to ease. In fact, easing price pressure was reported in the Core PCE (personal consumption expenditures) Index. This narrower measure of inflation that omits volatile food and energy costs, rose by a modest 0.3% in May.

It’s important to respect just how weak equities have been to start the year. Since the market is forward-looking, lowered inflation expectations and a less aggressive Fed, could ignite a rebound. Nevertheless, a bounce could be short-lived, if it turns out that hiking rates only serves to further curtail supply which induces more scarcity and price tension. In this instance, the Fed will have sacrificed employment in favour of a losing inflation policy that only pushes the economy further into recession. Accordingly, acknowledging all outcomes along the probability curve continues to be of utmost importance.

May 30, 2022

Stocks and Bonds Embark On a Skeptical Recovery

Market Recap & Boxscore

The calendar month is not officially over, but as of the U.S. Memorial Day holiday, it looks like the S&P 500 will close the month out with a 0.7% gain. The profit was achieved with a 6% boost in the final week, ending a 7-week losing streak and marking the index’s best one-week advance since the first week of Nov-20. The MSCI World managed to lead with a 0.9% improvement, paced b...

The calendar month is not officially over, but as of the U.S. Memorial Day holiday, it looks like the S&P 500 will close the month out with a 0.7% gain. The profit was achieved with a 6% boost in the final week, ending a 7-week losing streak and marking the index’s best one-week advance since the first week of Nov-20. The MSCI World managed to lead with a 0.9% improvement, paced by continued strength in Europe, while the TSX lagged, down 0.5%. Looking deeper, excluding energy, strength was concentrated in names that were hit hardest to start the year as consumer discretionary and technology led the way. However, energy fared just fine, up 8.3% during the month which marked an impressive 59.5% year-to-date increase for the sector. This compares to consumer discretionary which is down 24.7%. For those new to this, an 84% year-to-date spread between the top and bottomer performer is truly impressive. The turnaround in equities occurred around the time that the US Federal Reserve released its meeting minutes. The commentary was interpreted as an indication that the central bank will be less aggressive going forward. Our sense it that equity hedges were covered following the announcement. As such, the narrative fits the price action but expectations for a pause in the tightening cycle may be premature.

It wasn’t just stocks that managed to gain a bit of traction in May as the bond market turned in a strong month. The 10-year U.S. Treasury yield fell 0.20% to 2.74%, providing some reprieve for a traditional 60/40 portfolio which has suffered to start the year. U.S. high yield corporate bonds were also bid in May. The iShares iBoxx High Yield Corporate Bond ETF rebounded 2% after losing more than 10% in the first four months of the year.

Not a lot has changed with the broad bull market in commodities. Energy continued to lead the way with natural gas and WTI oil rising 21% and 12%, respectively. The agriculture complex was mixed as wheat rose 10% while corn fell 5%. Federal Reserve Chairman Jerome Powell identified the rapid rise in commodity prices, incited by Russia’s war, as an accelerant for inflationary pressures across the economy. Accordingly, a reversal in the sector will be helpful to fulfill the “less hawkish Fed” storyline.

Gold fell 3% during the period. A 4% bounce off its mid-month low helped minimize its weakness. We are starting to see signs of slowing growth in inflation and economic data, which may be supportive of gold. The U.S. dollar (USD) also seems to be sniffing this out as the DXY fell 2%, just after futures traders started piling in on the long side of the trade. If a pullback in the USD is maintained in the coming weeks, we could start to believe the rally in stocks. North of the border, the Loonie recoiled off the low-end of its recent range and rose 2% against the Greenback. The Bank of Canada will make its monetary policy announcement 01-Jun-22. The aggressiveness of its rate hike will draw attention especially since housing affordability is one of the top issues facing Canadians.

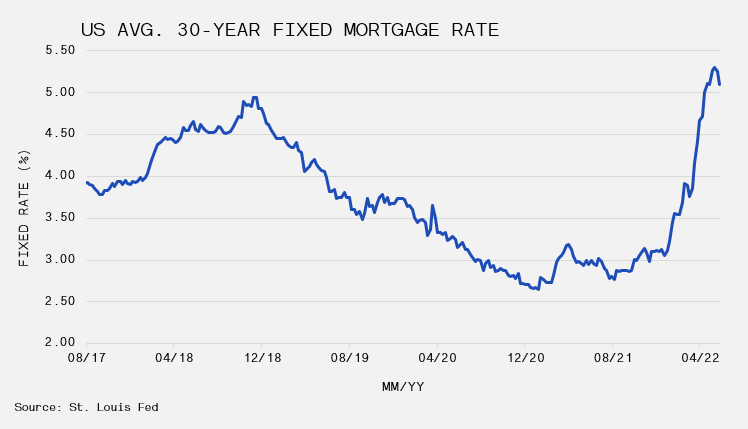

Consumer spending habits remain levered to the value of their home; as such, the prominence of price trends in the housing market cannot be overstated. With yields taking a pause, 30-year fixed rate mortgages in the US fell to 5.1% from 5.3% in mid-May, providing a much-needed pullback. Mortgage rates have risen rapidly since the start the year. This modest turnaround was well received as new home sales in April missed estimates by 21%., which pushed inventories higher by 8.3%. The housing picture remains bullish from a demographic’s perspective but expanding supply will weigh on the outlook. Homebuilders welcomed the rate pullback, as iShares US Home Construction ETF rose 6% in May, helping to trim the 32% drop to start the year.

May 01, 2022

Changes in Player Compensation

Smart Money

In July 2020, the NHL and the NHLPA agreed on an extension of the Collective Bargaining Agreement (CBA). The settlement added six seasons to the existing terms and promised hockey fans uninterrupted action through 2025-26. The extension provided players with increased visibility on salary figures, which include items such as entry-level contracts, individual/team bonus amounts, salary...

In July 2020, the NHL and the NHLPA agreed on an extension of the Collective Bargaining Agreement (CBA). The settlement added six seasons to the existing terms and promised hockey fans uninterrupted action through 2025-26. The extension provided players with increased visibility on salary figures, which include items such as entry-level contracts, individual/team bonus amounts, salary limits and, most notably, escrow withholdings. Click the link below to review upcoming changes!

April 28, 2022

Markets Bruised After Brutal April

Market Recap & Boxscore

Last month’s rally in equity markets quickly faded in April as aggressive and persistent selling led the S&P 500 and MSCI World indexes to declines of 7%. Even the TSX, which has defied gravity in 2022, fell 4.3%. Under the hood, the flight to safety accelerated with markets favouring staples, real estate and utilities, while selling discretionary, technology and financials. Unlik...

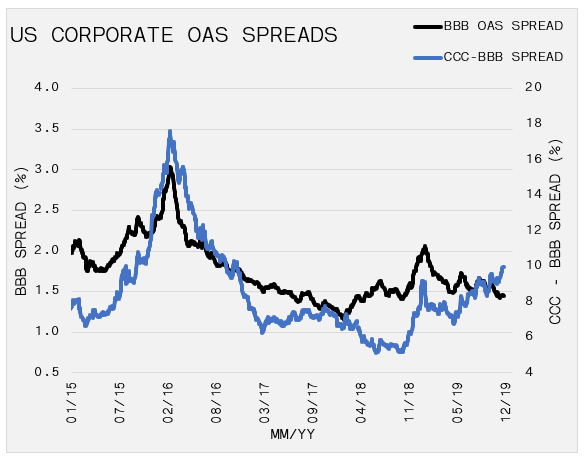

Last month’s rally in equity markets quickly faded in April as aggressive and persistent selling led the S&P 500 and MSCI World indexes to declines of 7%. Even the TSX, which has defied gravity in 2022, fell 4.3%. Under the hood, the flight to safety accelerated with markets favouring staples, real estate and utilities, while selling discretionary, technology and financials. Unlike earlier in the year, downside participation by large cap Generals contributed to the weakness during the period. Index-dominating names like Google and Apple crumbled over 16% and 8%, respectively. We always keep a close eye on credit markets to confirm a move in equities. Yields across corporate bonds persistently marched higher, and spreads, as measured by the BofA US High Yield Index OAS, rose 51bps to 3.89%. The trend in credit spreads is notable, but we are not yet at levels of excess stress.

Commodities did not cooperate with the decisive downward moves in equities and bonds. The results were mixed across the broad asset class, but collectively their winning streak extended for a fifth month. Gold head-faked another breakout, turning around and ending down 3.1% for the month. Oil swung for the fences, reaching +15% before settling at a 5.1% boost. Elsewhere, natural gas resumed its levitation trick, rising 23.4% as abnormally cold weather and supply issues emanating from Europe pressured supply. The agricultural commodities were positive as drought concerns and early indications of poor crop quality in the US led to gains of about 7% across the complex.

The uninterrupted upward move in bond yields carried on in April. The US 10-year yield increased 50bps to 2.86%; 2-year yields rose 33bps to 2.64% – an indication that an aggressive Fed will persist throughout 2022 and 2023. Equity drawdowns are logical given experience during periods of heightened economic uncertainly but the degree of weakness in the bond market has few comparables. The Bloomberg Aggregate Bond Index has slumped almost 9%. In fact, one would have visit the late 1970s to find a comparable decline for the index.

The U.S. Dollar continues to be a global wrecking ball in currency markets. The DXY strength was previously a function of its heavy weighting to EUR and JPY which were both faltering. However, in April even the mighty Canadian dollar fell 2.3% while the British pound fell 5.2%. Both the USD and yields have an outsized impact on corporate profitability so these factors will become more prominent in the evaluation of future earnings.

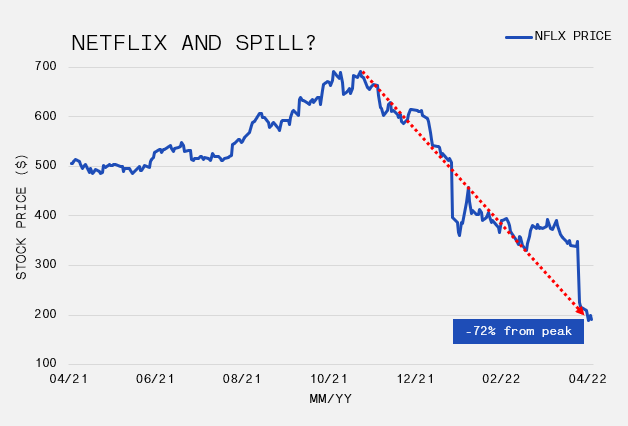

With a new quarter came the start of Q1 earnings season, and so far on aggregate we are seeing results that leave something to be desired. Probably the biggest surprise were the results from Netflix, which left the stock down 35% on earnings day, about 50% for the month and over 70% from its peak in November 2021. The carnage occurred despite beating on earnings and matching revenue expectations. However, investors keyed-in on a drop in global paid streaming subscribers as a sign of competition eating into the aggressive growth expectations that were baked into the stock’s price.

From a macro perspective, US GDP came in well below the estimated 1% growth rate in Q1, falling 1.4%. Upon further investigation, there are some positive signs of economic resilience. First, consumer and business spending remained robust, but this demand was satisfied through imports rather than domestically, while at the same time exports globally contracted. Second, government spending fell 2.7%. The question now will be whether the Fed will use this as an excuse to walk back some of their hawkish talk from May. Or, will they look through the weak headline number and reference the underlying positivity as a reason to continue their tightening program? With equities rising following the news release and yields remaining stubbornly high, it seems bond and stock markets are predicting different outcomes.

April 01, 2022

The Wall of Worry, Is It Different This Time?

First Quarter 2022 Newsletter

Bonds Face Worse Start to Calendar Year – March helped pull U.S. equity indices out of correction territory, defined as a peak-to-trough decline of more than 20%, as risk assets rebounded from a difficult start to the year. The key themes that dominated the market during the first quarter were inflation, rising rates and the conflict between Russia and Ukraine. With U.S. CPI reaching ...

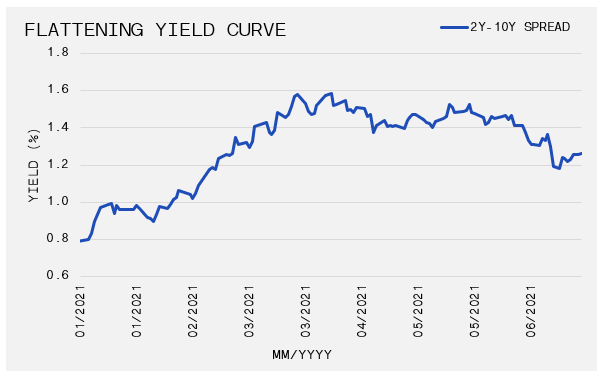

Bonds Face Worse Start to Calendar Year – March helped pull U.S. equity indices out of correction territory, defined as a peak-to-trough decline of more than 20%, as risk assets rebounded from a difficult start to the year. The key themes that dominated the market during the first quarter were inflation, rising rates and the conflict between Russia and Ukraine. With U.S. CPI reaching 7.5% and European inflation touching 5.8%, there is strong pressure for the Fed and ECB to tighten monetary policy, through higher interest rates mainly. While raising rates can keep inflation under control in a growing economy, today’s situation is less certain. Inflation appears to be increasing as a result of excess liquidity, supply chain disruptions and inadequate capital expenditures. Furthermore, the yield curve (interest rates over different time periods) has already flattened, which has in the past been a good predictor of a coming growth slowdown or even a recession.

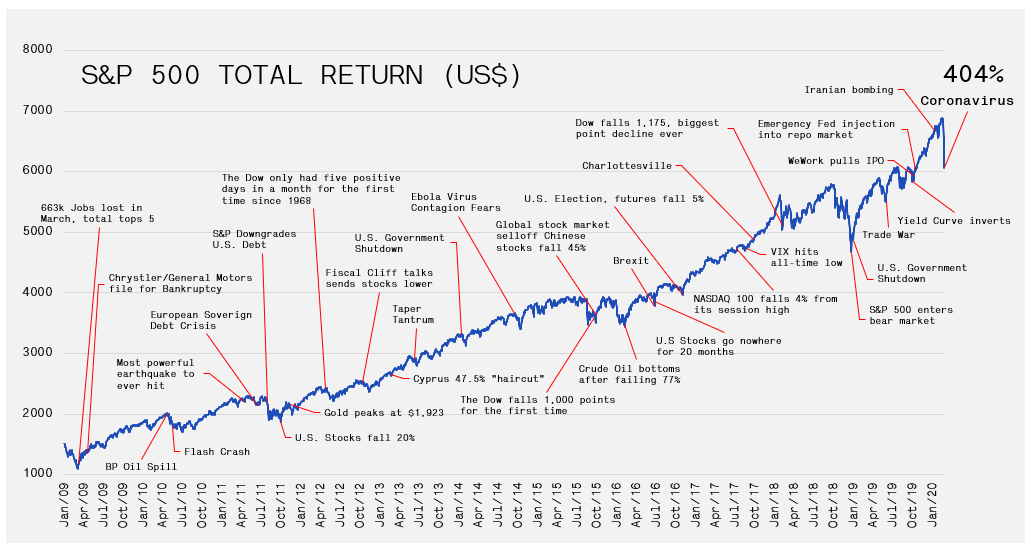

The Wall of Worry, Is It Different This Time? – There are no shortages of bearish narratives these days in global markets. The central banks raising short-term interest rates to combat inflation, the very sad news of war in Ukraine, continued lockdowns in China and the flattening yield curve makes it difficult to maintain a positive outlook. Sentiment certainly reflects this with the AAII Investor Sentiment Survey showing optimism among individual investors falling to a level not seen in nearly 30 years. Positioning is also beginning to echo sentiment with Large and Small Traders lowering their exposures. This combination has placed the market at an interesting juncture.

With inflation hitting the wallets of consumers around the world, Central Banks use rate increases to combat inflation. In theory, rate increases should slow demand as borrowing costs increase. Thus less discretionary spending occurs. This in turn slows the economy, particularly in the U.S. where consumption makes up the lion’s share of gross domestic product. A bit surprising, is the fact that stocks typically perform reasonable during the rate increase cycle. Over the last 12 rate hike cycles, Truist Advisory Services found the S&P500 posted a total return at an averaged annualized rate of 9.4%, showing positive returns in 11 of those periods.

This cycle naturally has its own nuances, in addition to having just injected the economy with the most capital ever outside of the World Wars, the world now faces the possibility of energy and food shortages due to the war in Ukraine. Higher energy prices played a significant role in the 2008 recession with prices going parabolic. Higher hydrocarbon prices not only impact corporate margins through raw material prices, it also slows demand for travel. But it is not just higher input costs crimping margins, wages are increasing as corporations attempt to lure people back into the job market. Declining margins have historically led to lower valuations.

A zero COVID policy continues to be implemented in China. The difficulty of managing locking down cities with 26 million people has become more evident as there are reports of food shortages and riots. Here in North America, supply chains are facing their largest challenges to date as factories and ports in China are shut down. This is coming at a time of already slowing earnings growth and putting further pressure on margins. The most severe of the impacts will begin to take place during the second quarter and extend for six to 9 months.

The yield curve, which maps the interest rate over different durations, has already inverted. This has a history of occurring just prior to recessions. While equities have indeed been spooked by the flattening, there are structural forces at play in the market causing yields to spike, particularly on the short end. With sentiment recognizing this, we anticipate a number of sharp rallies as volatility will remain high. During the 2000 bear market, there were 16 rallies by the NASDAQ that were greater than 10%, averaging just over 22%.

Therefore, with news flow, economic data and forward indicators pointing to more market downside, our preference remains to seek out quality investments, while remaining nimble to capture sharp rallies.

March 31, 2022

Stocks Dragged From The Boneyard

Market Recap & Boxscore

“Beware the Ides of March” was meant to warn Julius Caesar of his eventual assassination in Shakespeare’s play. However, it was an appropriate warning for short sellers this year. Following an initial 4.6% drawdown to start March, the 15th of the month marked the beginning of an 11-day, 11.3% recovery in the S&P 500 to finish the period up 5.6%. The TSX was positive 4.4%, while th...

“Beware the Ides of March” was meant to warn Julius Caesar of his eventual assassination in Shakespeare’s play. However, it was an appropriate warning for short sellers this year. Following an initial 4.6% drawdown to start March, the 15th of the month marked the beginning of an 11-day, 11.3% recovery in the S&P 500 to finish the period up 5.6%. The TSX was positive 4.4%, while the MSCI World Index rose 4.9%.

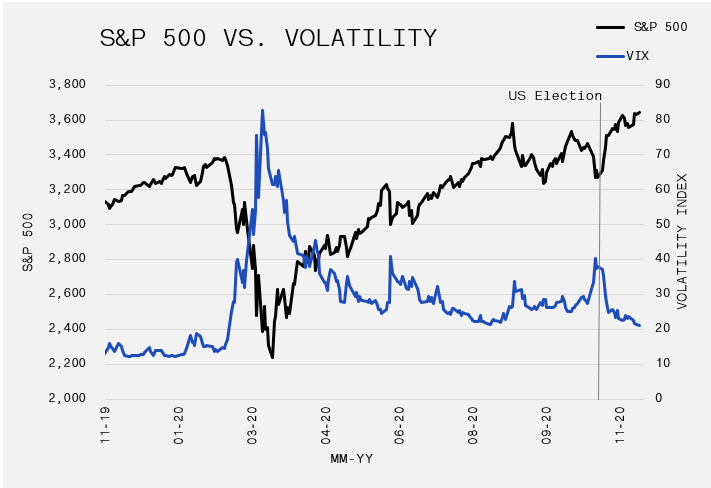

In early March, the VIX Index, which measures the stock market’s expectation of volatility, reached levels not hit since October 2020. The short-term outlook was forbidding given the situation in Ukraine, the beginning of the Fed’s hiking cycle and a quarterly options expiry. But, the flashpoint for a rebound often occurs when doubt is deepest. As time passed without a downside surprise, hedges were forced to unwind and a reflexive upward thrust was released, the likes of which we have not seen since the COVID lows.

Commodities extended their march higher, with the Bloomberg Commodities Index rising 9.6%, and 30% year-to-date. The combination of oil’s weight in the index and its 13.3% rise in March helped propel the gauge, but agricultural and metals are significant contributors due to the supply chain disruptions caused by Russia’s assault on Ukraine. The Canadian dollar’s ascent was unbroken, gaining 2.2%. The loonie is restoring its petro-dollar label after being essentially static when oil prices rose from US$65 to over US$100.

Outside of equities, action in the bond market remains volatile as the 10-year yield rose 53bps to 2.38%. The short end of the curve exhibited an even more dramatic move, with the 2-year rising 65bps to 2.35%, briefly flipping the difference between the 10-year and 2-year yield into negative territory. This negative yield curve is seen by many as a harbinger of recession due to its perfect track record since the 1980s, but as we’ve discussed numerous times the outlook was clear regardless of the inverted yield curve. With the nominal yield (2.38%) below the 10-year breakeven inflation (3%), the market was already pricing a growth slowdown over the next decade. With most of the action happening on the short-end, the market is declaring that an aggressive Fed will only accelerate the slowdown.

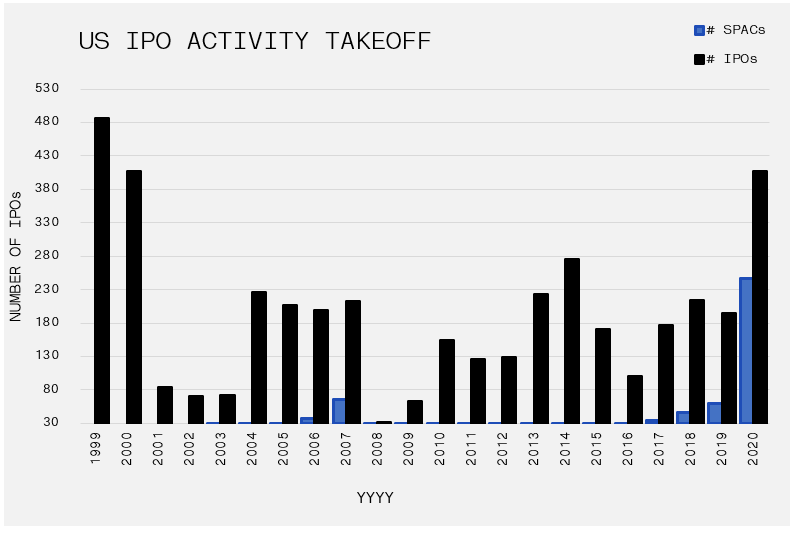

So, where does that leave us with the S&P 500 off 3.5% year-to-date? First, the bad news. Bonds are revealing that we’re likely to enter a recession in the next year. The Fed is intent on hiking into this downtrend, while commodities are gaining, employment is peaking, economic growth is cresting and the market is nearing all-time highs. However, the market doesn’t always reflect the economy, which was validated as recently as 2020. Opposing the bear view is the fact that economic growth and employment are strong, even if these are topping. Moreover, positioning among levered funds is now fairly tight after a deleveraging to start the year, real rates continue to be negative, indicating a loose environment, and most important, the recovery in risk assets despite a negative environment is indicative of a bull market. Finally, from a supply/demand picture, IPO supply is anticipated to be very low, while buybacks in the U.S. are currently approved at US$319 billion, compared to US$267 billion at the same point last year. Market pundits or news sources are too often pursued for forecasts and predictions, while the market’s ability to effectively price risk is regularly ignored. Currently, there is a wide range of uncertainty priced into the market. Accordingly, we respect the downside scenario, but also recognize that risk can be rewarded to the upside.

March 10, 2022

Ukraine & The Market Downturn

Interim Market Update

Russia’s military invasion of Ukraine is producing a humanitarian crisis and suffering that is drawing comparisons to the Second World War. The attachment below provides a modest perspective on the conflict and some guidance on the investing implications. Overall, it is critical to recall that equity markets delivered positive outcomes over 5-10 year holding periods despite combat in ...

Russia’s military invasion of Ukraine is producing a humanitarian crisis and suffering that is drawing comparisons to the Second World War. The attachment below provides a modest perspective on the conflict and some guidance on the investing implications. Overall, it is critical to recall that equity markets delivered positive outcomes over 5-10 year holding periods despite combat in Iraq, Korea and WWII. As always, we encourage you to reach out with any questions or comments.

February 28, 2022

What Is Up With Inflation?

Smart Money

Well before Russia’s shameful invasion of Ukraine caused oil and natural gas prices to spike, there was plenty of talk surrounding red hot inflation and its impact on consumers. In addition to its affect on the cost of living for individuals, investors are experiencing a variety of challenges when constructing their investment portfolios. Click the link below to learn about infl...

Well before Russia’s shameful invasion of Ukraine caused oil and natural gas prices to spike, there was plenty of talk surrounding red hot inflation and its impact on consumers. In addition to its affect on the cost of living for individuals, investors are experiencing a variety of challenges when constructing their investment portfolios. Click the link below to learn about inflation, how it has recently affected your outflows and how your portfolio should have been positioned.

February 25, 2022

“A Time for Iron Resolve”

Market Recap & Boxscore

Following January’s bout of volatility, February failed to provide any reprieve as markets continued to have difficulty pricing the risk of a more aggressive Fed. This, combined with Russia’s shameful invasion of Ukraine on 24-Feb-22 caused the S&P 500 to fall 3% during the month, marking an 8% decline year-to-date. The MSCI Index fell 2.4%, while the TSX’s exposure to energy and ...

Following January’s bout of volatility, February failed to provide any reprieve as markets continued to have difficulty pricing the risk of a more aggressive Fed. This, combined with Russia’s shameful invasion of Ukraine on 24-Feb-22 caused the S&P 500 to fall 3% during the month, marking an 8% decline year-to-date. The MSCI Index fell 2.4%, while the TSX’s exposure to energy and materials helped it remain flat for the period and just below break-even for the year. The unrest in Eastern Europe arrested the weakness in the U.S. Dollar and U.S. Treasuries, as investors flocked to the traditional safety of the world’s largest and most liquid economy. Nevertheless, the DXY was only flat for the month, and the 10-year yield rose 0.19%, down from 0.28% prior to Moscow’s attack.

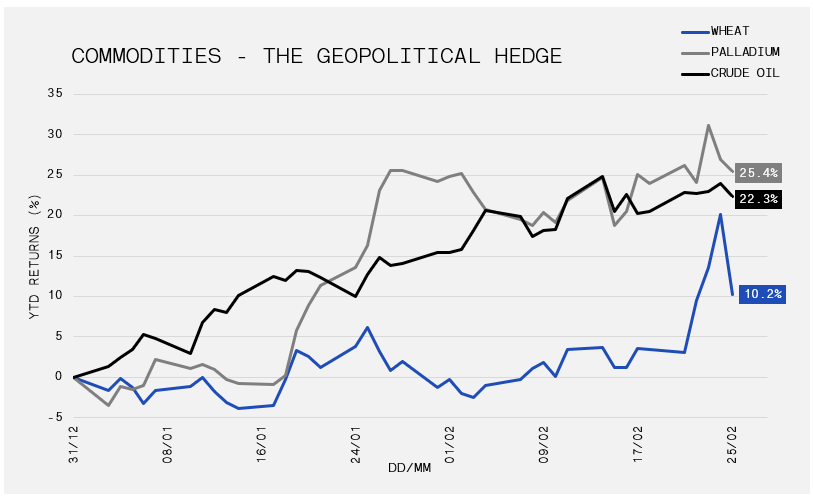

Commodities continued to catch a bid in February, no doubt fueled by tensions in Eastern Europe where either Russia or Ukraine are key suppliers of oil, natural gas, wheat and palladium. The implementation of economic sanctions on Russia including the removal of Russia and its major banks from the SWIFT network will inflame an already hot market. Simply put, the SWIFT network allows banks, including Russia’s central bank, to send and receive payments. These actions are designed to limit the flow of exports from Russia and to prevent Vladimir Putin from using $630 billion in central bank currency reserves to fund its war. Accordingly, the decline in Russia’s provisions will further stress the already undersupplied commodity market thereby pushing prices higher. The global consumer is already feeling the effects of a commodity bull market that began in mid-2020. Additional stress on the consumer is a major political risk in an economy that is starting to slowdown. This is a major predicament for global central banks. Tighter conditions are needed to cool demand and soften food and gas prices, but if they overreach, they could be inserting the equivalent of the 1995 New Jersey Devils’ Neutral Zone Trap into the economy. Will inflation surprise to the upside and force the Fed to tighten more aggressively? Or, will the geopolitical situation provide an out for the Fed to delay its hiking cycle?

Commentators, reporters and “experts” are rarely short on reasons for market movements. However, it is foolish to predict the outcome over the next 24 hours or the next week based on a news headline. For instance, the S&P 500 futures market was down 10% (month-to-date) after Putin announced that he ordered a special military operation in eastern Ukraine and missiles struck dozens of cities across the country. Since that low point, the market rallied 7% in two days. Rather than attempt to foretell the following week or month’s events, we can only offer that the confluence of factors will provide an environment of heightened volatility. Therefore, for markets, and more importantly the innocent lives in Ukraine, the absence of peace will create more uncertainty, fear and arbitrary outcomes. Additionally, a more involved NATO/U.S. could also increase the risk of a nuclear threat and the unknown consequences.

Looking forward to the upcoming month, all eyes were originally fixated on the Federal Reserves’ meeting in mid-March. The impact that commodity prices, in particular oil and agricultural products, were having on inflation were primary considerations for the launch of an interest rate tightening cycle. However, the geopolitical and humanitarian events associated with the Kremlin’s senseless aggression, have distracted people’s attention while also compounding the central banks predicament. At this point, and in most aspects of forecasting, we can only be certain of uncertainty.

January 31, 2022

Olympic Hockey Primer

Smart Money

When the NHL and NHLPA decided to abandon the 2022 Olympics, the tournament was drained of its star attractions like Connor McDavid, Auston Matthews, and Alexander Ovechkin. While hockey fans will not get the joy of watching a “best-on-best” clash in Beijing, it will be an exciting competition featuring a mixture of young players and veterans who are inspired to play in a showcase tha...

When the NHL and NHLPA decided to abandon the 2022 Olympics, the tournament was drained of its star attractions like Connor McDavid, Auston Matthews, and Alexander Ovechkin. While hockey fans will not get the joy of watching a “best-on-best” clash in Beijing, it will be an exciting competition featuring a mixture of young players and veterans who are inspired to play in a showcase that was otherwise elusive. Click the link below to see a brief tournament primer for the men and women, including the leagues that are represented, age breakdowns and gold medal betting odds.

January 28, 2022

When The Tide Goes Out

Market Recap & Boxscore

Following an incredible 27% rise in 2021, the S&P 500 started 2022 by heading in the opposite direction. The index fell over 10% in January, but as of 28-Jan-22, it had settled at losses just north of 8%, similar to the global (MSCI World) benchmark. The TSX faired better, sliding just 3%, due to its heavy allocation to sector leaders, Energy and Financials. The major event this m...

Following an incredible 27% rise in 2021, the S&P 500 started 2022 by heading in the opposite direction. The index fell over 10% in January, but as of 28-Jan-22, it had settled at losses just north of 8%, similar to the global (MSCI World) benchmark. The TSX faired better, sliding just 3%, due to its heavy allocation to sector leaders, Energy and Financials.

The major event this month was the U.S. Federal Reserve meeting on 25-Jan-22, where Governor Powell followed up a fairly muted Fed Statement with a very hawkish Q&A session, in which he pointed to a better-than-expected employment situation and above-average inflation as reasons to start hiking rates and tapering QE. The market was positioned for the hawkish tone, as participants were buying volatility protection. However, traders clearly underestimated the risk of an accelerated tightening in a potentially slowing economy.

Oil’s continued strength (+16% month-to-date as of 28-Jan-22) did nothing to temper investor worries around inflation and its influence on the Fed. The stress was evident on the short-end of the U.S. yield curve, as the 2-year yield rose aggressively from 0.73% to 1.18%. This movement implies six rate increases by the end of 2023. Economic growth in the first half of 2022 will surely show a slower pace than the above average levels reported in the first half of 2021. As such, tightening monetary policy into an economy that is losing speed, will hurt equity performance. Accordingly, inflation will be closely monitored for insight into the Fed’s actions.

On the long-end of the yield curve, bonds have not provided the cushion for equity weakness to which investors have become accustomed. The Barclays Aggregate Bond Index fell over 2% as the 10-year yield rose. In general, long-term yields fall when the short-end increases. Long bond rates are typically priced off the combination of growth and inflation. Consequently, tightening monetary conditions are negative for growth rates and inflation rates; thereby, causing long-term yields to fall. As such, it is noteworthy that short-term yields and long-term yields moved upwards together this month. One explanation for rising long-term yields is the sensitive supply-demand outlook for long-term Treasury Bonds. The Fed is scheduled to reduce its monthly purchases of Treasury Bonds and the absence of its bid from the market will put downward pressure on prices, causing yields to rise.

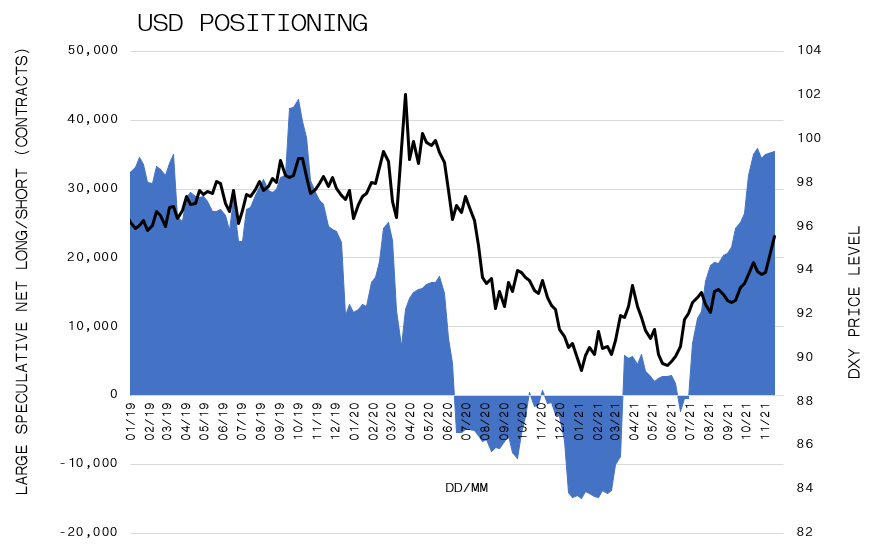

The U.S. dollar, as measured by DXY, rose 1.2% during the period and soared almost 3% from its January low. Naturally, if the market is expecting a more aggressive Fed, especially against a more dovish ECB and Bank of Canada, one would expect the U.S. dollar to rise. However, this hypothesis is not that reliable. Since 1977, the Fed has attempted to increase rates on five separate occasions. On two occasions (1977-1980 and 2015-2018), the dollar ended the cycle at a similar level to where it started. In the remaining three periods, the U.S. dollar sunk between 10% and 15%. Hence, the strength of the U.S. dollar may be closer to its peak; and conceivably, the crowded long positioning in the Greenback is supportive of its cresting popularity.

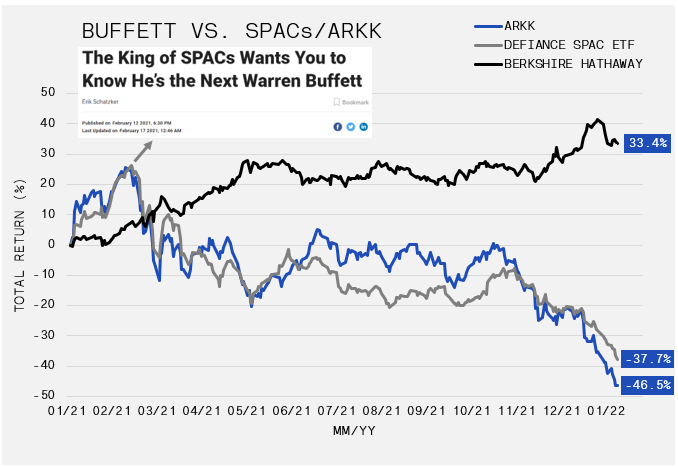

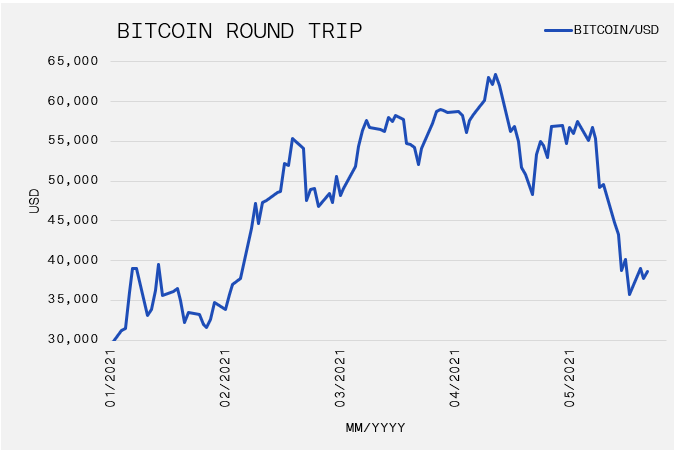

Warren Buffett has a famous quote that reads “only when the tide goes out do you discover who has been swimming naked.” The past twelve months have provided an opportunity to understand its pertinence. Following a terrific year for growth and technology stocks, 2021 started brilliantly as gains compounded with the monumental performance of meme stocks and SPACs. Many were once again questioning Mr. Buffett’s ability to navigate markets in a new tech-driven world, pointing to newly minted leaders like Cathy Wood and Chamath Palihapitiya as the new age. The chart that follows reveals the performance of Berkshire Hathaway (Warren Buffet) versus ARK Innovation ETF (Cathy Wood) and Defiance Next Gen SPAC Derived ETF. No further commentary is necessary.

January 03, 2022

All (Bumpy) Roads Lead to Equities

Fourth Quarter 2021 Newsletter

Stocks Stage Year-end Upswing – Large-capitalization US and Canadian stocks staged a year-end upswing, underpinning a strong quarter, and year, for North American equities. The fourth quarter opened with the passage of the bipartisan Infrastructure and Jobs Act that sent risk assets higher. The momentum stalled, albeit temporarily, in late November by fears surrounding Omicron (COVID-...

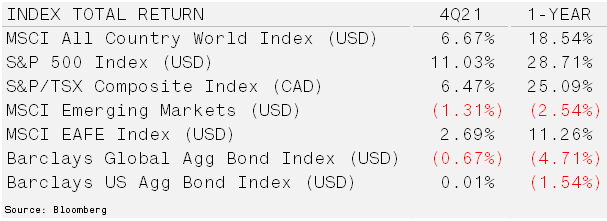

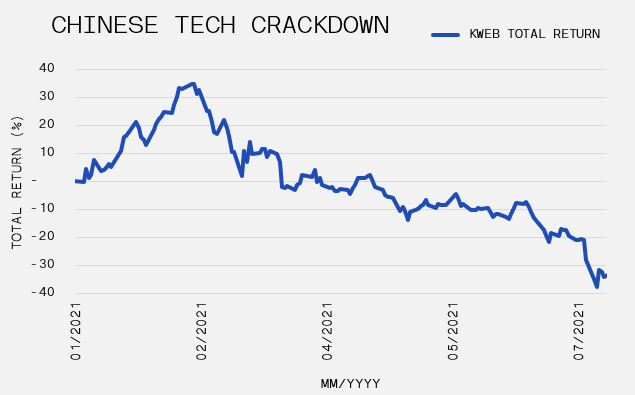

Stocks Stage Year-end Upswing – Large-capitalization US and Canadian stocks staged a year-end upswing, underpinning a strong quarter, and year, for North American equities. The fourth quarter opened with the passage of the bipartisan Infrastructure and Jobs Act that sent risk assets higher. The momentum stalled, albeit temporarily, in late November by fears surrounding Omicron (COVID-19 variant). At the same time, inflation prints crossed 6% for the first time since 1990 forcing the Federal Reserve to walk back its use of “transitory inflation”. Eventually, most markets climbed the “Wall of Worry”. The most significant deviation came from China which suffered from stringent COVID policies that exacerbated an economic slowdown.

Bonds finished the quarter flat. However, most sovereign debt instruments had losses in 2021 as yields moved higher. Yield curves flattened, with short-dated bonds hit as central banks turned more hawkish. The US 2-year yield increased from 0.28% to 0.73% during the fourth quarter.

All (Bumpy) Roads Lead to Equities – Financial journalists often glorify markets, emphasizing the extreme moves over long timeframes as though it was an effortless journey. Often lost in stargazing at historical charts is that it is seldom a straight line, there are many head-fakes in either direction and markets often consolidate – neither continuing the existing trend nor veering along a new path. Our expectation for 2022 is for volatility to highlight the difficult path in staying the course, testing investor patience often.

The pace of growth for the world economy appears to be slowing despite a few tailwinds. The bond market is picking up on this, with the yield curve flattening along with slowing ISM readings, job creation and other economic indicators. Lapping difficult year-over-year comparisons in the first half the year, it is likely to lead to a challenging backdrop for equities.

The handling of the COVID crisis has resulted in rising dissatisfaction with political leaders. Citizens in an increasing number of countries are pushing back on restrictions and rejecting leadership by (or for) the elite class. It is unlikely coincidental that this is occurring with inflation readings at multi-decade highs, December CPI was 7%. Inflation is often the tipping point (see Tiananmen Square and The Arab Spring) for uprisings.

Structural headwinds have not gone away for most major economies. Unfavorable demographics, excessive debt and regulation have crimped growth for much of the recovery since 2009 and these issues remain. The US Federal Reserve certainly is not oblivious to this fact and has attempted to “let the economy run hot”. However, the market now appears to be pushing back, pricing in four rate hikes and lifting commodity prices further despite economic indicators rolling over. A moderation in commodity prices would suggest the December CPI was the top for this cycle. However, this has not occurred. Moreover, net long positions in the US dollar imply that meaningfully more support for the greenback is not on the horizon. A stronger US dollar would slow commodity prices.

With this as the backdrop coming into 2022, We have become more constructive on quality and interest rate sensitive investments. To make room, commodity positions have been reduced along with small capitalization names. Gold remains a healthy position and should perform well with declining nominal yields, unstable equity prices or geopolitical unrest (Russia/Ukraine or China/Taiwan).

Four Federal Reserve rate hikes are currently priced-in to the markets. However, the tightening cycle could intensify the economic slowdown and impair equity performance. This would likely force the Fed to depart from their plan. The contrary view is that the cycle will remain in force as COVID restrictions and supply chain bottlenecks diminish. As we get deeper into 2022, year over year economic comparisons ease. With growth stocks feeling the brunt of the recent sell-off, our focus will turn to quality names within this style group.

December 23, 2021

The NFT Mania

Smart Money

A new type of digital asset exploded in popularity in 2021 – NFTs or “non-fungible tokens”. Examples of NFTs range from digital artwork and sports cards to pieces of land in virtual environments. Enthusiasts and investors have allegedly spent $22 billion in this rapidly expanding market. Check out our video summarizing the new asset and its developing role in the sports world.

December 22, 2021

Choppy Markets Scramble to the Finish Line

Market Recap & Boxscore

As of 22-Dec-21, equity markets delivered positive returns during the final month of 2021. The US benchmark (S&P500) was positive 2.84%, the S&P/TSX and MSCI World Index followed with gains in the 2% range. The upbeat results concealed significant volatility that arose through three primary sources; (i) the Fed met on 14-Dec-21 and announced an accelerated taper of bond purcha...

As of 22-Dec-21, equity markets delivered positive returns during the final month of 2021. The US benchmark (S&P500) was positive 2.84%, the S&P/TSX and MSCI World Index followed with gains in the 2% range. The upbeat results concealed significant volatility that arose through three primary sources; (i) the Fed met on 14-Dec-21 and announced an accelerated taper of bond purchases while also expanding the forecast for interest rate increases from two to three in 2022; (ii) the expiry of both options and futures positions on Friday (17-Dec-21); and, (iii) the aggressive spread of the current Omicron variant, which re-introduced numerous shutdowns and travel restrictions globally.

Often key events like (i) and (ii), especially when occurring simultaneously, will cause widespread market participants to hedge possible declines. This in turn has the potential to cause a positive feedback loop because dealers typically adjust their offsetting positions by selling the underlying asset after its price falls. The combination of these events along with renewed COVID-19 fears caused the S&P500 to lose over 3% during the six trading days between 13-Dec-21 and 20-Dec-21. However, when the event for which protection was sought is determined to be less treacherous, the subsequent covering of the original hedges often pushes prices upwards. Consequently, the 3% loss was essentially erased by the profits registered on the 21st and 22nd.

The yield curve flattened leading up to the Christmas break. Following the Fed’s announcement that an additional interest hike should be anticipated in 2022, the 2-year yield remained slightly below the peak (0.69%) touched in early December. This is an indication that the aggressive increase in yield since June (from below 0.15%) may have tired. Concurrently, the 10-year yield has settled at about 1.45%, quite a distance from the 1.67% print in late November. The 10-year continues to trade toward the lower end of its up-trend since August. If a breakdown occurs in the first quarter of 2022, this will potentially indicate that the market has lost confidence in the prospects for economic growth or possibly that inflation fears have been extinguished.

On the commodity front, gold caught a bid as nominal yields fell, rising 1.87% in December. Nevertheless, the price remains in the middle of its 2021 trading range. If long yields break down and growth slows into 2022, the shiny metal may have the flight for which so many have hoped. Oil reversed its November weakness, with WTI increasing 2.2% in December, though it remains 13% off its October highs. Finally, the USD, as measured by the DXY, was flat during the month, though it did rise 0.8% against CAD.

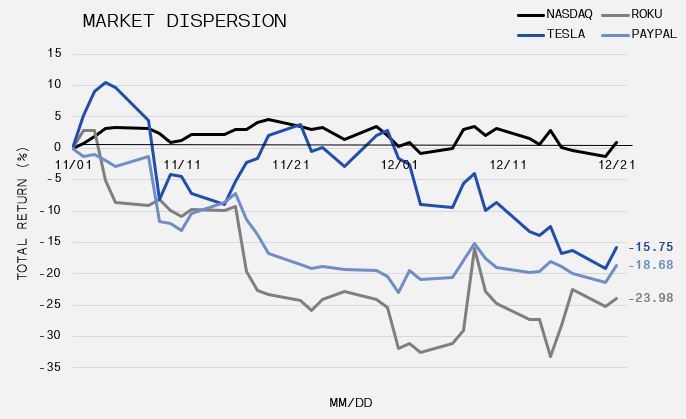

The TSX’s underperformance relative to the S&P500 since mid-November speaks to many factors playing into markets globally. The TSX is about 3% below its high point for the year reached on 12-Nov-21, while the S&P has gained about 1% during the same period. However, each benchmark’s composition provides insight into the return dispersion. The TSX’s top holdings are represented by Shopify, Canadian National Railways, Enbridge and the large banks. Meanwhile, The S&P largest weights are all technology-focused giants; Apple, Microsoft, Amazon, Alphabet (Google), Nvidia and Meta Platforms (Facebook). The performance of these behemoths conceals the struggles of the stocks beneath the largest weights. The accompanying chart discloses this phenomenon by demonstrating how the NASDAQ appears resilient while other prominent names have been battered since 01-Nov-21. Similarly, on 07-Dec-21, Gavin Baker revealed on Twitter that NASDAQ’s mighty 21.2% gain for the year was reduced to only 5.8%, when Apple, Microsoft, Alphabet, Tesla and Nvidia, were excluded. Large cap dominance has been a common narrative since 2019, but as we gaze into 2022, the persistence of the trend will be closely examined. A horse can’t run with a wounded leg.

November 30, 2021

A Savvy Approach to Charitable Giving

Smart Money

Among professional athletes, hockey players are often viewed as philanthropic leaders. Take for instance the league-wide involvement in this past month’s Hockey Fights Cancer campaign, or the unrivaled participation in the always popular Movember competition. As the holiday season approaches, hockey players, like many others are reminded of their fortunate situations and the importanc...

Among professional athletes, hockey players are often viewed as philanthropic leaders. Take for instance the league-wide involvement in this past month’s Hockey Fights Cancer campaign, or the unrivaled participation in the always popular Movember competition. As the holiday season approaches, hockey players, like many others are reminded of their fortunate situations and the importance of supporting those less fortunate. Click the link below to learn more about the substantial and lasting impact you can have with the increasingly popular “Donor Advised Fund”.

November 29, 2021

Investors Reposition Assets To Hide From Omicron

Market Recap & Boxscore

Third quarter earning reports lifted equities early in the month until a violent selloff after Thanksgiving Day. For the period ending on 28-Nov-21, the S&P 500 gained 0.9%, while the TSX grinded out a small 0.3% gain as Energy took a breather. The MSCI World Index was the laggard, dropping 1.1% as European weakness led the drawdown. Germany’s DAX Index fell 2.5%. Certainly, the s...

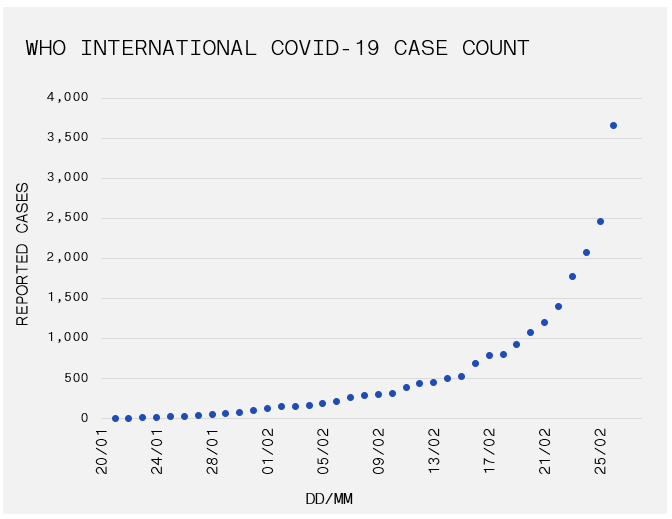

Third quarter earning reports lifted equities early in the month until a violent selloff after Thanksgiving Day. For the period ending on 28-Nov-21, the S&P 500 gained 0.9%, while the TSX grinded out a small 0.3% gain as Energy took a breather. The MSCI World Index was the laggard, dropping 1.1% as European weakness led the drawdown. Germany’s DAX Index fell 2.5%. Certainly, the situation with COVID-19 in Europe is much worse than North America. Many countries are recording case counts that far exceed the third wave data. Moreover, Austria and the Netherlands are entering another stage of restrictions and lockdowns.

U.S. stock benchmarks are often dominated by a relatively small number of companies or large cap tech leaders. The top ten positions in the S&P500 represent more than 30% of the capitalization. Predictably, when we look under the hood, we observe that there was limited participation in the uptrend that preceded Thanksgiving Day. Fewer and fewer US companies were trading above their 50-day moving average, which is typically a sign of market fragility. Similar to equities, high yield bonds faltered as month-end approached. The U.S. High Yield Options Adjusted Spread rose from 3.15% to 3.62%. The concentration of Energy issues within the High Yield universe had an outsized impact, but the 3.62% yield is the highest level since March 2021. Access to capital and liquidity have a considerable influence on markets and the economy. The inability to raise money or if the cost to borrow becomes too expensive, businesses become less profitable and unable to expand their workforce, grow their product lines or invest in new opportunities. The current reading is in line with its long-term averages, so it is by no means a sign of long-term market stress – but the trend needs to be monitored.

The Friday after U.S. Thanksgiving is typically reserved for nursing hangovers and analyzing another Detroit Lions loss, but 2021 was different. While US investors still woke up to another Lions loss, there was also a sea of red across equity indices, commodities, and crypto. The Russell 2000 (small-cap stock market index) led the way down, losing 3.7%, while S&P 500 and Nasdaq fell 2.3% and 2.1%, respectively. News of a new COVID-19 variant, Omicron, triggered demand for large cap and tech-heavy indexes, while the reflation/re-opening sectors were shunned. Governments quickly enacted travel bans and momentum for additional lockdowns advanced across Europe and into North America, which caused oil to be the day’s biggest loser, down 12.0%. US Bond performance was equally volatile, with the long-end serving as a flight to safety as the 10-year yield ended the day down from 1.636% to 1.482%. While this was one of the largest one-day moves in recent times, the action at the short-end was even more material as the 2-year yield fell from 0.644% to 0.508%. Yields on the short-end have been increasing aggressively since June as the market anticipated an accelerated pace of Fed tapering and interest hikes. The threat of COVID-induced slowdown obviously tempered these expectations.

Investor money flows and positioning shifted post-Thanksgiving, particularly in over-crowded areas like the Russell 2000, 10-Year U.S. Treasury Bond and the U.S. Dollar. Russell 2000 had recently become net long as speculators piled into the benchmark. Consequently, risk-takers quickly became sellers as the Omicron news circulated. Similarly, the 10-Year Bond was a popular position for short-sellers wishing to take advantage of the outlook for rising rates. These positions were quickly covered when growth prospects diminished. Most interestingly was the behaviour of the U.S Dollar. The greenback has been propelled higher by large speculator interest. The long position has not been this crowded since November 2019. Typically, when markets falter, investors engage in a flight to safety which causes the U.S. dollar to rise on risk-off days. However, the DXY (the index of the U.S. dollar relative to a basket of foreign currencies) fell 0.7%, a relatively large move down.

Looking out over the very short-term, governments’ response to the new variant and the scientific communities’ reaction to the mutation will likely dictate if investors exercise more traditional re-balancing into year-end or if the Thanksgiving selloff was the onset of a more meaningful correction.

October 31, 2021

The Big Four: Bigger, Stronger, Wealthier (?)

Smart Money

The total value of the global sports market is estimated to be greater than $600-billion, making it among the most lucrative entertainment industries in the world. Specifically, North America’s professional sports revolve around its four major leagues; the NFL, NBA, MLB, and NHL. As each league looks to rebound after an impactful pandemic, GAVIN has reviewed their revenue, growth and ...

The total value of the global sports market is estimated to be greater than $600-billion, making it among the most lucrative entertainment industries in the world. Specifically, North America’s professional sports revolve around its four major leagues; the NFL, NBA, MLB, and NHL. As each league looks to rebound after an impactful pandemic, GAVIN has reviewed their revenue, growth and value, in addition to future plans to aid their recoveries.

October 28, 2021

The company formerly known as Facebook falters while markets rally

Market Recap & Boxscore

Markets re-established their 2021 uptrend in October, led by the S&P 500 Index, rising 5.2%, as of 27-Oct-21, as it hit a new all-time high. The TSX Index was not far behind, as strength in energy and financials contributed to a 5.1% gain for the month. The MSCI World Index lagged but still managed to pop 4.6% during the month. Commodities continued to march higher, with the CRB C...

Markets re-established their 2021 uptrend in October, led by the S&P 500 Index, rising 5.2%, as of 27-Oct-21, as it hit a new all-time high. The TSX Index was not far behind, as strength in energy and financials contributed to a 5.1% gain for the month. The MSCI World Index lagged but still managed to pop 4.6% during the month. Commodities continued to march higher, with the CRB Commodities Index climbing 4.0%. WTI Oil surged 11.2% and breached $85 for its first time since 2014. Rates initially appeared to extend its uptrend, with the 10-year U.S. Treasury yield rising from 1.52% to 1.70%, but a late rally in bonds helped bring the long-end back down to even. This event similarly reversed some of the small cap outperformance over technology that started the month. Gold rose 3.4% and continues to be range-bound.

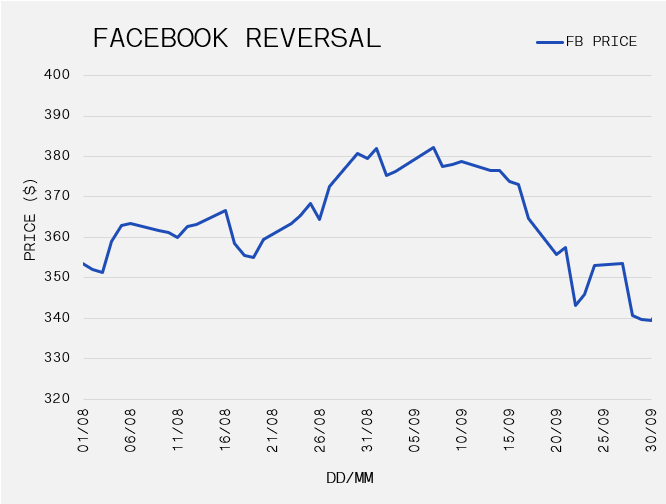

It was interesting to observe the aggressive moves in stock benchmarks without corresponding strength in the FAANG names. The only name to outperform the S&P amongst the five was Netflix, posting a 12.7% gain in October on strong earnings and subscriber growth which beat analyst expectations. (Thank you, Squid Game!). The biggest laggard of the group continues to be Facebook, down 10.9% in October and 14.8% over the last three months. There has been no shortage of narratives to justify the fall, and likely much of this started back in April when Apple announced iPhone privacy changes that would prevent advertisers from tracking iPhone users without their consent. It is no secret that FB’s bread and butter has been their ability to track and personalize advertisements, and without the ability to do so, the appeal of FB for marketing spend has subsided. Their third quarter results showed the company missed expectations on advertising performance. Further, FB announced a massive capital spending program to fund growth initiatives like AR/VR and their foray into the metaverse, which starts to introduce some thesis creep into the bull case. It is worth noting that supply chain issues are also potentially affecting the company’s results. There is less incentives for product vendors to spend on advertising without goods to sell. In any case, doubts about FB’s growth forecasts are certainly emerging.

The third quarter earning season has begun and the market’s reaction to the reported results has been noteworthy. A selloff in the reporting company’s stock price has largely been the outcome even for those who beat expectations. While the bull trend remains intact, we will be monitoring a couple of factors to gauge the rally’s vigour; (1) the relative strength of large cap tech, and (2) if price momentum fades despite top and bottom-line results that substantially beat expectations.

Rates and inflation remain top of mind for investors. Globally, long-term yields have risen and breakeven inflation rates have moved to levels not seen since we exited the Global Financial Crisis. Accordingly, the U.S. Federal Reserve’s actions will garner massive attention. Decision makers greeted early signs of inflation from November 2020 through to mid-2021 with confidence that price increases were transient. However, more recently, commentary suggests that secular inflation fears are mounting. Meanwhile, the Bank of Canada cited “higher energy prices and pandemic-related supply bottlenecks now appear stronger and more persistent than expected.” As a result, they declared their intention to start lifting rates quicker than anticipated. The Bank is also ending its QE program which originally purchased C$5 billion of government bonds per week. The challenge for policy makers and investors is to process the sustainability of better-than-expected growth with higher-than-expected prices.

October 15, 2021

Real Estate as an Asset Class

Third Quarter 2021 Newsletter

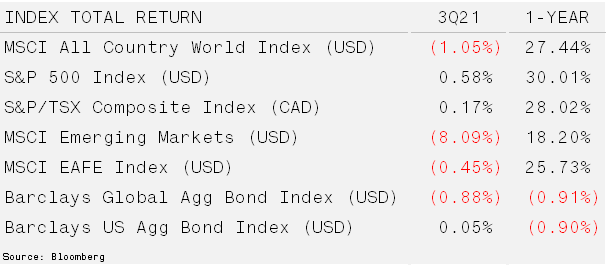

September Effect Hits Equities – North American equities were mixed for the third quarter, giving back most of their gains in September. The S&P 500 was the leader for the quarter with emerging markets struggling mightily as China slowed and global COVID case counts increased. The often-discussed September Effect caught up with equities. Since 1929 the S&P 500 has lost 1.0% on...

September Effect Hits Equities – North American equities were mixed for the third quarter, giving back most of their gains in September. The S&P 500 was the leader for the quarter with emerging markets struggling mightily as China slowed and global COVID case counts increased. The often-discussed September Effect caught up with equities. Since 1929 the S&P 500 has lost 1.0% on average during September versus a +0.8% for all the other months.

Bonds also gave investors something to worry about as equity market weakness coincided with bond price declines. After falling to a closing low of 1.17% in August, the US 10-year Treasury yield finished the quarter at 1.49%. Despite a rising US dollar, crude prices made their way back to cycle highs also by quarter end. Rising yields and commodity prices are following inflation numbers higher which is happening across the globe.

Investment Opportunities Within Real Estate – The global real estate market can be classified into two broad categories: residential, where lots or dwelling units are owned, and commercial, which are income generating assets. Commercial real estate includes offices, industrial, healthcare, retail centers, hotels and multifamily rental apartment properties. Other forms of real estate-related investments are real estate-intensive operating companies, real estate investment trusts, loan pools and real estate debt. Investors exploring opportunities in the asset class have many options that offer a range of benefits and risk-return profiles.

Some of the benefits of investing in real estate include attractive total returns, portfolio diversification, inflation hedges and downside protection. The necessity function of real estate creates consistent cash flows that often lead to strong returns. According to the NCREIF Property Index, returns for real estate over the last 15 years were 6.85% annually versus 10.5% for the S&P 500. While these figures may surprise investors, the diversification and inflation benefit of real estate investing make it an attractive asset class for all types of investors.

Real estate, specifically private real estate, has historically displayed low correlation relative to stocks and bonds. Furthermore, as a real asset, property markets typically rise in inflationary periods. This is particularly true for short-term lease contracts as rent resets can be negotiated more often. Public storage is an example of a short-duration lease because rental contracts are typically monthly.

While fiduciaries and institutional investors are aware of the diversification and inflation protection benefits of real estate, most investors are attracted to the return potential. As previously illustrated, the returns are misleading, which is due to the use of leverage. As a large, mostly stable asset, lending is required and accepted widely. Therefore, when appreciation occurs, the benefits to equity can be significant. For example, if a $1,000,000 home appreciates at the average NCREIF Property Index rate of 6.85%, it’s leveraged return jumps to 11.42% if it carries a reasonable 40% mortgage.

Avenues to invest in real estate include both debt and equity (ownership) opportunities across private and public markets. The most common equity investment option, also the most liquid, is the real estate investment trusts (REITs). These are often diversified, well-capitalized properties that generate cash flow that is passed on to investors. The downside of this option is the high correlation to traditional equities. On the other side of the liquidity and correlation spectrum is direct investments. The challenge with this strategy is that it requires on-the-ground personnel in target markets and in-depth knowledge of regulations, deal flow and access to capital. A good middle ground that investors are often unaware of is through private real estate investment funds. This strategy can provide slightly more liquidity than direct holdings and it requires far less expertise of the asset. To ensure professional assessments and/or opportunities are maintained a portion of the return is foregone as a service.

Real estate investing has produced solid returns for investors as interest rates have fallen for nearly 30 years. This remains the number one driver for the asset class as a whole. Returns however should be viewed through an unlevered lens (take away leverage) and for most investors, retaining experts to assess the merits of local markets is a good risk mitigation strategy to protect capital. Our partners remain steadfast and operate in growing, diverse economies for our commercial investments while diversification is enhanced through our farmland allocation.

September 30, 2021

NHL Pre-Season Primer 2021-22

Smart Money

To ensure a player is financially prepared for the upcoming season, GAVIN updated its annual Pre-Season Primer. The exhibit provides current and relevant financial data for the upcoming season; including pay periods, escrow rates, income tax rates, NHL group benefits and retirement contributions. Check it by clicking the link below!

September 30, 2021

Stocks Slide in September as Supply Shortages Boost Oil & Gas

Market Recap & Boxscore

Stock markets were able to maintain their footing in August despite being temporarily shaken by volatility. However, September was a different story. The S&P 500 recorded its first negative month of 2021, dipping 4.76%. Canada faired better with oil and financials showing some strength, limiting the TSX decline to 2.5%. The MSCI World Index registered losses that mirrored the U...

Stock markets were able to maintain their footing in August despite being temporarily shaken by volatility. However, September was a different story. The S&P 500 recorded its first negative month of 2021, dipping 4.76%. Canada faired better with oil and financials showing some strength, limiting the TSX decline to 2.5%. The MSCI World Index registered losses that mirrored the US benchmark.

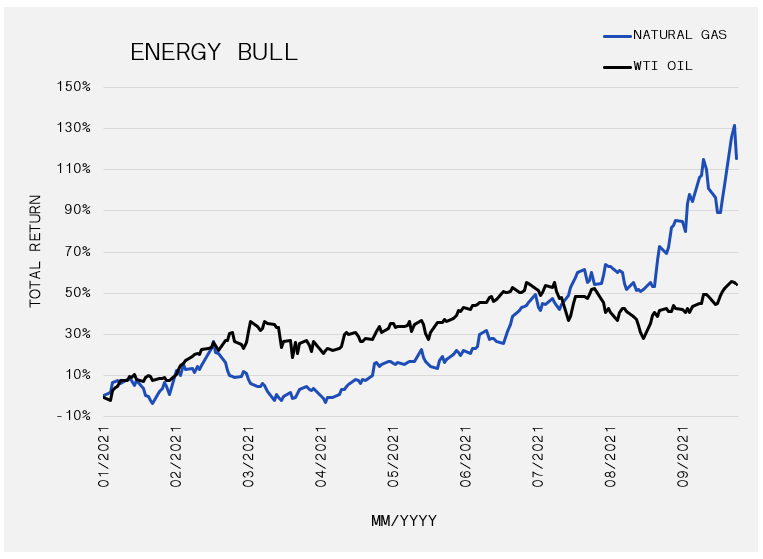

While equities were weak, commodities seemed to have re-ignited as the Bloomberg Commodity Index rose 3.6%. The energy complex paced gains with natural gas up 26.6% in September (up 105% YTD), and WTI crude oil posted a 9.8% jump, bringing its year-to-date vault to 44.3%. While US natural gas price gains have been impressive, the soaring prices across the pond are truly unprecedented. Dutch and UK natural gas prices reached an all time high on 27-Sep-21. Environmental regulations implemented years ago have severely impacted supply, the mandated switch from coal to natural gas has further stressed the situation and governments have not adequately adapted for the intermittency of renewable energy. Further, local supply constraints have been compounded by Russia curtailing distributions to Europe, while demand has also increased 7.6% in the first quarter of 2021. China has experienced similar energy dynamics. The combination of increased prices of coal and natural gas and capped carbon emissions have forced regulators to implement rolling brownouts across the country. At this point, many will hope to avoid a cold winter as any fundamental boost to demand can not be met in the current supply environment.

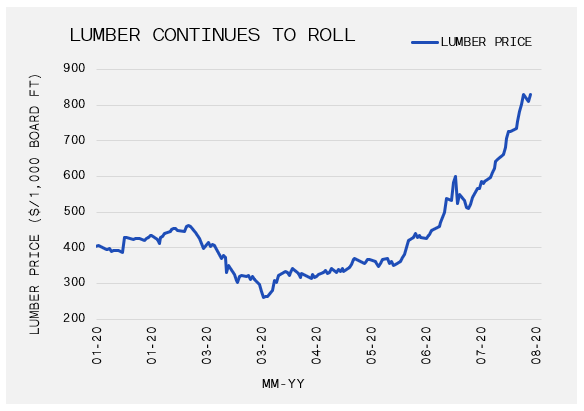

Outside of energy, grains bounced from its post-April lows, and even lumber, the star of the early 2021 commodity rally, woke up with a 23% leap in September. Counterintuitively, these gains were made while the U.S. Dollar (USD) broke above its 2021 high to advance 2.1%. Since commodities are generally priced in USD, they typically move in opposite directions.

Notably, in a risk-off backdrop, it is typical for the USD to rise when stocks fall. Commodities will also sink in this scenario. As such, the strength in the resource sector was uncharacteristic and it is potentially explained by Fed Reserve Chairman Powell’s comments about inflation and the timing of tapering. Tapering is the reduction in central bank asset purchases and it is positive for the US dollar and negative for equities. Meanwhile, the omission of “transitory” from the Federal Reserves meeting minutes, supports higher commodity prices.

Bond yields broke out to the upside in September. The U.S. Treasury 10 and 30-year yields rose 0.22% and 0.13%, to 1.50% and 2.05%, respectively. Some have tried to justify the rise in rates to the U.S. debt ceiling, which if triggered, would potentially lead to a default on their debt. Treasury Secretary Janet Yellen has told lawmakers the U.S. will not have money to pay its bills by about 18-Oct-21. However, if we zoom out, we see similar yield increases across Europe and even into Asia. If the US yield increase has anything to do with default, then likely this would be a more isolated event and not global in nature. Concurrently, equity leadership has shifted to businesses associated with the re-opening themes; such as Booking Holdings Inc., energy stocks, consumer discretionary companies and financial names. Perhaps these occurrences hint at a more robust economy as 2021 winds down and delta COVID case counts subside. Despite the September equity pessimism, in the absence of a surprise taper and/or Fed rate increase, we are not exceptionally concerned about sustained weakness in stocks to end the year.

September 02, 2021

Free Agent Frenzy?

Smart Money

With the expectation that the NHL’s salary cap will stagnate for the foreseeable future, players are adjusting to an uncertain free agent environment and management teams are assembling their rosters with a more resourceful and creative approach. To better understand how these developments are impacting the contracts offered to free agents, GAVIN examined the signings of all UFA and R...

With the expectation that the NHL’s salary cap will stagnate for the foreseeable future, players are adjusting to an uncertain free agent environment and management teams are assembling their rosters with a more resourceful and creative approach. To better understand how these developments are impacting the contracts offered to free agents, GAVIN examined the signings of all UFA and RFAs between 28-Jul-21 and 21-Aug-21.

September 01, 2021

Equity Markets Manage to Stay On Track

Market Recap & Boxscore

The S&P 500 rose 2.4% in August 2021. MSCI World and TSX also registered positive results, gaining 1.8% and 1.6%, respectively. Large capitalization companies have been carrying most of the weight over the past few months. As such, the strength in small and mid-cap names late in the month was noteworthy. In similar fashion, we are starting to see some life re-emerge in the “reflat...

The S&P 500 rose 2.4% in August 2021. MSCI World and TSX also registered positive results, gaining 1.8% and 1.6%, respectively. Large capitalization companies have been carrying most of the weight over the past few months. As such, the strength in small and mid-cap names late in the month was noteworthy. In similar fashion, we are starting to see some life re-emerge in the “reflation trade”. The Financials, Industrials, Energy and Materials sectors outperformed, resuming the trend that occurred from November to June.

Delta variant waves in India and U.K. receded during the month, while daily infections in the U.S. exceeded 280,000. Notably, it had been more than six months since the U.S. had topped 100,000 infections in a single day. Moreover, in June the daily number had dropped to approximately 4,000. The U.K.’s dramatic declining case count provides hope that the U.S. will recover quickly but vaccine hesitancy, aversion to mask wearing and reluctance to self-isolate are seen as risks. As such, the persistence of the reflation trade may well depend on the America’s resolve against Delta, as well as a revival in China’s economy, which may need a jab of policy support to boost growth.

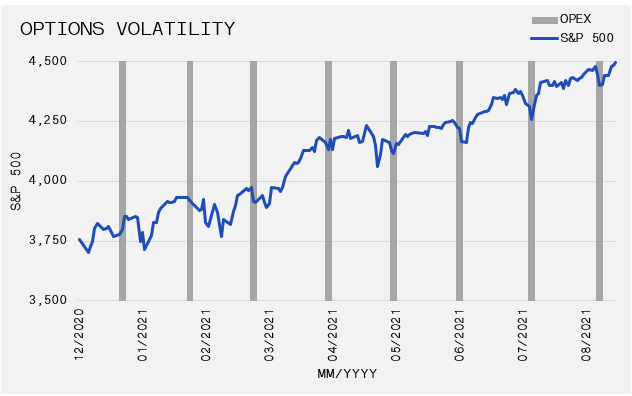

While the month-over month trend continues to push to the upside, we continue to see similar and repeated bouts of volatility in and around the third week of the month corresponding to options expiration (“Opex”). In August, the S&P 500 softened by 2.5% in just three days between the 17th and 19th, before rallying 3.4% to end the month. The move was more pronounced in the Russell 2000, dropping 5.7% before rallying 7.5% to end the month. The narratives used to justify each and every daily move are plentiful. However, the timing of these intramonth drawdowns is getting oddly similar.

In our opinion Opex is a possible explanation because of the option hedging strategies employed by dealers and large banks). When an option buyer enters a position, a dealer who sold the option will buy the stock in the market to remove the risk. When the scale of this activity is high in an up-trending market, gains are compounded as buyer increasingly push up the prices. As the option expiry date approaches, the dealers start to exit the market as the need to hedge subsides, removing that bid from the market that was previously pinned to a certain level. Post-expiration, the opposite occurs as the need to hedge rises again. However, this is not a one-way street, and can work in the opposite direction as put options, which pay as a stock price falls, rise in value as the market falls, which forces additional selling to hedge dealer positioning for puts sold. While the trend remains up which has made every dip a buyable event so far in 2021, the timing and regularity of these events suggests some participants have caught on to the trade and may be looking to front-run the move.