Slumping Real Yields and the US Dollar Downturn Prop Gold Prices

July marked another upbeat period for equity markets. The S&P 500 rose 3.1%, bringing its price increase since the March low to 44.2%. The TSX was boosted by sustained strength in commodities, which we discussed in our June recap. It climbed 3.3%. Meanwhile, the MSCI World Index returned 2.8%. The technology and health care sectors have provided the biggest lift since the benchmarks touched bottom. However, Nasdaq did not shepherd the flock over the past several weeks. It is too early to declare that leadership is shifting. Nevertheless, scrutiny is intensifying, as the CEOs for the big four (Facebook, Amazon, Google, Apple) prepare to answer for their companies’ unproven anti-trust practices before Congress.

Perhaps the most interesting developments have been in the currency market, as the strength of the US Dollar (USD) has far reaching impacts. The greenback fell 4.2% as measured by DXY, which is a gauge of the USD relative to the currencies of its most significant trading partners. The decline brought the USD’s drop to a full 9.0% from the peak on 19-Mar-20. American policymakers continue to devalue its currency through unprecedented fiscal and monetary impulse. In late March, the government enacted the biggest intervention in the private sector since the Second World War to help fight the economic impact of coronavirus. Further, the Senate Republicans are finalising the details of their second rescue package this week. It is anticipated that trillions of dollars will be shoveled into infrastructure projects and into consumer wallets. On the monetary side, additional asset purchases will be required to pin yields lower across the curve. Foreign demand for Treasuries is uncertain; as such, the Federal Reserve will be needed to potentially mop-up the surplus. All of which will apply more pressure on the USD.

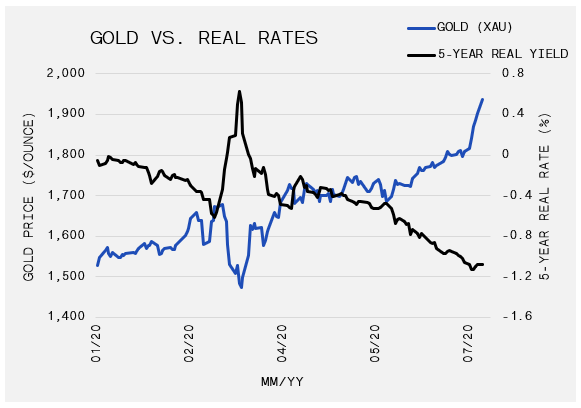

Related to the above, gold and silver’s upward momentum has continued unabated, casting a shadow over the shine in equities. Gold rose 10.2% to $1,940, a 34.5% year-to-date return, breaching its previous all-time high seen in 2011. While the move has been aggressive, the negative correlation between USD and Gold has intensified as the currency fades. Moreover, the price of gold has a primary relationship with real yields, which are simply nominal yields less the rate of inflation. Since gold does not generate a yield and thus has a cost to hold in the form of storage and insurance, traditionally US Treasuries have been a more attractive store of value. Even though global growth prospects continue to diminish, the falling USD causes commodity prices to advance which potentially translates into inflation. As a result, real yields have fallen to their lowest level seen since July 2012.

There is some certainty surrounding the growth aspect of the real rate equation. COVID-related shutdowns are reappearing, while data from unemployment claims, credit card spending, and air travel are plateauing in July. However, the inflation input is less conclusive. Following the Financial Crisis, many forecasters anticipated that government bailouts would produce price increases. Rather, Quantitative Easing was largely deflationary as the money injected into the financial system was generally retained by the financial sector. Although, inflation is more likely to boil over with fiscal policy expansion, higher minimum wages, de-globalization and oil prices that are no longer sliding.

Potentially related to USD weakness and commodities, but no less important, has been the relative strength of emerging market and European equities. In China, the Shanghai Composite Index rose 7.9% this month, while the MSCI European Index rose 4.3%. Both economies have been able to control the spread of Covid-19 much more successfully than the US, which seems to have attracted some fund flows. Add to this China’s announcement of paring back their stimulus efforts, which is in stark contrast to the US commentary above, and one can see the relative attractiveness.