Short End of a Wishbone

Equities failed to follow-through on July’s positive results as a late-month selloff pushed benchmarks into negative territory in August. The S&P 500 fell about 2% while MSCI ACWI and TSX dropped approximately 2.5% and 2%, respectively. From a sector perspective, energy stocks brushed off a 4% drop in WTI oil to be the leading segment. Otherwise, the flight-to-safety trade was in full effect. Utilities and staples were relative winners, up 2% and down 0.6%, respectively. Technology (-5.3%) and healthcare (-5.2%) led on the downside. Bitcoin continued to act as a levered bet on equities, falling 17.7% on the month to $19,700.

The U.S. dollar was soft to start the month, but it turned to the upside in the second week of August. Its renewed strength acted as a global wrecking ball across other assets classes. As the U.S. Dollar Index (DXY) gained, the S&P 500 crumpled over 5% and the 10-year U.S. Treasury Bond buckled almost 3%. Causation and correlation tend to be spurious at best, but in the case of the U.S. dollar, there is little doubt about its ability to impact markets.

Gold’s recent advance was interrupted. It slid 1.8% due to rising real rates and the U.S. dollar popularity. The potential re-emergence of Iranian oil to international crude markets was a catalyst for falling oil prices. WTI oil continues to look for support in the low $90s. However, a revival of a nuclear deal with Iran could supply up to two million barrels of oil per day and cause support to fail.

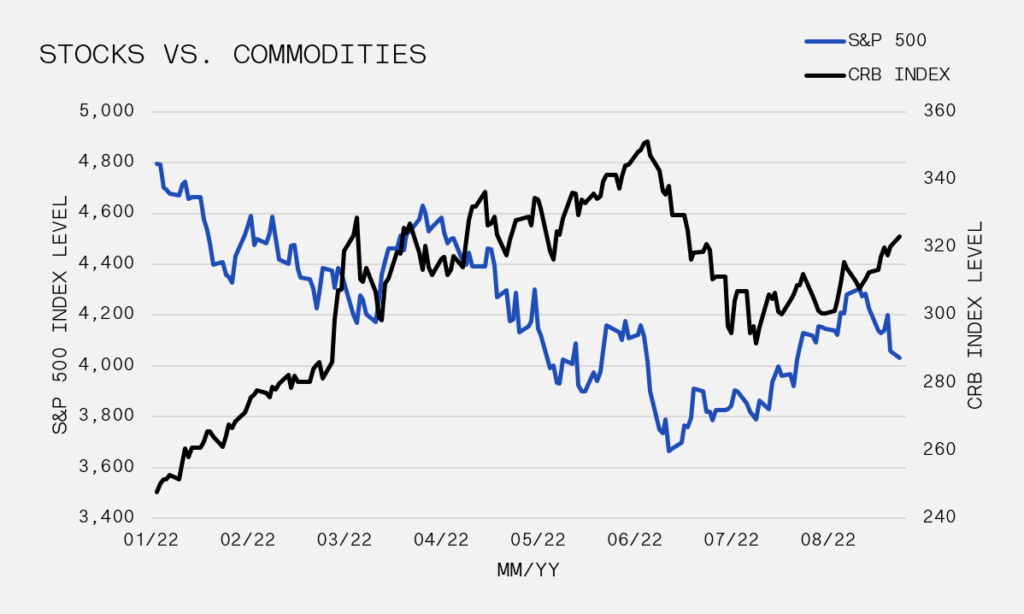

Outside of oil, commodities caught a bid as the CRB Commodities Index rose 1.8%. Supply issues worsened in Europe causing natural gas prices to surge 10.6%. Corn popped 9.6% as U.S. harvest indications came in lower than expected. The CRB Commodity Index has a negative 0.55 correlation to stocks in 2022. A negative correlation implies that the two variables are moving in opposite directions. In this instance, it is signaling that inflation is top-of-mind for investors. As we can see below, after a brief correlation break in July, the inflation trade returned to produce a negative return for stocks.

As the Federal Reserve plows ahead with interest rate increases, it is also set to double its Quantitative Tightening (QT) program in September. QT is a tactic to reduce liquidity and contract its balance sheet. It is usually accomplished by selling government bonds or allowing them to mature and moved from the bank’s cash balances. Thus far, QT has been operating far below the balance sheet reduction targets. Nevertheless, there is concern that too much liquidity will be sucked out of financial markets too quickly through the combination of higher interest rates and QT. In fact, economic warnings were proclaimed loudly when Federal Reserve Chairman Jerome Powell spoke at Jackson Hole on 25-Aug-22. He cemented the Fed’s commitment to fight inflation and to induce “some pain” to households and businesses.

Stock indices responded to Chairman Powell’s alert by selling-off more than 3%. It seems the market wished for a more dovish tone following dimmer than expected CPI data just one week earlier and overall softness in reported economic numbers. Ironically, it was only a year ago at the same speech that Powell insisted that inflation was still transitory. As such, we should maintain a healthy measure of skepticism with the central bank’s steadfastness.