September Slump Sets Stage for the Election & Fourth Quarter

After five consecutive months of gains across US and Canadian indices, the brakes were firmly applied to the rally. The S&P 500 fell 5.2% for the period with losses led by Financials and Technology. The MSCI World and TSX Indices provided little refuge, down 4.7% and 3.7%, respectively. Notably, when the S&P 500 and Nasdaq 100 scaled new peaks in August, their respective measures of implied volatility also rose in tandem. Concurrent increases in equity and volatility gauges are uncommon. Accordingly, the September slump was not alarming. The US presidential election date is fast approaching, and volatility is expected to remain elevated.

Gold and silver lost their lustre in September as well, sliding 3.4% and 14.7%, respectively, as the USD strengthened. WTI oil tumbled 6.9% but most of the weakness occurred early in the month, slumping from $43 to below $37 by 08-Sep-20, but recovering to $40.60 at press time. The timing of the rebound coincided with Saudi energy minister’s taunt to oil short sellers. Following the OPEC+ gathering, Prince Abdulaziz bin Salman invoked Dirty Harry, with a “Make My Day” warning directed at those who wished to gamble on declining prices. Elsewhere, bonds remained flat through the back half of September during the more aggressive stage of the equity selloff. Although this is a brief time series, if bond markets are viewed as overpriced and undesirable, it will fail to provide a traditional hedge to equity wreckage.

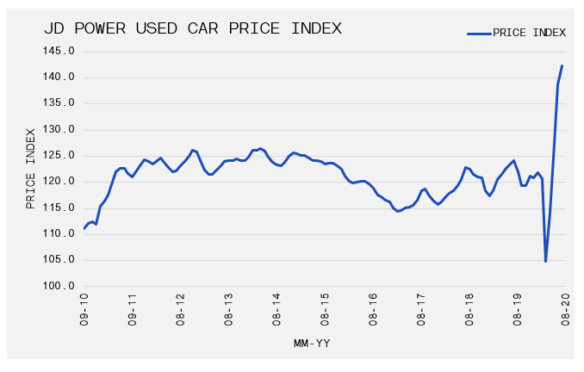

As the world reserve currency, the USD continues to act as the straw that stirs the financial asset drink. In September, the dollar measured by the DXY, reversed a 6-month downtrend by rising 2.2%, negatively affecting stock prices, credit, gold, silver, and other commodities. Since March, large dollar supply through monetary and fiscal stimulus depressed DXY by over 10%. One consequence of a weak dollar is that it contributes to inflation. However, inflation has been a threat since the Tech Wreck and the Great Financial Crisis because the government responded to these collapses by initiating large-scale stimulus through monetary printing. The thesis was that the increased supply of dollars would flood the economy and cause runaway inflation. However, the monetary stimulus mechanism is simply a route to add reserves to bank balance sheets. If the banks are reluctant to release those reserves to the economy through increased corporate or personal lending, the multiplier effect is unsuccessful. Once again, to counter the economic impact of the pandemic, the U.S. passed several stimulus packages, but banks are tightening lending standards, lowering credit limits and demanding higher minimum credit scores. As result, banks are applying a deflationary force that counteracts the government’s monetary efforts. However, the distinction with this regime’s rescue program is that banks are also being bypassed via direct payments to personal and corporate bank accounts. In August, the US Consumer Price Index (CPI) rose for the third consecutive month. The components that are leading the measure are Used Cars (up 5.4%!), Shelter, Recreation, and Household Furnishings.

Much of the dollar’s surge in September can be attributed to a logjam in Congress related to another round of stimulus spending. Negotiators remain far apart on an overall price tag, and with just over a month before Election Day, the window for striking a deal was slim. However, when an eventual deal is passed, the price tag will be north of $2 trillion, but less than the $3.4 trillion Democratic proposal in May. In any case, it should be sufficient to cap the upside on DXY, allowing for a renewal in commodities and stock prices.