Positioning For A Game Changer (Part I)

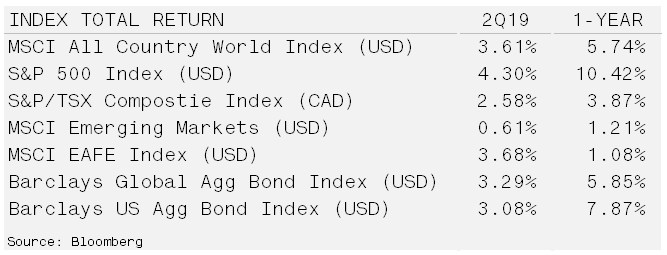

Volatile But Solid Quarter – Equity markets were broadly higher last quarter despite an escalation in US-China trade tensions and concerns of a global growth slowdown. The US once again led the group, returning 4.3% during the quarter and 10.42% over the trailing 12-months. The market rally was driven mostly by major central banks shifting their tone more clearly toward an easing bias as they acknowledged the weak global economic backdrop.

Safe-haven assets such as government bonds and gold were also among the biggest gainers on expectations of interest rate cuts and the possibility of further monetary easing. The Canadian dollar advanced 5.66% against the greenback as US interest rates collapsed and the Canadian economy recovered from its first quarter stall.

Paradigm Shifts & Turning Points – For those that have followed the National Hockey League closely, the paradigm shifts with regards to how the game is played have ebbed and flowed. The transitions from the “Run & Gun Era” (1984-‘94), to the “Dead Puck Era” (‘94-2004), the “Golden Era” (‘05-’15), and finally the “Precision Era” (’15-Today), required changing skill sets to generate success. During each turning point, teams that drafted and prepared well for the shift benefitted the most; Edmonton Oilers, New Jersey Devils, Chicago Blackhawks and Pittsburgh Penguins.

Analogous with eras in hockey, markets experience long-term changes that require structural modifications to portfolios. Early adopters typically see the largest benefits as teams/capital begin to accept and eventually mimic/support the strategy. In due course, a “New Paradigm” is declared because individuals become heavily influenced by current events. It is assumed the existing view will persist but the vast majority fail to anticipate shifts caused by the law of diminishing returns. The transition to a new path begins when a consensus view creates excessive optimism, encourages abnormal risk-taking and distorts valuations.

The 10-year time frame works in hockey and it also appears to hold up well in markets. Looking back at the last four decades there are distinct beliefs that become psychologically engrained in society. These prominent convictions become reflected in markets through valuations that teeter into “bubble territory.” Accordingly, avoiding the previous dominant themes and the largest stocks associated with the era can lead to outperformance over the next 10-years. The table below demonstrates this phenomenon.

1980 to 1989

- Beginning

Inflation exceeded 10% and bond yields were rising rapidly. Top 10 global stocks included five energy companies and nine were US domiciled.

- Ending

The best allocation decision was to underweight the US to hold zero energy companies as inflation receded.

1990 to 1999

- Beginning

Japanese equities dominated, owning eight of the top 10 equity positions by size while accounting for 45% of the global index. The core belief was Japan’s corporations held superior management techniques and banking systems.

- Ending

Simply underweighting Japan allowed a global investor to outperform as the Tokyo exchange peaked in 1990.

2000 to 2009

- Beginning

The internet and housing boom fostered the “new economy”. Technology, media and telecom stocks (TMT) comprised more than one-third of the MSCI World.

- Ending

Investors that performed well in the 2000s owned commodities and sold TMT.

2010 to 2019

- Beginning

Quantitative easing stoked concerns of inflation once again, while China’s growth and talk of peak oil helped push Chinese and commodity equities into the top 10.

- Ending

Best trade for 2010s was to underweight China and to be short commodity stocks.

Paradigm shifts do not signal a bleak future; conversely, the transition often leads to net gains. Technology stocks once again dominate the top 10 board by market share and the US now accounts for 56% of the MSCI World Index. However, the seeds that were sowed for this decade’s rich harvest are beginning to become unviable, similar to the one-dimensional enforcer in today’s NHL. Click the link to download the PDF version. >