OPEC Cuts, Stalling Shale Boost Oil Prices

The 2019 calendar years is shaping up to be the strongest year since 2013 for the S&P 500. North of the border, the TSX should post its strongest year since 2009. The results would have seemed unthinkable during Q4 of 2018 as markets were crashing and a recession was all but guaranteed. For the month ending 17-Dec-19, the S&P 500 and MSCI World indices gained 1.3% and 0.6%, while the TSX was flat.

Equity strength continues to defy expectations despite lingering recession concerns. However, the economic slump sentiment seemed to subside when the employment survey from the US Bureau of Statistics was released on 06-Dec-19. The jobs market showed a very healthy gain of 266,000 (vs. expectations of 187,000) nonfarm jobs in November, along with an unemployment rate at 3.5% and a 3.1% bump in hourly earnings. While employment data has historically been a fairly backward-looking statistic, the news seemed correlated with a 1% rise in the S&P 500 for the day, and a break above the previous high for the month. A secondary, or perhaps primary, driver for the market was the Fed’s declaration that it would allow inflation to run above the 2% policy target. The justification that the rate has remained below target for enough time that allowing it to run above will bring the average to 2%. Readers may now wonder why a plan to let inflation rise may be good for markets, especially if they have read our past commentaries, but in this case it comes down to the lens with which a participant wants to view the market. In the short-term, this translates to sustained accommodation and zero quantitative tightening. If history repeats, this means prolonged asset inflation and a rise in equity markets. We won’t beat a dead horse, but if market participants decide to apply a longer-term lens, the implications of higher inflation could signify lower corporate margins, additional consumer stress through higher costs if wages don’t keep up, and the inevitable Fed scramble to temper expectations through make-up tightening down the road. It is easy to see the forest for the trees, but 2019 does not provide much of a reason to expect an imminent change in focus.

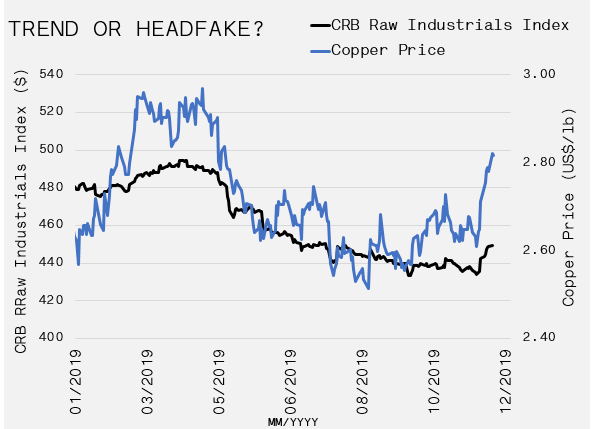

Speaking of inflation … ok, fine, just a couple more shots at said horse … rates and commodities seem to have started to sniff out a pickup during December. The US 10-year and 30-year yield both rose 10bps for the month as the yield curve steepened, meaning longer-term yields are rising via a perceived pickup in growth or inflation, while the short-term continues to be suppressed through dovish Fed policy. Elsewhere, copper climbed 5.3%, while weakness in the CRB US Spot Raw Industrials index reversed course, rising 2.6%. This one is fairly noteworthy as it includes things like steel, tin, burlap, cotton, cloth etc., in addition to copper, which is a diversified gauge of key economic inputs. Now one month does not a trend make. However, employment has historically been a lagging indicator, these commodities are a fairly accurate leading indicator, and can help form judgements of how things may unfold in the coming months.

Moving on to oil, WTI demonstrated strength during the month and moved through the $60 ceiling, up 4.6%. Helping drive the move was the result of December’s OPEC meeting. The 14 country cartel agreed to cut an additional 500K barrels per day, bringing the total cut to 1.7MM barrels per day, above consensus. Media outlets have suggested that the improved trade situation between the US and China could also impact expectations for global growth, and in turn demand for oil. Possibly related and likely more impactful, persistent negativity surrounding the trend in US shale oil productivity. Global supply has been profoundly impacted by shale over the past few years. Accordingly, weakness should be bullish for oil prices in the long-term. Shale basins lose 70% of production after year 1, and 35% of the remainder in year 2. The short life cycle of shale operations means that the taps could turn off even quicker than anticipated. Rapid depletion and tighter lending standards within the industry have caused concern for the US’s ability to grow production and pace global supply growth. As a result, there has been renewed enthusiasm in the narrative north of the border, with the S&P/TSX Energy Index rising 6.5% for the period.