Oil Prices Become Negative As Stock Markets Rebound

After the S&P 500 and MSCI World indices fell 33.5% and 27.3%, respectively from the 20-Feb-20 high to 23-Mar-20, markets globally have shrugged off any negative economic news, leading to rallies of 27% and 24%, respectively. Since our last note 26-Mar-20, the S&P 500, MSCI World and TSX indices are up 14.8%, 11.5% and 9.6%, respectively.

As an endorsement to the dichotomy between the economy and the stock market, consider that one of President Trump’s economic advisors optimistically estimated that US GDP would fall 20-30% in the second quarter, and unemployment would hit 16-17%. Yet, the broad market is off only 15% from its all-time highs, despite 26 million job losses in the US. During the Great Financial Crisis of 2007-08, the US lost 8.7 million jobs, unemployment peaked at 10.2%, GDP feel 4.3% and the S&P500’s peak-to-trough decline was 56.4%. Notably, the prompt and substantial rescue efforts supplied by the Fed and Congress should shorten the duration of the hardship this time around. And, with any luck, produce a ‘V-shaped’ economic recovery.

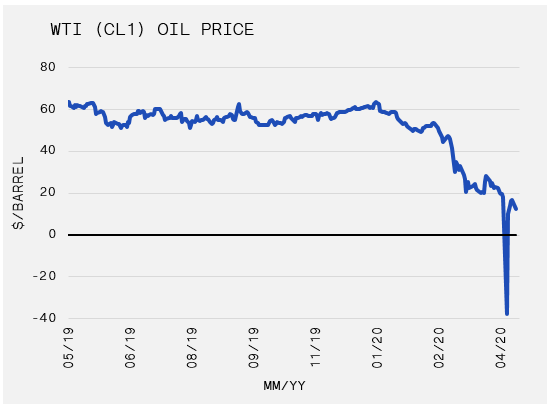

Commodities have been an incredibly interesting space, with many revealing conflicting stories and one product making unprecedented moves during April. Oil, as measured by the WTI May contract, fell to -$37 per barrel on 20-Apr-20, meaning an owner of a barrel of oil would pay a counterparty to take it off their hands. Granted, volume was very low at this price point and with the expiry of the May contract just two days following, any actual economic activity shifted to the following month. However, anyone stopping their analysis there are doing themselves a disservice as the historical event is significant for at least a couple of reasons.

The primary cause is related to a lack of storage capacity for oil, which again is a function of demand falling off a cliff. If you are a trader and cannot sell your oil contract or find someone to store it for you, you must take delivery of WTI at Cushing, Oklahoma. Since many speculators are unable to accept delivery, and severe storage shortages exist for those willing, desperation created negative prices.

The downside of commodity financialization also contributed to the pricing dysfunction. ETFs own a large percentage of the paper contracts for these products. In particular, US Oil Fund (NYSE: USO) owned 25% of the May futures contract. However, an ETF can not legally take delivery of the physical commodity. Therefore, the ETF is required to roll, or simultaneously sell one month and purchase the following month in an equal amount. This creates a natural downward push on the price of oil in any given month, and given the supply/demand imbalance in May, the prices collapsed. So far, we are seeing a similar situation unfold for the June contract. The price is down 23% as of 27-Apr-20.

While oil continues to fall, copper, a key industrial commodity and historically a great predictor of economic conditions, has demonstrated sustained strength through April, up 5.1% during the month. Copper began its sharp fall in late January, which reflected the economic situation and demand destruction in China. Its low was hit the same day that equities bottomed on 23-Mar-20, but the April rebound could hint at further gains. Also, noteworthy is the performance of gold, which has continued to move higher after falling with stocks in March. Gold is up 6% in April, hitting highs not seen since 2016, and is now 47% above its 2018 low. With global monetary and fiscal stimulus surprising even the most dovish of analysts and yields falling, the stage is set for a sustained bull market in the metal. Nevertheless, the trade is incredibly crowded, and the certainty of the predictions gives cause for concern.

We have written at length about credit in the past and to keep on top of the situation, it appears that US high yield credit spreads have once again begun to widen, albeit on a short time frame from 16-Apr-20. Originally, the spread over Treasuries peaked at of 10.9% on 23-Mar-20. But the support offered by the Fed and Congress, followed by the surprise proclamation of direct purchases of investment grade and downgraded high yield debt, caused yields to contract to a low of 7.35% on 13-Apr-20. Both investment grade and high yield issuers have been on a debt issuance binge since these announcements were made, taking advantage of the opportunity to either refinance existing debt or extend the maturities while the credit window was open. Outside of a few failures, a large-scale default cycle has yet to materialise, even within the oil patch. We will be monitoring spread behaviour closely as a re-widening of spreads with such large-scale Fed and Government support would be a red flag.