No-Gift Christmas

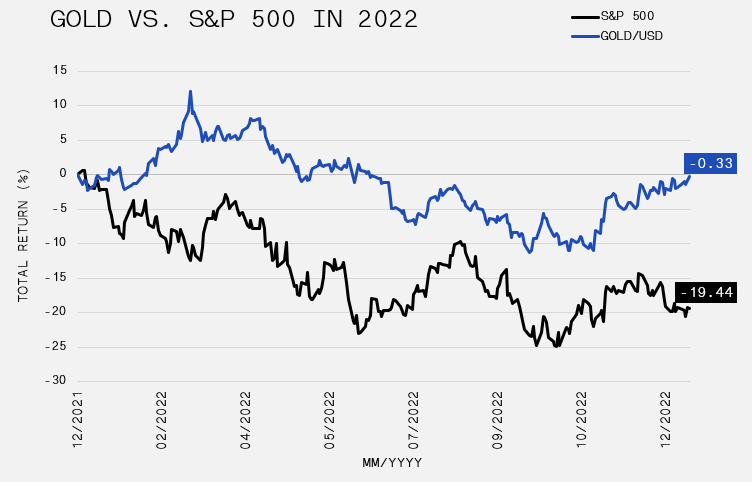

After recording gains in consecutive months for the first time in 2022, investors were waiting for Santa to arrive in December. Unfortunately, the S&P 500 refunded about half of the October and November gains. The index fell 5.9%, leaving it down 19.4% for the calendar year. The TSX Index and MSCI World also registered monthly losses of 5.2% and 4.6%, respectively. For the full year, both the TSX and MSCI World came out ahead of the S&P 500, with the former limiting its damage to 8.9%, while the MSCI World shrunk by 18.4%.

December was a typical risk-off month from a sector perspective. Utilities, healthcare and staples helped limit the harm, while consumer discretionary and technology stocks led the declines. Bonds once again failed to provide a cushion as the 10-year and 30-year bonds fell 1.1% and 1.3%, respectively.

The October and November gains for both equities and bonds occurred in an environment of a rapidly falling U.S. dollar, as measured by DXY (the U.S. dollar index, which tracks the price of the U.S. dollar against six foreign currencies). However, it was noteworthy that a ‘risk-off’ reversal occurred in December despite the U.S. dollar sliding 2.2%. The greenback’s softness was largely attributed to the strength of Japanese yen as it rose 3.2% on a hawkish shift by the Japanese central bank.

Gold maintained its upward momentum, rising 3.1% for the month and 12.8% from it’s early November low. No asset seems more prone to head fakes, so we remain cautiously optimistic with gold. However, it is encouraging that the yellow metal continues to be resilient while rates rise and the U.S. dollar is sturdy. Overall, gold achieved its mission as a portfolio hedge in 2022. It finished the year relatively flat while both equities and bonds buckled.

Elsewhere in commodities, oil reversed its early-November weakness to finish flat in December, but we can’t ignore the downward price momentum which helped erase most of the 2022 gains. Importantly, energy companies are starting to trade more in-line with the underlying commodity. In November, we noted the divergence which helped the energy equity sector hold up relatively well. We will monitor price action closely as a sell-off in the energy complex in a strong fundamental supply backdrop provides a persuasive indicator of how the market is discounting the risk of recession in 2023.

Since hitting a low in July 2022, copper has achieved persistent gains. Given copper’s correlation to global growth is normally positive, the price improvement is competing with the consensus narrative of a universal slump in 2023.

Quantitative Tightening is widely blamed for the disappointing performance across broad asset classes in 2022. Unrelenting central bank rate increases and the ensuing liquidity drain was the focal point for investors. In 2023, all eyes will be fixated on growth measures and earnings to derive a line of sight on the next move by monetary authorities. Analysts, forecasters and leading indicators are practically in collective harmony on the prospects for recession, yet the consensus for S&P 500 earnings growth in 2023 is 5% and then 10% for 2024. Certainly, inflation plays a large factor in these positive numbers, but if real earnings fall and nominal profits are even flat, it will be difficult for assets to avoid further vulnerability. On the flipside, a surprise upside move in the stock market would develop if the economy mimics the robust employment data. In summary, the eagerly anticipated Santa rally failed to take hold in December, so investors should hope he was simply too busy shopping and helping companies beat on fourth quarter earnings.