Mid-Summer Relief

A rally in the back-half of July propelled stock market indices to a positive month. The MSCI World led the way, up 5%, while the S&P 500 followed with a 4% return. The TSX lagged, with a gain of under 1%, as the heavy weight in Financials and Energy slowed the year-to-date leader. Interestingly, it was the year-to-date losers that guided the S&P 500’s 11% rally off its June low. Consumer Discretionary and Tech stocks registered gains of nearly 12% and 10%, respectively. The sole outlier was Communications as Meta Platforms Inc. produced quarterly results that once again disappointed across almost all metrics. The company, formerly named Facebook Inc., accounts for 24% of the Communications sector.

Commodities continued to weaken in July. Corn fell over 19% and WTI oil and copper dropped 13.4% and 7.9%, respectively. Gold slumped 3.9% during the period. However, real rates and the U.S. dollar faded into month-end, allowing gold to rebound 4% off its July bottom.

About half of the S&P 500’s constituents have reported Q2 results. It was feared that earnings would fall far short of analyst consensus estimates. However, panic has not materialised. Refinitiv reported 69% of companies beat expectations. Moreover, the reaction to company results has been an important difference from prior quarterly reporting periods. For instance, Microsoft Corp. and Alphabet Inc. both reported revenue and earnings that fell short of expectations. Nevertheless, their share prices popped 7% and 8%, respectively, on the day. This is in stark contrast to the relentless selling that greeted even strong earning reports earlier in 2022.

Continuing on the topic of counterintuitive follow-throughs, U.S. GDP fell 0.9% in the second quarter, which followed a 1.6% decline in Q1. Agreement on the definition of a technical recession is contentious. However, it is undeniable that the economic landscape is far from rosy given the clouding job picture and two consecutive negative GDP prints. Despite the GDP report on 28-Jul-22, stocks failed to give back any of the outsized gains that accrued following the Fed’s announcement of a 75bp rate increase a day earlier.

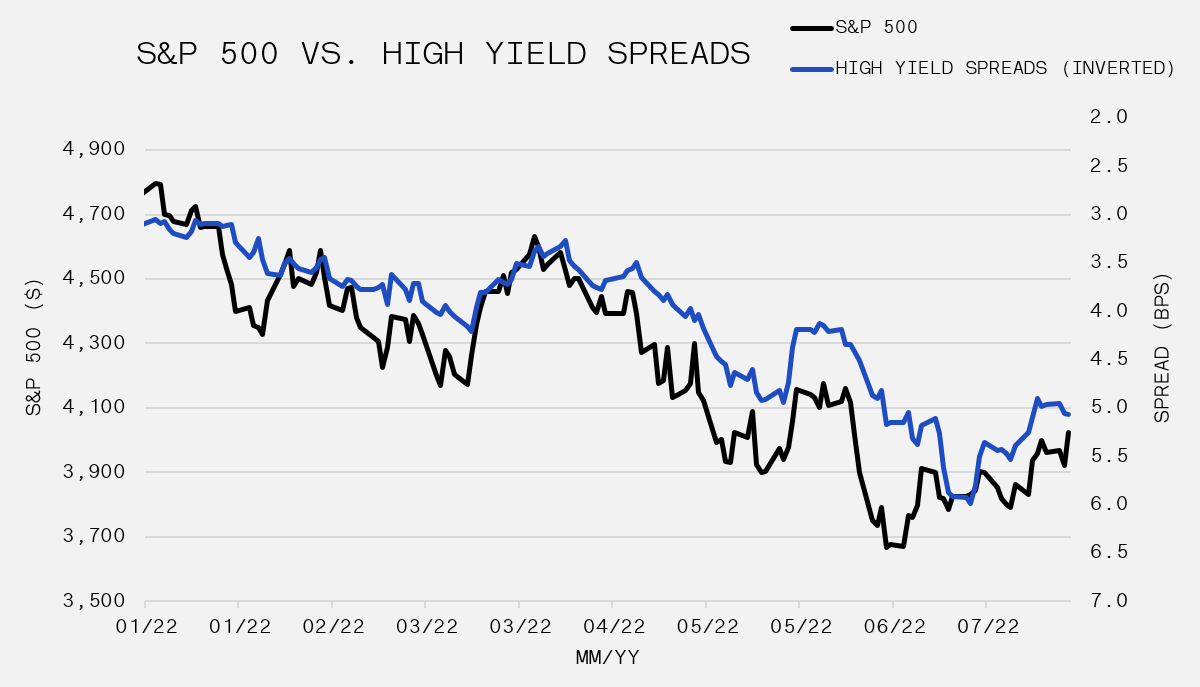

In our previous Monthly Recap, we commented about the profound weakness in the equity markets to start the year. In consideration of the first half bust, the outsized short position in S&P 500 futures and the low level of gross exposure among hedge funds, it is not overly surprising that stocks rallied in the face of negative economic news. Time will tell whether this is simply another aggressive bear market rally or if the bounce is more durable. For insight into the possible market direction going forward, there are three key indicators that require constant evaluation (i) the U.S. Dollar, (ii) credit spreads, (iii) the yield curve. The USD, represented by the DXY, is a key measure as it gauges the Federal Reserves determination for fighting inflation and it acts as a safe haven in times of stress. It rose another 2% in July, though it backed off 3% from the high on 14-Jul-22. The yield curve became negative during the month. The short end of the curve is lifted due to the Federal Reserve rate hikes while the bond market anticipates an economic slowdown and lowers bond yields on the long end. Despite the strong dollar and the recession signal, credit spreads tightened which typically suggest a willingness to take more risk and potentially improving economic conditions. The ICE BofA US High Yield OAS contracted from 5.26% to 5.07%. One month does not make a bull market, but there is an opening for additional upside, if the USD softens more and the yield curve re-steepens.