A Hectic Start to the New Year, Except in Stocks

With the first 20 days of 2020 in the books, global markets have continued their 2019 ascent with the S&P 500, TSX and MSCI World indices rising 4.4%, 3.3% and 3.5%, respectively. While we had cited a lack of retail and institutional participation as a reason for optimism in 4Q19, it seems that narrative has flipped as we enter the early innings of 2020. According to the CNN Fear & Greed Index, a 7-indicator reading of investor sentiment, the 21-Jan-20 reading hit 86 out of 100. This is a remarkable rise from the 30-range in September 2019. Moreover, it indicates extreme greed and a high level of complacency. Interestingly, gold has maintained its upward momentum, rising 5.1% for the month. Equity markets are broadcasting a calm signal, but gold’s shine reflects political turmoil in the middle east and the expectation for falling real rates, which boosts demand for the metal. Fears of reflation could be suppressing expectations for real yields in the future which is typically the true influence on the price of gold.

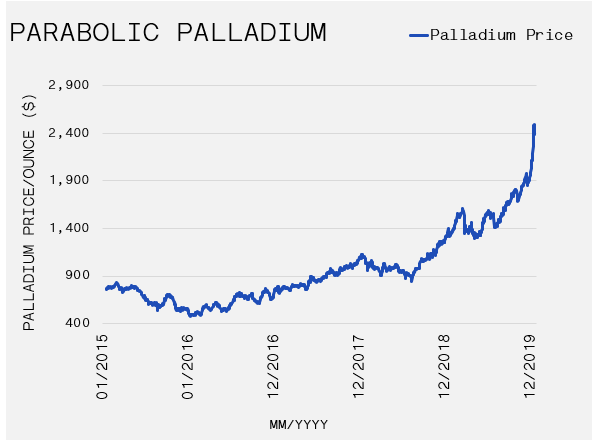

Elsewhere in metals, the meteoric rise in the price of palladium has been attention-grabbing. Palladium is a key component of catalytic converters. Eighty-five percent of mined palladium is used to turn toxic pollutants to carbon dioxide and water in exhaust systems. As governments like China clamp down on vehicle pollution, automakers have increased its usage. Coincidently, consumers are moving from diesel-powered cars which utilize platinum to carry out the same operation, to gasoline which uses palladium. As demand has increased, the supply has flatlined as palladium is primary mined as a by-product of platinum and nickel mining, rather than a focused end product. As automakers scramble to secure inventory, the price of palladium has risen 22.5% in Jan-20, which comes off of an incredibly strong 2019 where its price appreciated 53.6%. In total, palladium is up 3.3x over the past three years. Speculators have surely driven some of the momentum; nevertheless, palladium has been in a deficit since 2012 and without additional supply or a substitute product, we could continue to see strength.

Oil continues to defy expectations, falling 5.0% for the month, despite an escalation of tensions in the Middle East following the killing of Qasem Soleimani, the Iranian leader of the Islamic Revolutionary Guard. The assassination and subsequent bombing of US command posts in Iraq temporarily boosted the oil price by 3% but it has since fallen 8.6% as of 20-Jan-20. Both sides of the conflict have declared that a diplomatic conclusion to the dispute is preferred. As such, some market participants have cited this as the reason for oil’s composure. In addition, the possible absence of Soleimani’s military influence provide hopes that middle east tensions may moderate in the future. However, the situation is nowhere near solved. Iran’s persistently threatens to withdraw from the Global Nuclear Deal if European countries refer Tehran to the UN Security Council for violating the 2015 pact. In the meantime, Canadian oil, measured by Western Canadian Select, has fallen 13.9% during the period. This drop has once again pushed the spread with WTI to a 40% discount – back to where it was in late 2018. The combination of record high inventories following a recent outage on the Keystone pipeline, and a Canadian National rail strike has cast doubt on Canada’s ability to reliably access the homeland’s oil. Record-breaking cold weather in Western Canada has added fuel to the fire. Two large crude producers were obligated to declare force majeure when they couldn’t fulfil their contracts due to an inability to process crude at extreme low temperatures. Natural gas is a key ingredient in the conversion of bitumen to synthetic crude, and freeze offs have restricted the supply available to producers.

More recently, reports of a new Chinese coronavirus (the virus responsible for SARS in 2003) have made headlines and are impacting global markets. On 20-Jan-20, the World Health Organization announced it would convene a meeting to declare a world health emergency. The virus started in the Wuhan province of China, where 258 confirmed cases and six deaths have been reported. The virus has already spread, and it is poised to worsen as the Chinese New Year (25-Jan-20) travel rush begins. Global markets have taken note, with the iShares MSCI Emerging Markets Index down 2.2% on 21-Jan-20.