It’s About Getting Well

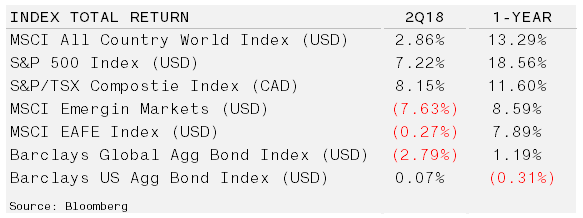

Markets Make Their Comeback – After a volatile 1Q18, developed markets regained their upward trajectory in the second quarter. Although, headlines related to trade wars and weakness in emerging market caused brief pullbacks, every selloff seemed to create a bid. Entering the third quarter, markets may find more momentum in corporate earnings or become vulnerable to tariffs and rising interest rates.

Following the most recent Fed interest hike in March, Fed Chair Powell indicated to Congress in July that they would continue to raise rates. In addition, the Bank of Canada raised its benchmark by 25bps to 1.5% and are expected to follow-suit with the US. Short-term yields have risen accordingly, but the 10- and 30-year yields continue to hold steady. This has the potential to invert the yield curve, often seen as a harbinger of recession. However, with the continuation of quantitative tightening and the increased issuance of longer-dated bonds in 2H18, eventually the US government will be forced to pay higher interest on its tragic debt piles. Accordingly, higher long-term yields needed to keep a positive curve are conceivable.

Cannabis Prepared to Enter the Limelight – The impending Canadian Federal recreational legalization on 17-Oct-18 represents a sea change in governmental attitudes towards cannabis. Numerous studies are broadening the momentum as the efficacy of cannabis’s abundant active ingredients are being emphasised. The plant’s benefits are being proposed as therapy for epilepsy, cancer, autism, schizophrenia, concussions, Alzheimer’s, Crohns, depression and more.

During 2Q18, GW Pharmaceuticals (NYSE: GWPH) announced FDA approval for their childhood epilepsy drug, Epidiolex, the first such approval of its kind. The next step to availability in the US will be rescheduling of Cannabidiol (CBD), the active ingredient. Currently cannabis carries Schedule I classification under the Controlled Substances Act, indicating high potential for abuse and no medical purpose.

Rescheduling carries with it many potential medical implications. First and foremost, lifting restrictions on the supply of cannabis will allow researchers to pursue medical testing. With the ability to test and discover new medical benefits, the opportunities for medical applications grows exponentially, and with it the investment thesis. Second, it should help increase public support for cannabis which continues to grow, as evidenced in the political universe. Cannabis’s popularity among groups as varied as military veterans and parents with sick children provides significant political motivation with US mid-term elections in November. Further, its prospective economic impact is difficult to ignore, as is its potential as an offset to the opioid epidemic.

Of course, it is important to evaluate both sides of an investment argument, and no doubt supply and demand will eventually rule out. Estimates for Canadian cannabis consumption seem overextended, which has helped extend the valuations for Canadian-listed equities. In addition, increased research will not exclusively focus on the benefits of cannabis. New and potential negative side effects will also become uncovered.

As always, it is critical to understand the industry and the competitive landscape of a targeted investment. Moreover, determining a valuation that provides a suitable margin of safety at which to invest requires complex financial models. Even small changes in a few variables can alter an outcome enormously. For a new sector, where regulations are evolving, and forecasts for demand are largely promoted by persons with a vested interest – the uncertainty for fundamentally predicting results is immense.

In summary, we have no doubt that opportunities in this budding sector are incredibly promising. But, we are very cognizant of the optimistic assumptions currently being used to justify some company’s valuations. The Horizons Marijuana Life Sciences ETF (TSE: HMMJ) has fallen 33% since its peak in January 2018. Investing is not for the impatient, and this story should be no different.

Click the link to read more. >

[1] “It’s About Getting Well”, Todd Harrison, Chief Investment Officer of CB1 Capital Management