“Higher For Longer” Douses The Flame

February started with a strong follow-through on January’s gain, but momentum was abandoned, leaving equity markets in the red for the month. The S&P 500 fell about 5% from its February high to close the month down roughly 1%, while the MSCI World and TSX fared worse, down 1.8% and 1.5%, respectively. In contrast to recent down months, Technology was a winner while Energy was the laggard on the back of a 4.6% decline in crude oil. Tech was fueled by Nvidia Corporation, the sector’s third largest holding, which increased 21% after reporting its 4Q22 financial results.

Bonds continued to move in lockstep with equities, as the Barclays Core Aggregate Bond Index slid 2.8% during the period. The reality that interest rates will stay higher for longer triggered a reversal in the yield curve’s recent ambitious fall. The prospect that the Federal Reserve would initiate policy easing in the second half of 2023 is now largely a lucid dream. With employment remaining strong and prices firming up, markets are starting to price an increasing probability of a 50bp hike at the March meeting. This would be the terminal jolt that awakens policy easing dreamers from their sleep paralysis.

Most of the action remains on the short-end of the curve as the U.S. Treasury 2-year yield rose to a fresh 52-week high at 4.8%, pushing the U.S. Treasury 10-year minus 2-year yield curve to a new low of -88bps. An inverted yield curve is a well known “predictor” of a recession. Accordingly, with the spread at levels not seen since the early 1980s, the “when” seems like more of an important question than the “if”. Nevertheless, the economy has demonstrated surprising resiliency, despite consensus prognostication that geopolitical strains, inflationary forces, and restrictive monetary policy would catapult it into a sharp downturn. It’s important to keep in mind that a recession is a feature, not a bug, of the economic cycle. And, from an investing perspective, it is essential not to overreact as the timing is clearly difficult to forecast and the duration is equally unpredictable.

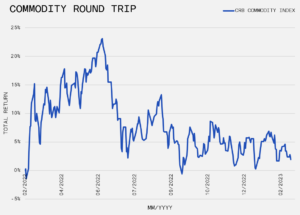

Continuing with mistaken extrapolations, prophecies of shortages across the commodity complex keep getting rebuffed. The CRB Index fell 4.68% in February, down 3.5% year-to-date. So far, positioning has not materially moved to the short side. As such, the direction of the U.S. Dollar will likely dictate the next move in commodities. WTI oil, the largest component of the Index at 23%, has painted an ugly chart that is now 42% off its 2022 highs, all the while the fundamental environment for oil is supposed to be improving. Oil has been consolidating since November 2022 so the next break will be important for energy equities as they remain relatively unscathed. The Energy Select Sector SPDR ETF (XLE) is only 10% below its 52-week high.

At the risk of sounding like a broken record, we are compelled to write that if one can cleverly anticipate the direction of the U.S. Dollar, the trend for most asset classes can be more easily navigated. This tune was played in February as the reversal in equities corresponded precisely with the U.S. Dollar Index (DXY). DXY bounced 4% off its local low on 02-Feb-23. Since then, the S&P 500, long-dated government bonds (TLT) and gold are all down 4.8%, 6.5%, and 5.0%, respectively. With the S&P 500 currently up 14% from the trough in October 2022, bulls need to see the USD resume its downtrend for equities to expand. Otherwise, the impressive rebound since autumn threatens to become nothing more than a bear market rally. This is not to discount our appreciation for the recovery, but it highlights an inflection point for money managers who also need to process a mess of mixed economic data.