Fear Tightens its Grip on the Equity Markets

Equity markets took a breather in August as investors seem to be considering the risks facing the global economy, while trade talks between the US and China became more aggressive. The MSCI World (USD) and S&P 500 led the declines, down 4.4% and 4.0% respectively for the period. The TSX’s 2.2% loss was softened by a 9.0% rise in the price of gold. Outside of precious metals, weakness in commodities is persistent due to reduced global demand. Copper fell 5.5%, and the CRB US Spot Raw Industrials Index slumped 1.3%. Both gauges have ignored equity market strength in 2019, which suggests that equity returns and inflation will be suppressed in the near future. WTI oil also slid 2.1% as it appears to be stabilizing around the $55 mark after a significant 25% decline from its October 2018 high of $75. Outside of primary markets, cannabis continues its lackluster 2019 campaign, with HMMJ sinking 14.5%. The sheen may have come off in the near-term but the long-term commitment is endorsed by political advances and medicinal progress.

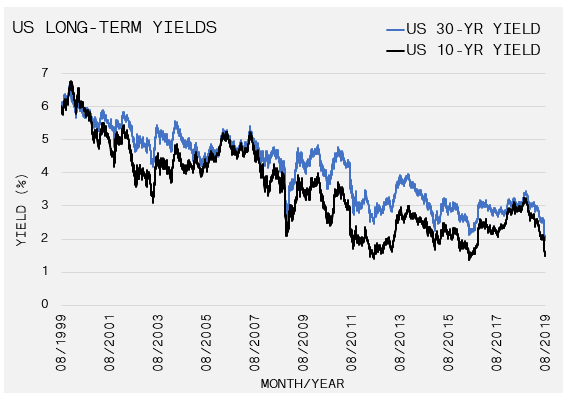

US Government Treasury Bonds were a primary recipient of investor proceeds over the past several weeks. The 10-year and 30-year bond yields dropped to 1.49% and 1.97%, respectively. The yield on the 10-Year Treasury achieved a new three year-low, while the sub-2% yield on the 30-year bond is an all-time low. These low rates reveal the bond market’s expectations for tepid economic growth in the coming years. Further, there has been an abundance of media focus on the yield curve inversion and its proficiency as a precursor for a recession. Pundits debate whether the 2-year vs. 10-year is a better predictor than the 3 month vs. 5 year; but for investors; here is what you need to know.

-

- The short end of the yield curve (0-2 years) is controlled by the Federal Reserve or simply the central bank of the United States.

- The long-end (10-30 years) is much more fundamentally-driven, with two primary inputs; (1) growth of the economy and (2) inflation expectations.

- For simplicity, let’s assume there is no inflation, the bond market is pricing in sub-2% growth annually for the next 30 years.

- Overreliance on debt to fund growth acts to suppress future growth and carries disinflationary impacts. Accordingly, this contributes to the forecast for sub-2% growth. The current policy response to this low growth outlook and to defend against a recession is, ironically, to add more debt. While we don’t know if a recession is one, five, or ten years out, we do know the bond market is pricing one in. So, considering the bond market’s track record, it would pay to listen.

In summary, with the 30-year yield at all-time lows in the US, $15 Trillion in global debt yielding negative rates, manufacturing data contracting globally and most equity markets outside of the US in negative territory over the past year, we can be fairly certain a recession, or something close to, is forthcoming. However, the market is nowhere near euphoria. The S&P 500 put/call ratio, which is a measure of how much downside protection is being purchased in the option market, is at 2.15. Over the past year, this level has been typically reached when markets are close to a bottom. CNN’s Fear & Greed Index, which uses seven market indicators to gauge investor’s bullishness from a rating of 0 (Extreme Fear) to 100 (Extreme Greed), is at a sufficiently fearful grade of 21. What does this tell us? It tells us that investors are right to worry, and perhaps this is not the time to be 100% allocated to equities, but investor positioning could be hinting it is not quite time to dig a bunker and clear out Costco for its canned food. We remain cautiously optimistic and believe that the fear currently over taking the markets may be overdone in the short-term. The S&P is only ~5% off its highs, but fear has caused the stock of many companies to correct much further. Accordingly, many more long-term investment opportunities are being created by short-term fear.